Investing is one of the few ways to earn a truly passive income. That’s why I enjoy it so much.

Yes, I do my research, and keep on top of developments, but it’s not like I’m working a second job or owning a buy-to-let property.

Like many of us, I put money aside each month. But it’s what we do with that money that really makes a difference in the long run.

Even today, my HSBC savings account is offering me just 2% AER — that’s up from 0.25% over most of the last decade.

I appreciate there are better rates out there, but they will fall when interest rates come down.

Getting richer

If we want to get rich (or richer), it’s what we do with our money that counts. It’s about making that money work hard and generating sizeable returns.

Let’s face it, if I put £400 a month into my HSBC savings account paying 2% AER, I’m not going to see my wealth grow very quickly.

So that’s why I invest on the stock market. This offers the potential for more substantial wealth growth compared to traditional savings accounts.

For example, billionaire investor Warren Buffett has actualised an annualised return of 19.8% over the past five decades, and that’s compounded over time, making him one of the richest individuals on the planet.

And by strategically allocating funds into a diversified portfolio of stocks, I can also benefit from the growth of companies over time and harness the power of compounding.

While the stock market involves risks, careful research and a long-term perspective can help navigate volatility.

But I do need to be careful. If I invest poorly, I could lose money.

Compounding

Compounding happens when an investment generates earnings, and those earnings, in turn, generate more earnings.

It’s a snowball effect where the initial investment grows not just on the principal amount but also on the accumulated interest or returns.

Some companies like Apple don’t offer much of a dividend, but reinvest the money it generates on behalf of investors.

But when companies do pay a dividend, I can help the compound returns process by reinvesting that money into the stock myself.

And this is where the annual rate of return become particularly important. In the charts below, I’ll illustrate the growth of a portfolio at different annualised rates.

