FTSE 100 shares are sometimes criticised as ‘dinosaur’ companies. Banks, insurance firms, tobacco giants, oil majors, and commodities titans — that list of traditional businesses isn’t exactly brimming with hot growth stocks of the future.

While I believe there’s value in owning such defensive stocks, some investors may want to consider higher-risk, higher-reward opportunities that are also in the Footsie.

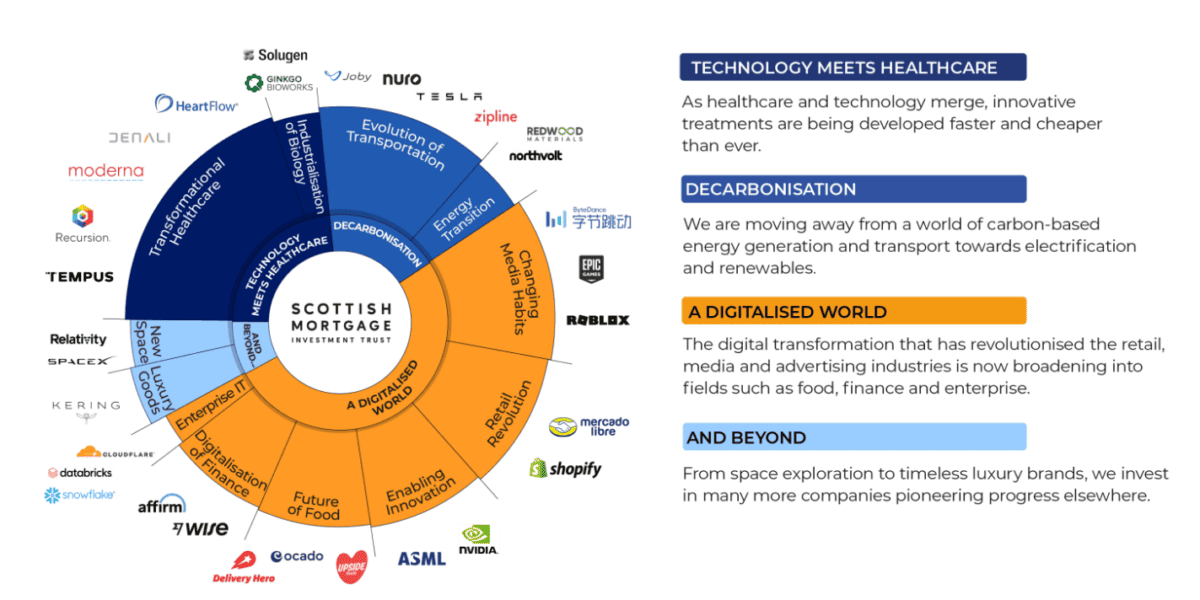

Scottish Mortgage Investment Trust (LSE:SMT) shares could be just the ticket since Baillie Gifford’s actively managed fund invests in global growth stocks. But, can the FTSE 100-listed trust outperform its index counterparts in 2024?

Let’s explore.

Interest rates

One defining feature of 2024 could be widespread interest rate reductions in developed countries. That might do a world of good for the Scottish Mortgage share price.

It’s one of the most rate-sensitive FTSE 100 stocks thanks to the high concentration of hyper-growth shares in its portfolio. Since these companies expect to generate most of their cash flows in the distant future and tend to be more highly leveraged, they can suffer when monetary policy tightens as debt financing costs rise.

Granted, recent upticks in inflation rates in both the US and UK have pared back expectations for early rate cuts. However, should better figures emerge in the coming months, Scottish Mortgage shares could benefit if central banks move accordingly.

Private equity

Beyond public markets, Scottish Mortgage also invests in unlisted equities. Currently, the trust’s private equity allocation is slightly above its self-imposed 30% limit. The management team puts this down to a lack of initial public offerings (IPOs) in recent years.

However, that could change in 2024. One major private equity position, lithium-ion battery manufacturer Northvolt, has been tipped to go public this year at a $20bn valuation.

Furthermore, speculation about a possible SpaceX IPO is growing, despite Elon Musk’s denials. Although a listing’s unlikely to come this year, the company’s valuation has ballooned to $180bn. That’s larger than any IPO in history. Representing 4% of the portfolio, the space exploration business is a key holding.

Private companies are difficult to value and IPO stocks are often volatile in their first months of public trading. Nonetheless, there are potentially exciting developments on this front for the Scottish Mortgage share price that investors should monitor closely.

Ready for a rebound?

Overall, I like the mix of growth stocks that Scottish Mortgage invests in. I have positions in many of its top holdings, as well as the trust itself.

| Stock | Portfolio weighting |

|---|---|

| ASML | 6.8% |

| Moderna | 5.3% |

| Nvidia | 5.2% |

| MercadoLibre | 5.1% |

| Amazon | 4.7% |

That said, Scottish Mortgage shares carry risks. If interest rate cuts materialise later than expected, the trust could underperform other FTSE 100 shares this year.

Plus, I don’t want to see a repeat of unedifying corporate governance rows that dominated last year’s headlines. Investor confidence in the management team will be crucial for a share price recovery.

Nonetheless, improving macro conditions and possible successful IPOs in the near future give me reasons to be optimistic. Moreover, the trust’s current 10.8% discount to its net asset value bolsters the investment case.

I’m holding my Scottish Mortgage shares. I think there’s a good chance it can outperform other FTSE 100 stocks in 2024 and this trust merits consideration from investors with sufficient risk appetites.