Unlike the S&P 500, the FTSE 100 is labouring this year. Yet that doesn’t mean there aren’t still exciting Footsie stocks to buy, with some even offering exposure to the growth of artificial intelligence (AI).

Here’s one I intend to snap up in February.

A data giant

At the top of my buy list right now is London Stock Exchange Group (LSE: LSEG). This is despite the share price being near an all-time high after rising from 4.685p to 8,883p over the past five years.

At first glance, this strong share price momentum might appear counterintuitive. After all, the mood music around the London Stock Exchange is sombre nowadays due a lack of new listings and some companies deciding to move to New York in search of higher valuations.

However, the exchange business only accounts for around 3% of revenue. The Group itself is a global data and analytics company that appears to have many years of profitable growth ahead of it.

A transformative acquisition

In 2021, it acquired Refinitiv for $27bn. This is a major provider of real-time financial market data and infrastructure with over 40,000 customers (banks, wealth managers, hedge funds, etc).

These organisations glean crucial insights through its data, analytics, AI, and workflow solutions. It is also the sole provider of Reuters news to the global financial marketplace.

Given the indispensable role that real-time financial data plays in the workflow of a finance professional, this is an incredibly sticky business. And this makes a significant portion of the Group’s revenue recurring (73% in 2022).

Risks

Now, all-weather technology businesses that generate reliable revenue like this are usually highly valued. London Stock Exchange Group is no exception.

Currently, the stock is trading on a forward price-to-earnings (P/E) ratio of 24.5 based on analyst forecasts for 2024. This could add a bit of valuation risk if earnings come in light.

Another thing to be aware of is that there’s still a fair bit of debt from the massive Refinitiv acquisition. This could become an issue if it lingers on the balance sheet longer than anticipated.

That said, City analysts expect the Group to generate free cash flow of around £2.3bn from revenue of £8.7bn in 2024. So the company is in rude health financially, which is crucial when there’s significant debt.

Artificial intelligence

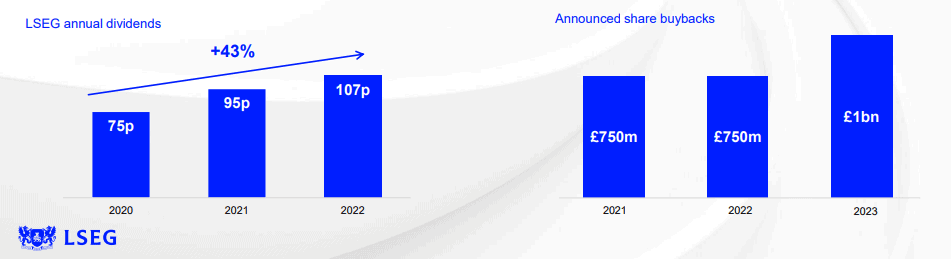

There’s also a dividend yielding 1.3%. While that might seem laughably small, the payout has more than doubled in five years. Easily covered by earnings, this is a dividend I can see growing for a very long time.

Complementing this is a further £1bn share buyback programme in 2024.

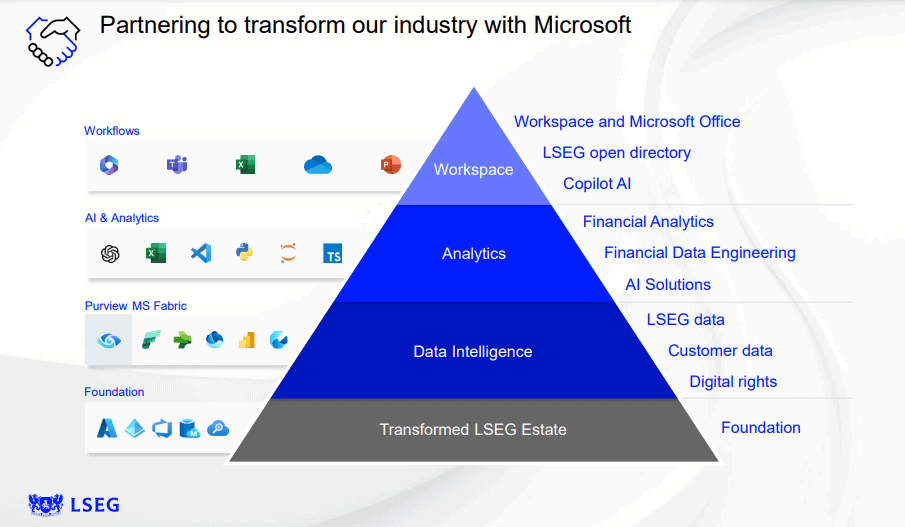

Finally, I’m excited by the firm’s 10-year joint venture with Microsoft.

Launched in December 2022, this centres around building powerful generative AI-based solutions for customers across the financial industry.

The company has one of the largest and cleanest financial data sets in the world, which is crucial for training AI models effectively. Pair this with Microsoft’s expertise in AI and these products could significantly enhance the company’s competitive position.

The fact Microsoft also took a 4% stake in the Group is a tremendous vote of confidence in its future.