Examples

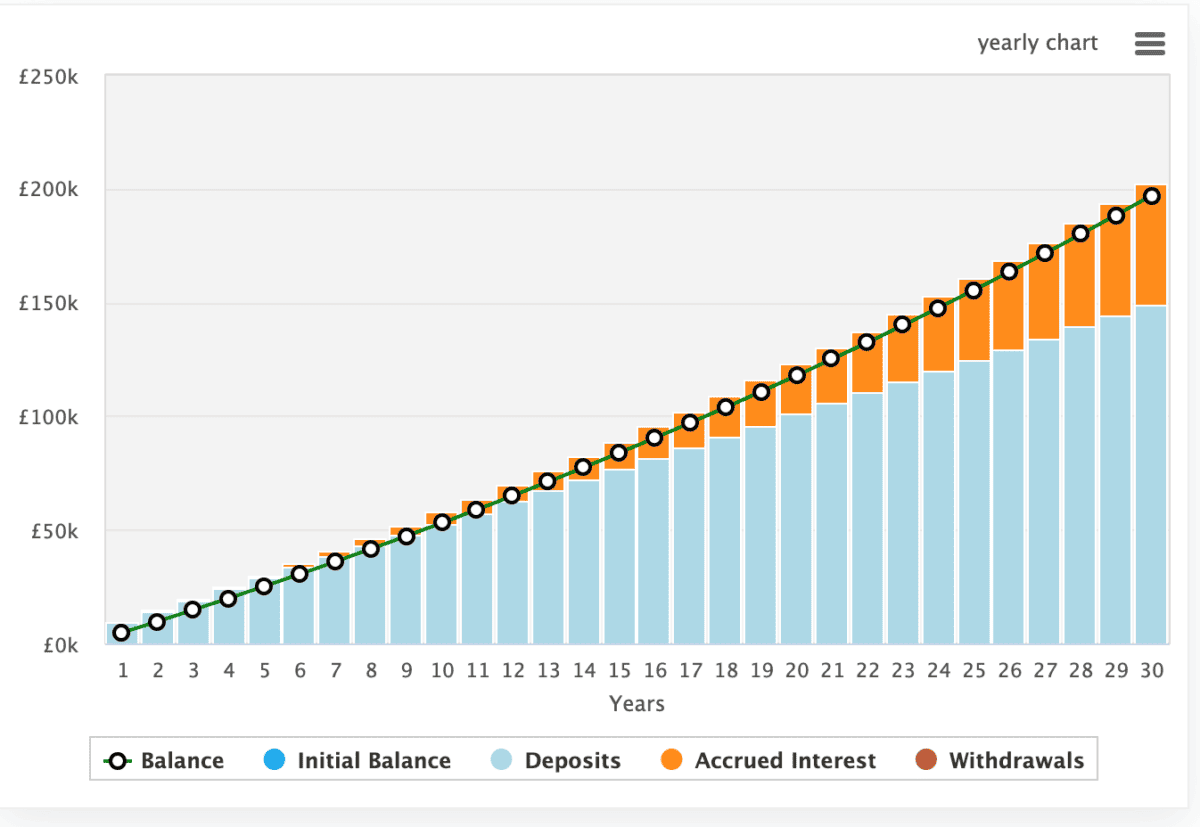

So if I were to put aside £400 a month and leave it in my HSBC savings account at 2% AER — I recognise this rate is variable — after 30 years, I’d have £197k, enough to generate £3,842 in passive income a year.

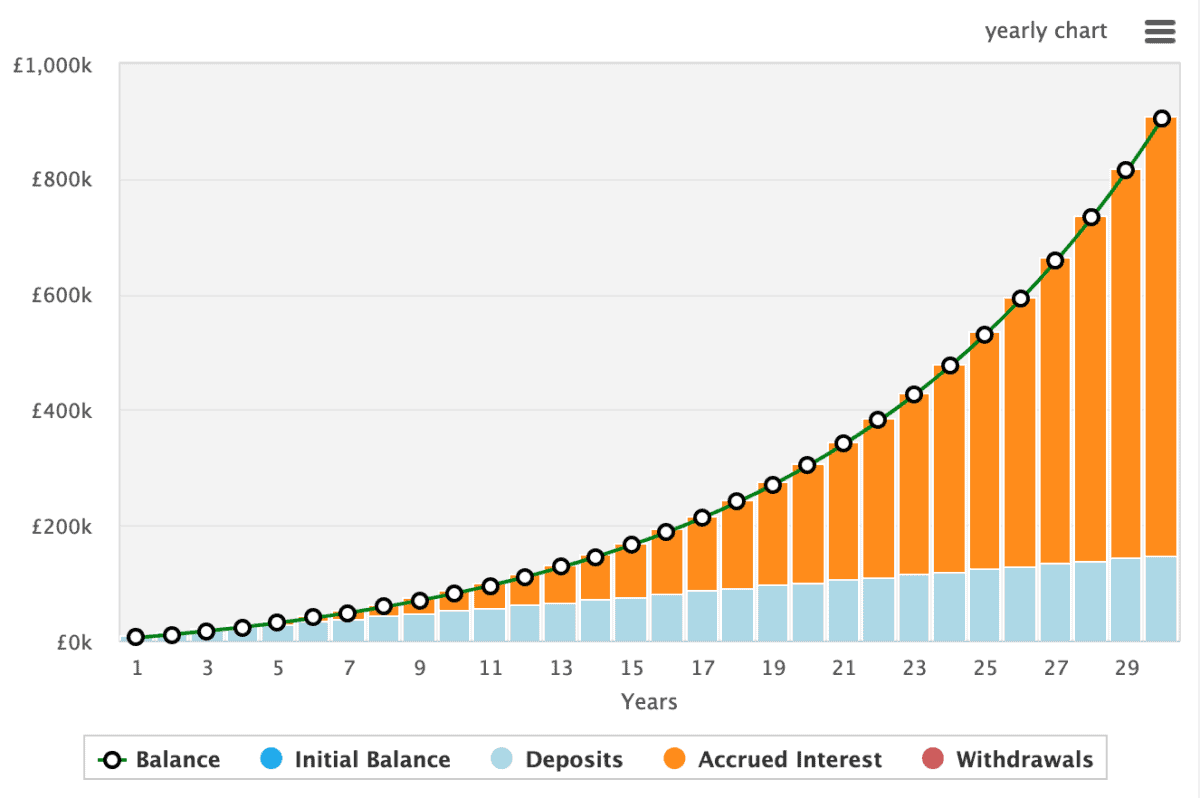

Now, a very good annualised return for a novice investor would be around 10%. So if I invested £400 a month for 30 years, and achieved 10% annually, at the end of the period I’d have £904k. That could generate £85k in passive income annually.

