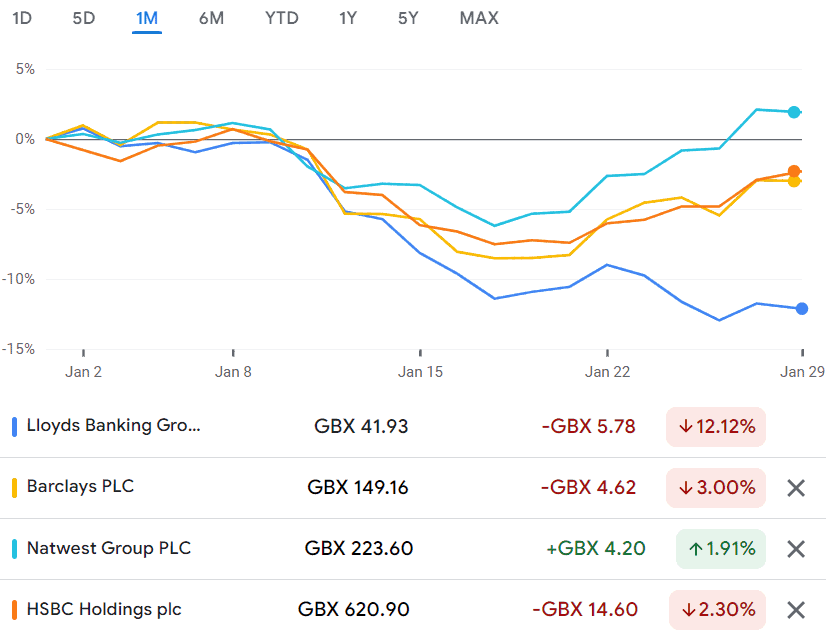

Today, I’m looking at one bank stock that I think is selling at a bargain – Lloyds (LSE:LLOY). After climbing 12% during December, the Lloyds share price hit a snag at the start of the year and is now back where it was last November. If it falls much further, it will be at its lowest level in over two years.

The dip resumes a trend that persisted throughout 2023, a year that saw the price fall from 54p a share to a low of 39.7p. That was the only time since the pandemic the price dipped below 40p, which has served as a key support level for the past three years.

With the price now hovering just above 40p, I don’t expect to see a significant decrease from here.

Lloyds is not alone in its struggle – most UK high street banks suffered a similar fate this month, albeit to a lesser degree. It seems the initial excitement about interest rate cuts has subsided. At a meeting this Thursday, the Bank of England (BoE) is expected to maintain the current rate for another month.

Even so, I think the UK banking sector is hinting at a mild recovery after a difficult 2023. As such, I believe this could be an opportunity to grab some Lloyds shares while they’re still cheap.

What analysts are saying

Despite the falling share price, Lloyds had a good year in 2023. Earnings grew by 125%, with net profit margins now up to 32% from only 19% last year. Although that’s not expected to continue — looking ahead, earnings are forecast to decline by 11% per year for the next three years.

Will that hurt the share price? Not everyone thinks so.

With the share price now so low, some analysts estimate it to be trading at 32% below fair value. I think it’s unlikely we’ll see it increase that much in 2024 but I’ve seen a fair share of optimistic analysis. Some forecast a price increase of up to 67p!

But I think that’s a little hopeful.

Unless really meaningful rate cuts become a reality again, I’d expect something in the far more conservative 50p–55p range. Either way, I think the share price unlikely to fall below 40p and should gain again when inflation finally settles. However, if the current recession fears become a reality, then it runs the risk of falling further.

Dividends

One extra benefit is that Lloyds has a good track record of paying out a reliable dividend. Its dividend yield is currently set at a very favourable 6% and is expected to increase to 8.5% in three years.

That makes Lloyds an attractive investment to me, even if the share price has a lacklustre year. I think grabbing some shares now while the price is cheap will secure me a decent bit of passive income from dividends.

Naturally, if the share price does fall further it’ll negate those gains — but I’m confident enough to take that risk.