Like many of us, I’m investing for a second income. But I’m not investing for a second income today. I’m investing for an income in the future, perhaps when I need it more — maybe when the kids are at school, or if I want to reduce my working hours.

And my timeframe is important, because it gives me time to transform my savings into something much larger. And with a larger portfolio, I can generate a much greater second income.

Time is key

Time is a hugely important part of a successful investing strategy. In fact, if I started an account today with £100 in it, left it for 35 years, and achieved an annualised return of 10%, I’d have more money than I would if I put £1,000 away for 10 years.

This is the nature of long-term investing and it’s something most novice investors don’t truly understand. Of course, you’re only young once, and you may have more capital to put aside when you’re older, but our investments compound over time.

Practical elements

If I were starting my investment journey today, I’d kick off by selecting a trustworthy brokerage platform and setting up a Stocks and Shares ISA for tax advantages.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Next, understanding my risk tolerance and financial goals is crucial. I could look to build a diversified portfolio with a mix of stocks, bonds, and other assets.

Consistency is key, and I’d probably look to commit to regular contributions if I could afford it. This would give my portfolio more fuel to grow.

Picking stocks

This is the part where many newcomers fail. Picking investments isn’t easy. And if my investment falls 50%, it’s got to grow 100% to get back to where I was. That’s the crux of it, and that’s why billionaire investor Warren Buffett’s golden rule is: “Don’t lose money”.

Thankfully, these days there’s a host of online resources — and offline too — that can help us become better investors. Whether it’s David Rubenstein’s book ‘How to Invest’ or The Motley Fool itself, these developments have done a lot to democratise investing.

However, with a long-term investing horizon, I’d focus on long-term growth rather than chasing short-term gains, prioritising quality over volatility. Regularly reviewing my portfolio and adapting to changing market conditions is essential.

Bringing it together

Novices can look to achieve anything between 6% and 10% annually if their investments perform well. More experienced investors may be looking for double-digit growth. Buffett, for example, has achieved annualised returns near 20% over the past four decades. But that’s not guaranteed and even the experienced can make bad calls that lose them money.

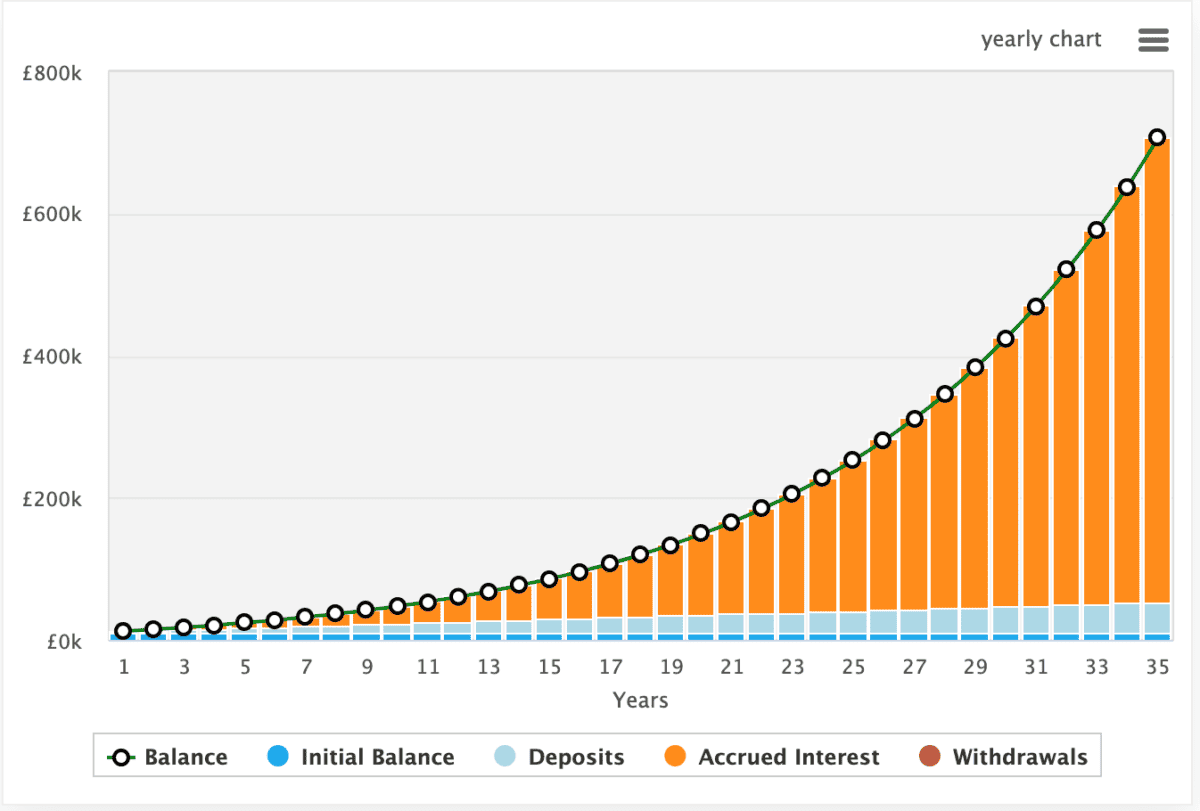

But here’s a simple calculation as to how it could look if I got things right. In the chart below, I’m starting with £10,000, I’m contributing a further £100 a month, and I’m achieving an annualised return of 10%.

As we can see, the growth over 35 years can be phenomenal. And thanks to the compounding effect, the growth speeds up over time. At the end of the period, I’d be 65 and have £706,050. That’s enough to generate £66,828 a year as a second income.