With the Tesco (LSE:TSCO) share price down 55% since 2007, I think there’s a significant opportunity for me here.

I like value investing, which is a strategy that focuses on buying shares at reasonable prices based on a business’s earnings and other growth rates.

And I think right now Tesco does present good value. But there are risks to consider.

For example, the price-to-earnings ratio of the company is still around 14. That’s better than only about 55% of 240 companies in the retail industry.

Why has the share price been going down?

Tesco has had problems stretching back almost two decades. There was its attempted expansion into the US in 2007. It exited the US in 2012 at a cost of £1.8bn.

It also faced a significant accounting scandal in 2014 after overstating its profits by around £250m.

Fast forward to today and perhaps its biggest issue, the cost-of-living crisis, is driving consumers to more ‘affordable’ supermarkets like Aldi and Lidl. This is an ongoing risk for the business.

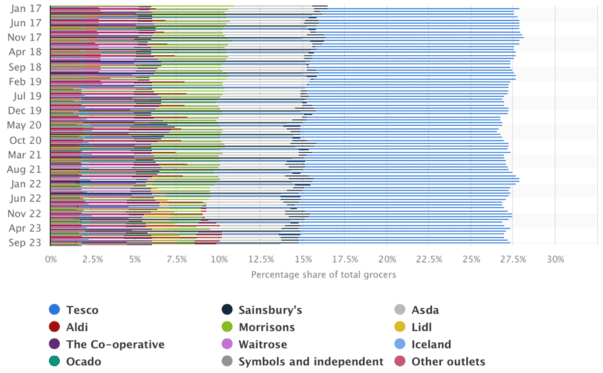

Yet Tesco still comfortably holds the top spot in the UK for grocery store market share. It has 27% of the market, and second place goes to Sainsbury’s with 15%.

What does the future look like?

Despite the historical setbacks, the retail giant reported a 7.8% increase in like-for-like sales for the first half of 2023.

But with 7,000 stores worldwide, can such growth continue? The market is already quite saturated for Tesco. However, it has had success recently in expanding into Ireland and South Korea. It’s investing €80m this year in eight new stores in Ireland, for example.

The company has also significantly invested in its e-commerce abilities to provide a superior service to those budget chains snapping at its heels via their physical stores. Lidl still doesn’t do e-tail and Aldi was relative latecomer to the channel.

I think it’s only a matter of time before Aldi implements better digital services in Britain, though. And Lidl might still enter the fray (it already sells online in its native Germany is currently testing home delivery in North America).

It’s not a value play I’ll be making

While I can see a successful turnaround story for Tesco in the works, I’m not convinced buying the shares right now is the best investment strategy.

My analysis suggests to me that the company isn’t remarkable on any fundamental measures.

Although the price is good, I really want to see more forward strategies that can increase revenue growth before investing.

Don’t get me wrong, I can see some potential for price growth in buying the shares right now, but I think it’s relatively short term. As a long-term investor, I’m looking for growth and value all in one far into the future.