I added to my holding in Agronomics (LSE: ANIC) pretty regularly throughout 2023. And my intention is to buy a few more of this penny stock in February, then leave it alone.

Here’s why I remain cautiously optimistic, despite the inherent risks associated with penny stocks.

The company

Agronomics is a venture capital firm run by Jim Mellon and chaired, until recently, by Innocent smoothies founder Richard Reed (he’s still a non-executive board member).

It invests in the emerging industry of cellular agriculture. This is the sci-fi-sounding production of agricultural products from cells, removing animals from supply chains.

Beyond meat, this method includes a new way of producing key food products such as proteins, fats, eggs, coffee, and cocoa, as well as materials like leather and palm oil.

The portfolio

Now, I don’t expect to see lab-grown ribeye steaks down Tesco‘s meat aisle anytime soon. But for coffee and cocoa, scientists can use cell cultures to produce key components that replicate the taste and texture without needing the whole plant.

Agronomics owns 42% of a pet food start-up called Meatly, which makes “real meat, without animals“. I’d imagine cell-based pet food aimed at ethically-minded owners might be an easier market to crack at first.

Dogs arguably have less discerning palates than us, though I’ve seen football fans queuing up at burger vans that even hungry poodles might avoid.

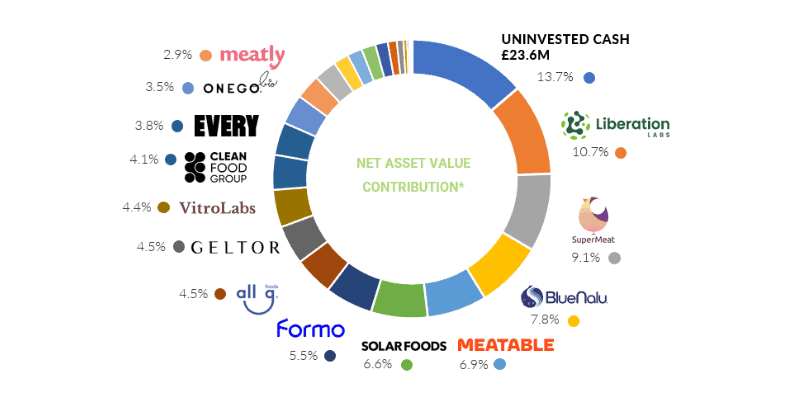

Meatly is preparing for its upcoming UK product launch. As of June 2023, it made up 2.9% of assets.

The third-largest holding, BlueNalu, is in the process of commercialising a Pacific bluefin tuna toro. It closed a $33.5m Series B round in November, which (subject to audit) Agronomics is carrying forward at a book value of £13.3m. This represents an encouraging uplift of £6.8m.

In its financial year ended 30 June, pre-tax profit jumped to £22.4m from £8.4m the year before. Its investment income, including net unrealised gains, more than tripled to £29.7m.

Meanwhile, net asset value per share rose 14% to nearly 17p from 14.85p per share the year before. It had £23.6m in cash reserves left to put to work.

A high-risk stock

This may be the riskiest stock in my portfolio. As such, I’d never feel comfortable making it a top holding. If it ever surges, I’ll harvest gains on the way up.

As the firm admits, “All of these technologies only have validity if the products can achieve parity with their conventional counterparts, not only in terms of price but also sensory profile and convenience.”

The industry is still some way off going mainstream. Pilot production facilities have been opened, but scaling up and producing commercially viable products is a totally different ball game.

Considering the era of cheap and abundant capital has been over since 2022, I’m surprised there haven’t been outright failures in the portfolio by now. It’s still a risk (arguably an inevitability). And some US states could just ban cultivated meat altogether.

In conclusion, this is an emerging industry with great promise. But as Warren Buffet once memorably put it, “First come the innovators, then the imitators, then come the idiots.”

As a shareholder, I’m banking on Agronomics to invest in the innovators and not the latter!