The BP (LSE:BP.) share price has made a mixed start to 2024. After nearly touching a 52-week low last month, the oil and gas stock has recovered somewhat in recent days.

However, BP shares are down 10% over five years. That’s despite a strong recovery from the pandemic, as the company benefitted from rising wholesale energy prices following Russia’s invasion of Ukraine.

So what’s the growth outlook for the FTSE 100 energy giant? Is the stock undervalued today, or is the wartime windfall beginning to dissipate?

Here’s what the charts say.

Cheap valuation

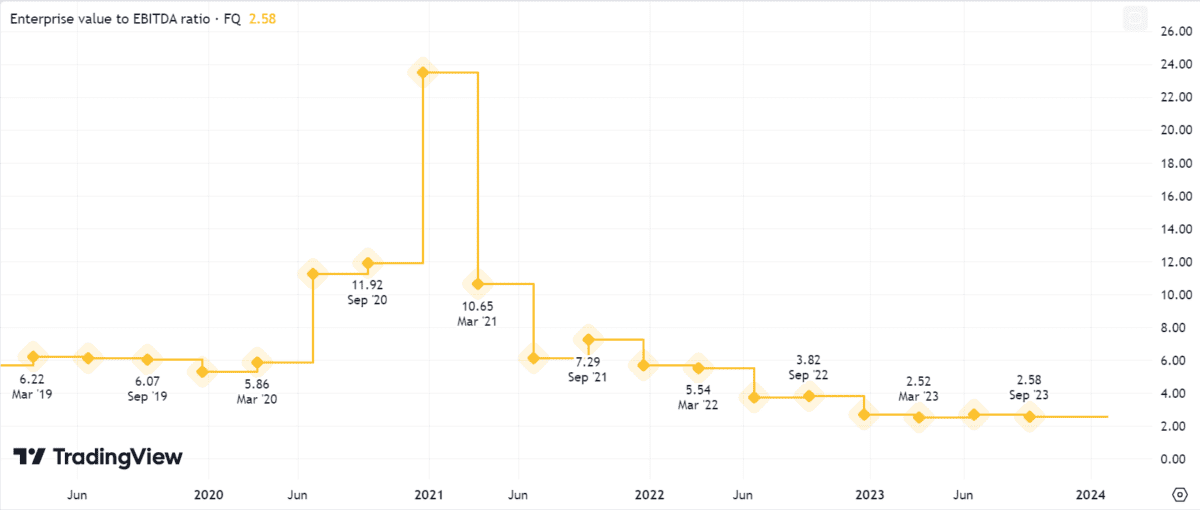

A popular way for analysts to value oil and gas shares beyond the traditional price-to-earnings (P/E) ratio is examining a company’s enterprise value (EV) to EBITDA ratio.

Using this metric can eliminate differences that arise from varying depletion rates. This is essentially the way oil majors expend their reserves via extraction.

BP shares currently have a trailing P/E ratio under 4.3 and a forward P/E ratio below 7.2. At these multiples, they look cheap compared to the wider FTSE 100 index.

Furthermore, the company currently has an EV/EBITDA ratio of just 2.58. Generally, a number below 10 is a good marker of a potentially attractive investment.

This multiple’s at the bottom end of where it’s been over the past five years. This adds weight to the case that the BP share price could be undervalued today.

