Many individuals invest with the aim of generating passive income. This means having a financial strategy that involves setting money aside today to grow wealth and generate substantial returns in the future.

However, the way in which we make our money work determines how much passive income we’ll eventually be able to receive.

If I leave all my money in a low-interest savings account, the cash is safe. But I won’t see much growth, and may not even keep up with inflation.

I invest for stronger returns and eventually more passive income.

Investing vs saving

While saving is often viewed as a conservative approach, providing liquidity and preserving capital for short-term needs, traditional savings accounts offer minimal returns.

The best interest rates are currently hovering around 5.15%. However, with expected cuts to the Bank of England base rate, it won’t stay like this for long.

By contrast, investing introduces an element of risk while offering an opportunity for long-term wealth growth. While my HSBC savings account offers a yield of 2%, I aim for double-digit returns when investing.

Monthly contributions

Not all of us are fortunate enough to start our investment journey with a lump sum. For many, the path to financial growth begins with regular, disciplined savings. This is often in the form of automatic savings or contributions.

The power of consistency cannot be overstated, as even modest contributions, such as £100 a month, can accumulate over time, harnessing the magic of compounding.

By committing to a systematic approach, I can steadily build my investment portfolio, creating a foundation for long-term wealth and financial security.

Compounding returns

The key to building substantial wealth with a modest monthly investment lies in the concept of compounding returns.

By reinvesting returns year after year, compounding accelerates wealth growth.

This self-reinforcing cycle capitalises on exponential growth, earning interest on both the initial investment and its accumulated returns.

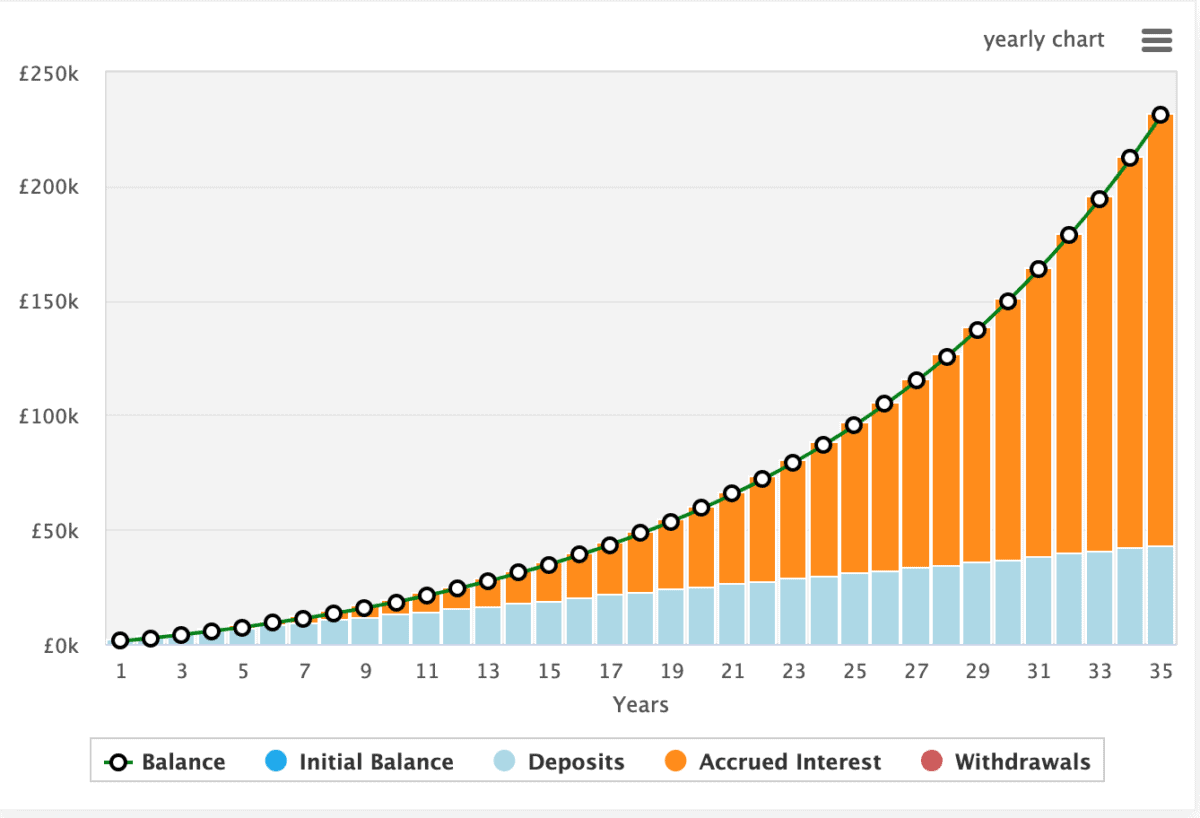

This chart shows how a monthly investment of £100, with a modest 8% annualised return could grow to £230k over 35 years.

In turn, this could potentially generate £17,530 in passive income annually without withdrawing from the manin amount.

Of course, the greater the annualised rate of return, the more money I’ll have in the long run.

It’s true, however, that I may not achieve an 8% return. This is dependent on my ability to make savvy investment decisions as well as the direction of global markets.

Sensible Investments

Investing involves risks, and that means making informed and sensible investment decisions is crucial.

The thing is, losses can compound too. If I lose 50%, I need to gain 100% to get back to where I started.

Rather than attempting to cover every stock on the market, creating a shortlist and comparing these with analyst recommendations can be a strategic approach.

My personal strategy starts with metrics. I’m looking for companies that stand out as being cheaper than their peers.

I follow this up with broader research, and then comparing my findings with other analysts and brokerages.