The dividend yield of Imperial Brands (LSE: IMB) certainly catches my eye when I glance across the FTSE 100. At 8.1% currently, only four Footsie shares offer more, according to my data provider. And the forward yield is 8.5%.

I’m always on the hunt for high-yield passive income opportunities. Could this tobacco stock be what I’m looking for? Let’s take a look.

Generous returns

There are a few things that I immediately find attractive here from an income standpoint.

Most obviously, we have the forecast dividend of 155p per share for FY24 (Imperial’s fiscal year runs to the end of September). Based on today’s (2 January) share price of 1,812p, as mentioned, that translates into a dividend yield of 8.5%.

That’s more than double the market average. But what’s the chance of the yield being met?

Well, going on the dividend cover of 1.94, it would seem very high.

As a reminder, this ratio is a popular measure of dividend safety. Coverage of 2 indicates that the company’s earnings are twice the amount needed to cover its forecast dividend payout.

In other words, Imperial is expected to comfortably generate sufficient earnings to cover its payout obligations. So that’s reassuring.

On top of this, there’s an ongoing share buyback programme. Indeed, the firm has earmarked total returns (both dividends and buybacks) of £2.4bn for FY24. That’s equivalent to around 15% of its total market value, which is certainly a generous return for shareholders.

Product concerns

On the negative side, I can’t ignore that the company still generates most of its revenue from its cigarette labels like Lambert & Butler and John Player Special.

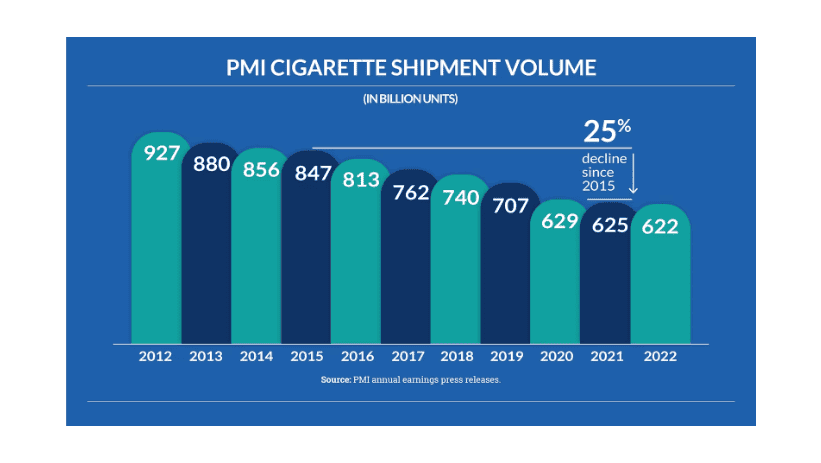

The decline of smoking is well-documented, even by tobacco firms, as the figures below from rival Philip Morris International demonstrate.

Of course, the counterargument is that future growth will come from smoke-free products. However, even e-cigarettes are under increasing regulatory attack.

According to the World Health Organization (WHO), a total of 34 countries — including Mexico, Brazil and India — had banned the sale of the devices, as of July 2023. And the WHO itself is calling for all flavoured vapes to be banned.

Are the shares a good buy for my ISA?

For me, tobacco companies are in a strange conundrum where they’re committed to the long-term decline of their core product (harmful cigarettes) while also seeing their next-generation vaping products come under increasing scrutiny.

Given this rock-and-a-hard-place dynamic, and the unstoppable push for ESG investing, I see more fund managers turning their backs on tobacco stocks. The long-term outlook is very uncertain, in my opinion.

Of course, the flip side to this is the addictive nature of nicotine. This gives the firm the power to increase prices to offset lower volumes. Therefore, I don’t expect profits to fall off a cliff any time soon.

But it wouldn’t surprise me if the share price drifted lower over the next few years. And it also wouldn’t surprise me if Imperial shareholders were to push for a main listing in the US, where peers like Altria Group and Philip Morris regularly trade at higher valuations.

Perhaps a move overseas could breathe some life into the share price. Still, I’d rather invest in other dividend shares with more certain futures right now.