The Barratt Developments (LSE:BDEV) share price fell 5% during the first few minutes of trading this morning (7 February). They’re down over 7% as I write after the company released its earnings for the six months ended 31 December 2023.

The results were overshadowed by the announcement of a planned takeover of Redrow, a smaller competitor. The deal values the company at £2.5bn — a 26% premium to its closing share price on 6 February.

Redrow’s shares soared 16% on the news, before falling back slightly.

Tough times

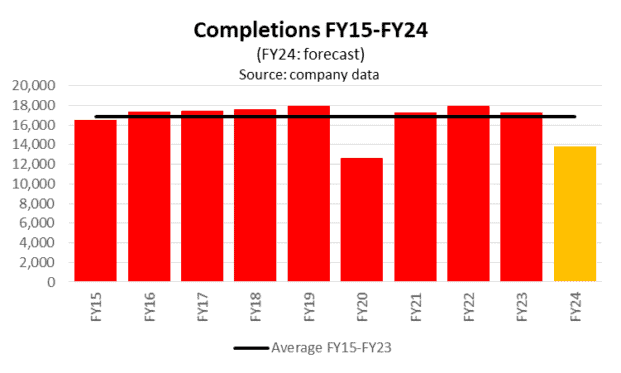

Barratt’s results show a 28% drop in completions, compared to the same period in 2022.

The company now says it will deliver 13,500-14,000 homes during its 2024 financial year (FY24). Previously, it was forecasting sales of 13,250-14,250.

The housebuilder’s financial performance has been impacted by a reduction in its average selling price, to £300k from H1 FY23’s £323k.

And it’s experienced a significant increase in its build costs.

This double whammy has caused a big fall in its adjusted gross margin, to 16%.

| Half-year results/Measure | 31.12.20 | 30.6.21 | 31.12.21 | 30.6.22 | 31.12.22 | 30.6.23 | 31.12.23 |

|---|---|---|---|---|---|---|---|

| Homes completed | 9,077 | 8,166 | 8,067 | 9,841 | 8,626 | 8,580 | 6,171 |

| Revenue (£m) | 2,495 | 2,317 | 2,247 | 3,021 | 2,784 | 2,537 | 1,851 |

| Adjusted gross profit (£m) | 593 | 522 | 562 | 746 | 648 | 482 | 296 |

| Adjusted gross margin (%) | 23.8 | 22.5 | 25.0 | 24.7 | 23.3 | 19.0 | 16.0 |

| Adjusted profit before tax (£m) | 507 | 413 | 450 | 605 | 522 | 362 | 157 |

| Adjusted basic earnings per share (pence) | 40.5 | 33.0 | 35.9 | 47.1 | 39.2 | 28.1 | 11.8 |

Although I don’t think the results make for good reading, there are reasons to be optimistic.

Resilience

The company appears to have survived the current downturn in the housing market better than some peers.

Despite the Bank of England increasing interest rates 14 times since March 2020, if it achieves the mid-point of its forecast completions for FY24 (13,750), it will have built 17% fewer homes than its average for the past five financial years.

Compare this to, for example, Persimmon, which built 34% fewer properties in 2023, than its 2018-2022 average.

The company says “underlying demand” for its houses remains strong. Since the start of 2024, it’s seen “early signs of improvement in both reservation rates and buyer sentiment“.

But its order book has fallen again. It’s now reporting contracted sales of 8,760 properties (£2.26bn). On 8 October 2023, it had forward-sold 9,221 units (£2.36bn).

Declining profitability

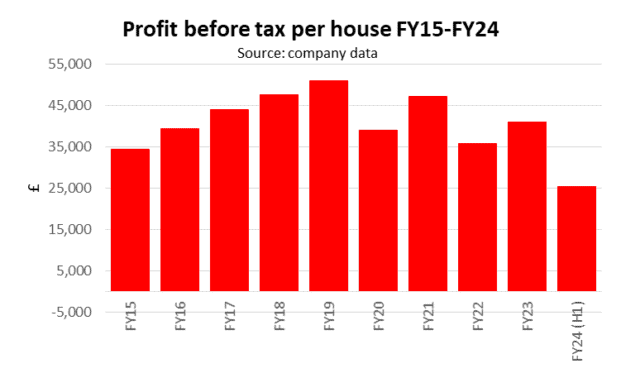

The big drop in its gross profit margin remains a concern. The average profit before tax per house was £25,442 in H1, compared to £50,952, in FY19.

As a result, the company has decided to cut its interim dividend to 4.4p from FY23’s 10.2p.

Surprise!

Although the takeover announcement wasn’t expected, it makes sense to me given the current slump in the housing market.

The two companies should be able to achieve some operational efficiencies. These may come in the form of overhead savings or additional discounts from the bulk-buying of materials.

The two companies also serve different markets — Redrow’s houses are approximately 50% more expensive. And it’s much smaller. During the 26 weeks to 31 December 2023, it sold 1,894 properties.

The deal appears to have come at a good time. According to Savills, the upmarket estate agency, the housing market is past its “peak pain“.

That’s because the UK economy is expected to grow in 2024. And as inflation subsides, economists are predicting interest rates will soon start to fall.

However, early indications are that the shareholders of Redrow are more impressed by the deal than those of Barratt Developments.