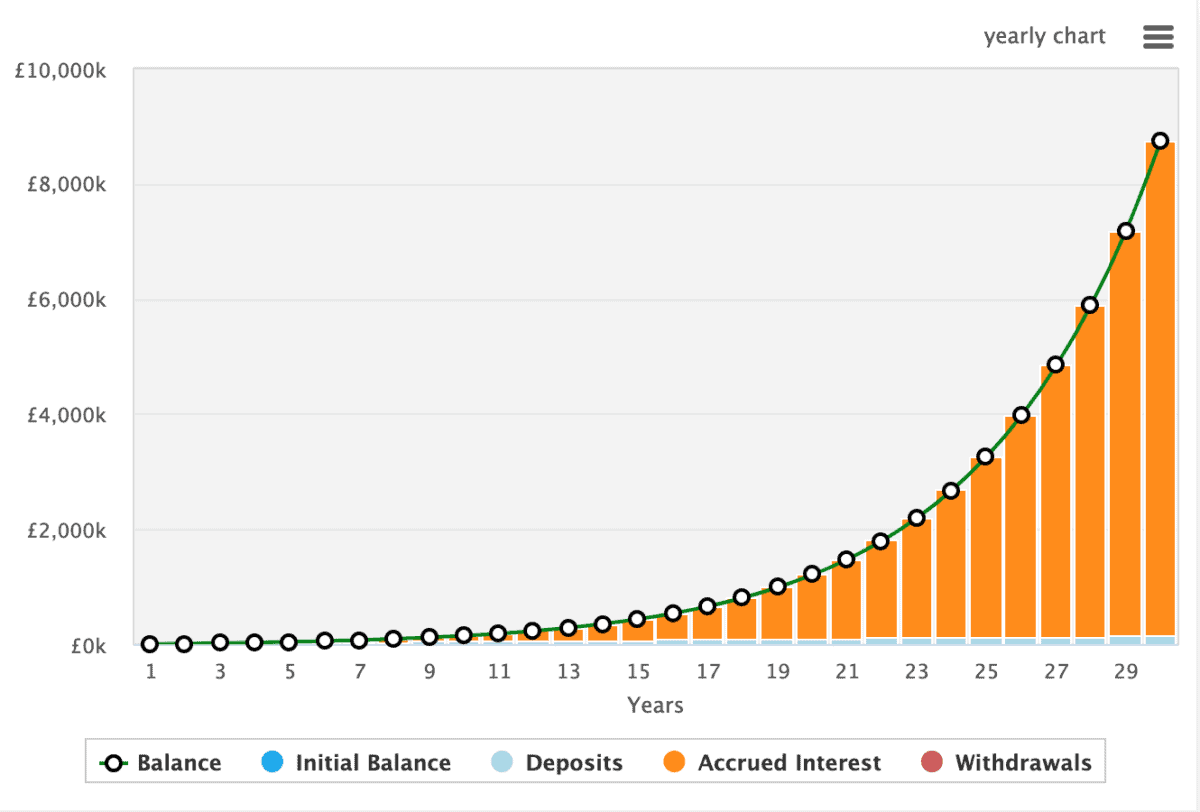

And if I could copy Buffett’s 19.8% returns… well, I’d have £8.6m after 30 years, generating as much a £1.56m in annual returns in the final year.

Of course, as Buffett demonstrates, it’s possible. However, I’ll settle for any double-digit returns.