The appeal of many FTSE shares dimmed once interest rates started heading higher in late 2021. However, things now appear to be changing, with the UK stock market currently pricing in at least four interest rate cuts from the Bank of England (BoE) by the end of 2024.

Possibly starting as soon as May, each cut would total one-quarter of a percentage point, bringing the base rate down to 4.25%.

By the end of 2025, investment giant Vanguard expects rates to be between 2.25% and 3.75% across major markets.

Now, none of this is guaranteed, with much still dependent on forthcoming inflation data. But if rates are cut this year, then many investors will likely start moving cash into stocks.

Here are two FTSE shares that I think are ready to break out.

Growth stocks

First up is Scottish Mortgage Investment Trust (LSE: SMT). Its portfolio is full of disruptive growth companies, some of them fairly young, which is exactly the sort of thing that got clobbered when inflation reared its head.

Higher interest rates can lead to an increase in the cost of capital for these emerging firms, as well as making them less desirable to investors who can secure decent risk-free returns by simply holding cash.

Conversely, a sharp fall in interest rates would be more supportive of the long duration assets that Scottish Mortgage holds.

According to the trust, its largest holdings — both public and private — are still growing their revenues by 40% a year on average. Therefore, the valuations of these stocks have the potential to bounce back sharply due to their higher rate of growth.

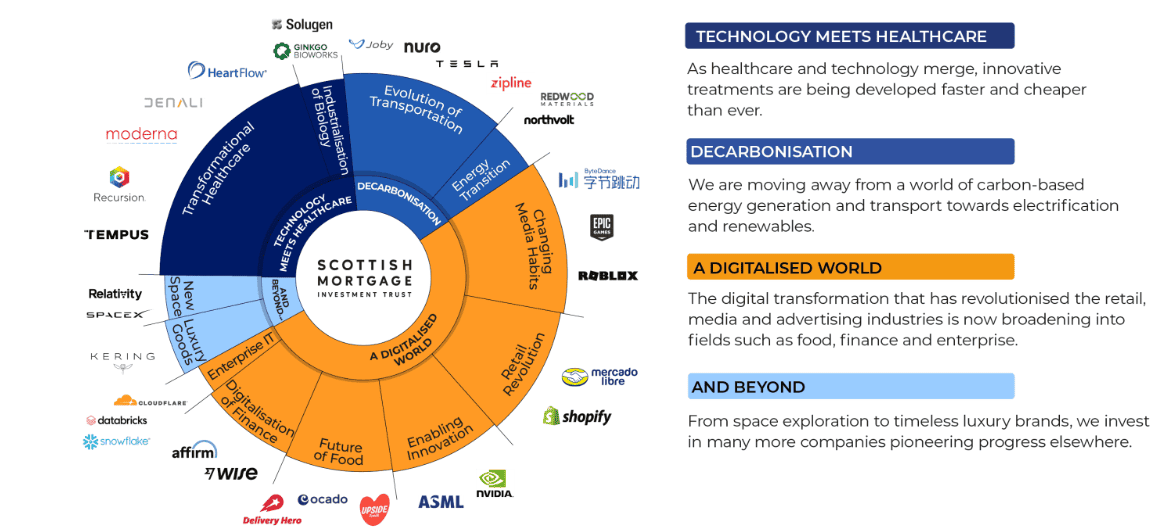

The mega-trends that Scottish Mortgage has targeted include AI-enabled healthcare, decarbonisation and the digital revolution. Beyond these overarching themes, it is also invested in luxury goods (Ferrari) and the space economy (through SpaceX).

Due to the disruptive nature of its holdings, the trust can be very volatile. However, because I’m investing for the long term, I’m willing to ride out bouts of market turbulence.

As such, the shares form a core part of my portfolio.

Housebuilding stock

Another sector that is highly sensitive to interest rates is housebuilding. Higher rates negatively impact property affordability, especially for first-time buyers, and this has knock-on effects for the whole industry.

This has been reflected in a 50% fall in Persimmon (LSE: PSN) since the start of 2022.

The City expects the firm to report a 35% drop in revenues for 2023, with operating margins squeezed from 26% to 14%. This reflects the cyclical nature of the sector, and there’s a risk we’ve not reached the bottom of this cycle yet.

On the flip side, juicy gains can be made once these types of shares recover from their nadirs. The stock has rallied 40% since November, but I think there could be more to come as build cost inflation eases and rates come down.

Meanwhile, there’s a rebased dividend yield of 4.3% forecast for 2024.

Looking ahead, Persimmon has a strong balance sheet and a large landbank, which it can exploit to increase volumes whenever house prices fully recover. And surely they will, with Britons attached to the notion of home ownership amid an ongoing housing shortage.