There are plenty of ways to earn a second income. But only a few are truly passive. For me, it’s all about investing — putting money aside, investing it wisely, building wealth, and eventually drawing out the cash.

However, if I have £2,000 in savings, I need to be realistic. I’m not going to be generating life-changing passive income overnight. Instead, I must recognise that it’s going to take time, and maybe more money.

Building wealth

Phoenix Group is among the best paying dividend stocks on the FTSE 100. However, even if I put all of my £2,000 in there, I’d still only be generating £210 a year. Plus, it’s not overly wise to have all my money invested in one stock.

Instead, I need to build wealth over time, and then I can look to take a second income when the portfolio has reached my targets. But that can be easier said than done.

My strategy

If I were to put my £2,000 in an active savers account, it’d grow at a meagre rate — perhaps somewhere between 1.5% and 3% this year.

This is where investing comes in. A novice investor could look to make 6%-10% annually if they make wise investment decisions.

In theory, this means my money would be growing much faster than if it were in a savings account. This is particularly important when we consider compound returns — as explained below.

But I should also recognise that my investments will grow faster if I make regular contributions. Even if it’s as little as £50 a month. This will give my portfolio extra fuel for growth.

Compounding

In simple terms, compound returns is the concept of earning interest on interest, which leads to exponential growth over time.

The magic lies in the compounding process, where the money I earn from my investments starts generating its own returns when I reinvest it, creating a cycle of growth.

This effect is especially powerful over long periods, as the gains from each period contribute to an ever-expanding base.

Compound returns are a key principle in investing, emphasising the importance of starting early, making regular contributions, and reinvesting profits to maximise wealth accumulation over time.

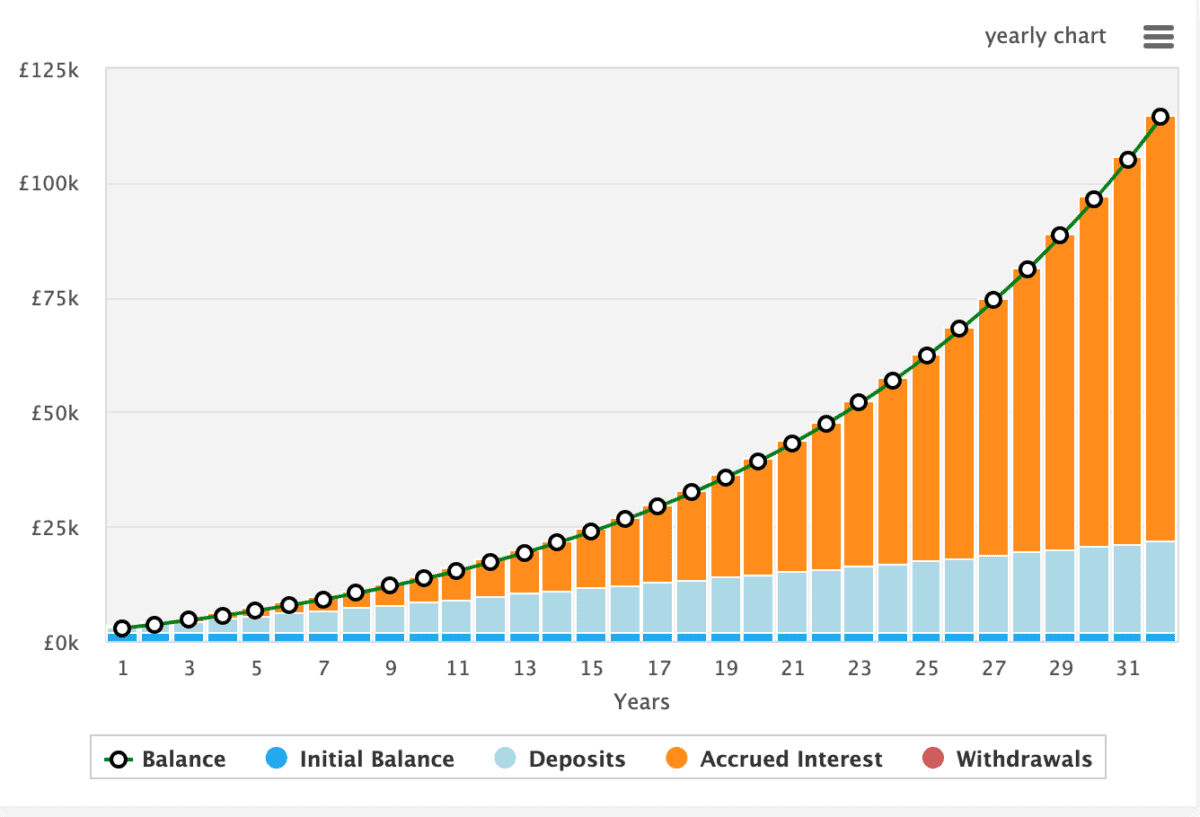

The below chart highlights the impact of compound returns on portfolio growth, when starting with £2,000, contributing £50 a month, and achieving an annualised return of 8%. The timeframe is 35 years.

After 35 years, the portfolio would be worth £114k. That’s enough to generate £8,738 every year — a substantial improvement on the original £210 figure.

Investing wisely

These days, there’s a host of democratising platforms that can help us make wise investment decisions. And that’s important, because many novice investors lose money. The thing is, if I lose 50% on an investment, I’ve got to achieve 100% to get back to where I started.