Small-cap stocks are generally considered to be those with a market cap of £50m-£230m. At the end of 2023, there were 415 of these listed on the London Stock Exchange.

Researching all of these would take a considerable amount of time. But one that’s already familiar to me is Begbies Traynor (LSE:BEG).

It specialises in restructuring and insolvency services. And given what it does, I think it’s well placed to cope with an economic downturn.

Doom and gloom

If the economy contracted in the final quarter of 2023 (which it ay have done), it means the UK has entered a technical recession.

That’s because a recession is defined as two successive quarters of falling Gross Domestic Product (GDP).

We won’t know until 15 February whether this is the case. But whatever the number, it’s clear that the economy is struggling at the moment.

A success story

Looking back over the past five years, Begbies Traynor has been growing steadily, which has helped its share price gain over 80%.

Both revenue and adjusted earnings per share have more than doubled.

Since 2020, it’s bought businesses that contributed £38m (31%) of turnover during the year ended 30 April 2023.

And the company hopes to continue this growth trajectory by acquiring other firms.

| Measure | FY19 | FY20 | FY21 | FY22 | FY23 |

|---|---|---|---|---|---|

| Revenue (£m) | 60.1 | 70.5 | 83.8 | 110.0 | 121.8 |

| Adjusted profit before tax (£m) | 7.0 | 9.2 | 11.5 | 17.8 | 20.7 |

| Adjusted earnings per share (pence) | 4.8 | 5.7 | 6.9 | 9.1 | 10.5 |

A worsening picture

But the UK hasn’t been in recession for five years, suggesting that the company isn’t totally reliant on company failures.

Indeed, 20% of revenue is earned from what it calls “pro-cyclical” activities. These include property valuations, corporate finance and transport planning.

However, the pandemic did cause many businesses to go bust. And it severely weakened numerous others.

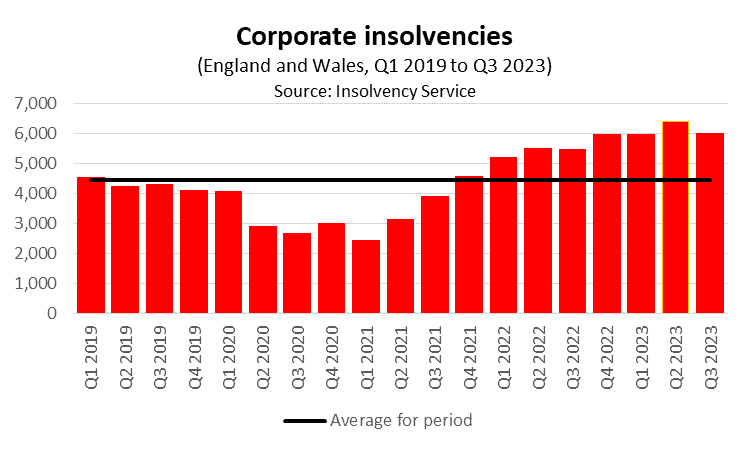

Figures for December 2023 have yet to be finalised, but based on data for October and November, I think it’s probable that the final quarter of the year will see the highest level of corporate failures, of the past five years.

Despite each being a tragedy for those involved, this bodes well for Begbies Traynor.

But with 80% of revenue earned from “defensive activities” this could also be its Achilles heel.

According to the Bank of England’s latest survey of economists, the average expectation is for GDP growth of 0.6% in 2024, and 1.4% in 2025.

Although far from spectacular, if these predictions are correct, the number of corporate failures is likely to fall.

Cautious optimism

And any reduction in earnings is likely to have a significant impact on the share price.

That’s because, like most firms providing professional services, there’s little substance to its balance sheet.

Of its net assets at 30 April 2023, intangibles accounted for 87%.

These are non-physical things including the premium paid on the businesses that it’s acquired.

They’re difficult to value — and unlikely to generate very much cash — should the company experience its own financial problems and need to raise cash quickly.

Encouragingly, I think the company will pay a dividend of 4.1p for its 2024 financial year. This means its shares are currently yielding 3.6%, which is impressive for a stock that’s listed on the Alternative Investment Market.

Overall, I think Begbies Traynor is likely to do well given the current economic backdrop. Unfortunately, I don’t have the cash available to include its stock in my ISA.