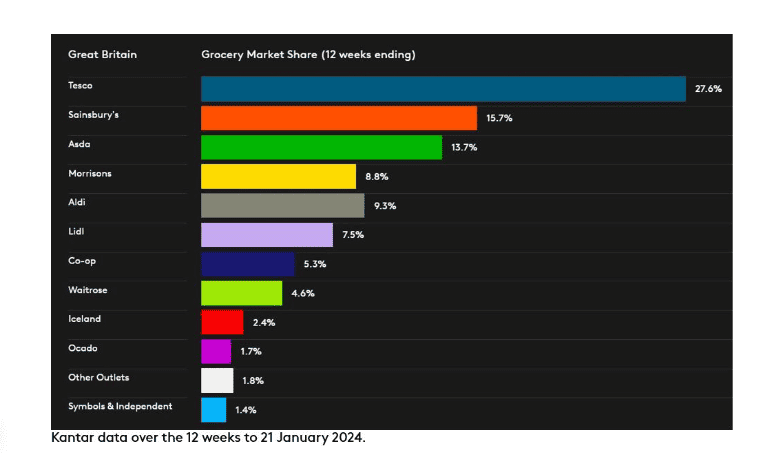

Tesco (LSE: TSCO) boasts a 27.6% share of the UK groceries market. Due to this commanding competitive position, Tesco shares are quite popular with income investors.

But how much would I need to invest in this FTSE 100 supermarket stock for £100 a month in passive income?

Passive income generation

To work this out, I’d first need to know the dividend yield. This is calculated as the dividend per share divided by the share price.

So, the dividend for FY 2024 (ending this month in February) is 11.6p per share. As I write, the share price is 288p (£2.88). Therefore, the dividend yield for FY 2024 is just over 4%.

The good news is that the City is expecting the dividend to rise to 12.9p per share in FY 2025. That’s only a forecast, though, and much will depend on whether UK consumers loosen or tighten the purse strings in Tesco stores.

While no dividend is guaranteed, Tesco’s payout is covered two times by forecast earnings. That’s solid coverage, suggesting the dividend is ‘safe’.

Assuming it is, the forward yield is almost 4.5%. Therefore, I’d need to splash out about £26,800 to secure 9,305 Tesco shares, which would generate me the equivalent of £100 a month in passive income.

That’s not chump change, of course. It’s a sizeable sum to invest in a single stock, especially when Tesco faces huge competition.

Low-margin industry

Groceries are generally low-margin products, which means profit margins across the sector are relatively slim.

This is exacerbated by the highly competitive nature of the industry, with numerous retailers vying for customers. To stay competitive, many supermarkets have to keep their prices low.

We can see this in Tesco’s gross (6.6%) and net profit (2.7%) margins. These razor-thin margins do mean that the company’s profits can quickly come under pressure during times of cost inflation and sector-wide price wars. These are risks.

A bumper Christmas

Having said that, Tesco expertly navigated the challenging post-Covid period of high inflation without losing market share. And as things have settled, the company has been able to reduce the price on thousands of products.

I noticed this the other day as I was shopping. Things that had shot up to more than £1 are now back to 75p. Thankfully, cheese was cheaper and spring onions were just a few pennies. Meanwhile, signs reminded me of its Aldi Price Match promise, which has been very effective.

The Christmas trading period was very strong. And according to the latest industry data from Kantar, Tesco saw its sales increase by 6.3% over the 12 weeks to 21 January. Its market share reached 27.6%, up from 27.5%.

A trend seems to be that Tesco and Sainsbury’s are growing share at the expense Asda and Morrisons. Meanwhile, Aldi and Lidl are gaining share but not as rapidly as before.

Valentine’s Day will be interesting. Will more couples swap fancy restaurants for Tesco’s meal deals? We’ll probably find out when the firm reports its full-year earnings in April.

Personally, I wouldn’t put nearly £27k into Tesco stock. I’d rather build a portfolio of dividend shares with such a sum, but Tesco would still be a part of it.