Recent FCA data reveals up to a third of UK adults over 40 have less than £1,000 in savings. With little or no savings, an aggressive savings plan is required to build a passive income stream for retirement. Here’s how.

The average 40-year-old UK citizen earns £40k a year – around £2,700 a month after tax. By saving £500 a month, I could turn that into a decent passive income stream of £27,000 a year.

But £500 a month only saves me £6,000 a year, so how can I reach that goal?

Less tax, more returns

Aiming to retire at 65 would give me 25 years to build my passive income stream. A typical bank savings account won’t provide anywhere near enough interest for me to reach my goal. Neither will bonds or real estate, which typically offer average annual returns of around 4%. So I’m looking at shares.

Using a Stocks and Shares ISA, I can invest up to £20,000 a year tax-free into the UK stock market. I would start by building a portfolio of shares in companies with long-term reliable growth. By reinvesting my gains, I would maximise my savings through the miracle of compounding returns.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

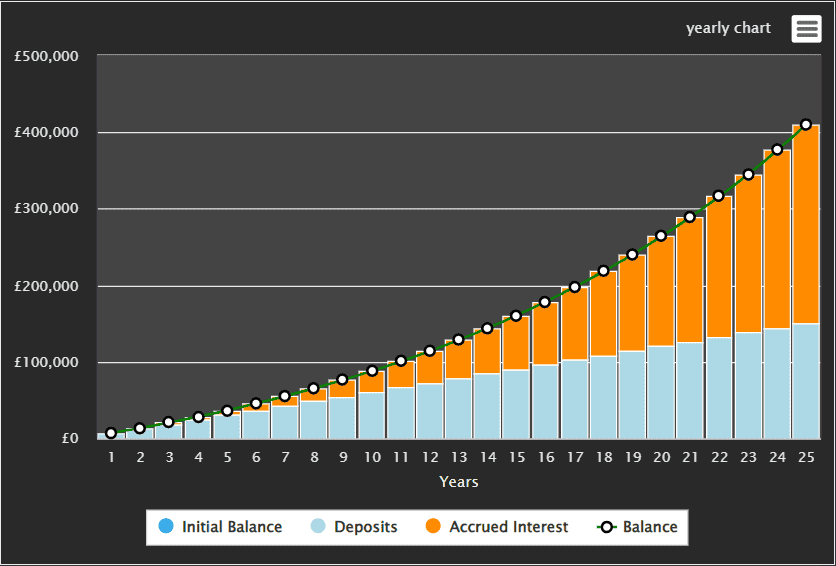

Building a portfolio that delivers reliable returns of around 7% annually is what I would aim for. By investing £500 a month for 25 years, my investment could grow to £410,261. At this point, I would be earning £27,470 a year in passive income – assuming I maintain an average 7% annual return.

Of course, there’s a risk that some years I may earn less than 7% or possibly even lose money.

An example of a UK share I would consider for my ISA

To secure reliable returns for 25 years, I must choose my shares wisely. This means selecting well-established companies with a long history of stable growth.

Unilever (LSE:ULVR) is one such stock. As a multinational goods producer of everything from food to cosmetics, Unilever’s services are typically in high demand. With shares that are less volatile than 75% of UK stocks, I think it’s a safe, reliable option.

In its 2022 earnings report last March, Unilever’s earnings per share (EPS) exceeded analyst’s expectations. More recent Q3 results revealed sales growth of 5.2% per year, putting Unilever’s future return on equity (ROE) at 33.1%. ROE is a good measure of long-term potential, indicating how effectively management is expected to allocate shareholder resources.

However, in 2023 Unilever shares fell 9%, leaving the company with a negative forward-looking EPS growth rate of -1.1%. Its dividend yield has also decreased recently, from 4% to 3%. This is an example of how some shares have bad years but it’s important to focus on the long term.

To diversify my portfolio, I would include some high-yield dividend shares that may be less stable but promise better returns. Examples include insurance firm Phoenix Group, with a dividend yield of 8.9%, and Vodafone, currently paying an impressive 11.2% dividend yield. I would also consider adding a few index-tracking exchange-traded funds (ETFs) like the iShares Core S&P 500.