Passive income

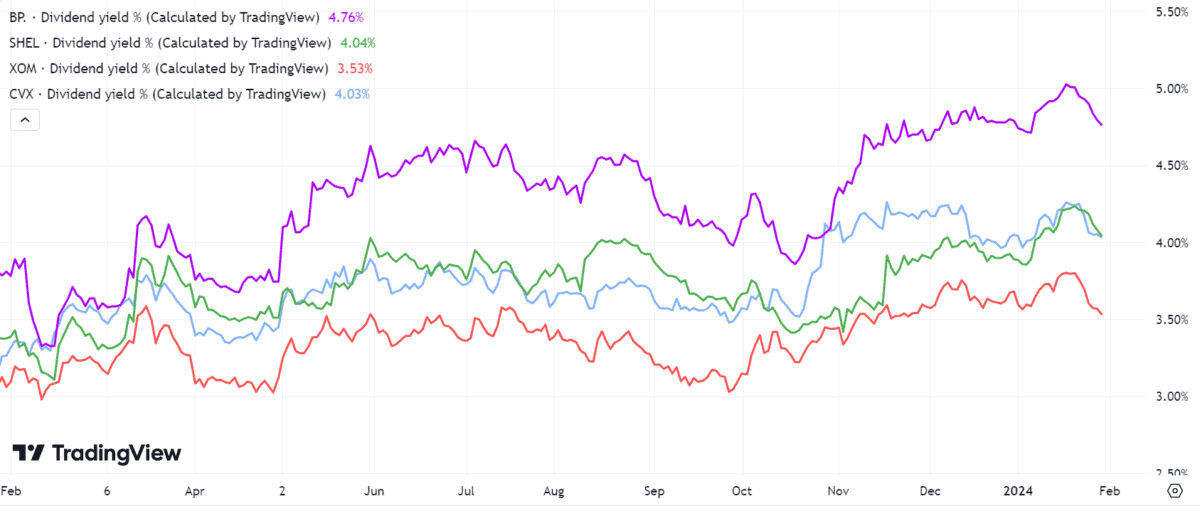

It’s also worth noting that BP looks attractive relative to industry competitors for dividend payouts.

Forecast dividend cover of 2.9 times earnings indicates a robust margin of safety. In addition, the company has a higher dividend yield than fellow FTSE 100 company Shell as well as major US energy stocks like ExxonMobil and Chevron.

Oil prices

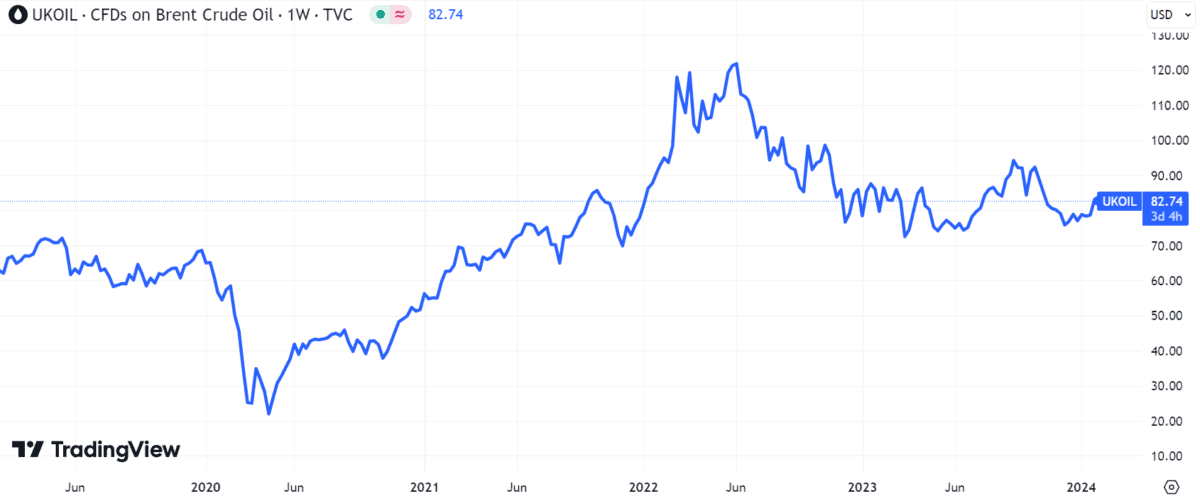

Turning to the macro backdrop, BP’s fortunes are intrinsically linked to oil prices. Granted, the company’s recently been pursuing a long-term strategy to transform the business into a clean energy provider.

However, it’s facing pressure from activist hedge fund shareholder Bluebell Capital Partners to change tack and stick to traditional hydrocarbon projects.

Oil prices have fallen from their peak after Russia invaded Ukraine. Many analysts have trimmed their crude price forecasts for 2024 due to stagnating global demand coupled with rising supply from the US, Libya, and Norway.

That said, the world’s largest oil supplier, Saudi Aramco, recently abandoned plans to expand its maximum production capacity, from 12m to 13m barrels a day.

The ramifications this move will have on OPEC+ policies and any potential response from the US to lower pump prices in an election year remains to be seen.

Although notoriously difficult to predict, if oil prices do drift lower this year, that could be a significant headwind for growth in the BP share price. That’s especially true in light of BP’s latest quarterly profit of $3.3bn, which was below the consensus City forecast of $4bn.

A stock worth considering?

There are risks from global energy markets for BP shares, but the stock does look cheap right now. Plus, it’s a leader in the oil and gas sector when it comes to dividends.

Overall, if investors are eyeing up energy stocks for their portfolios, I think BP merits serious consideration.