Tobacco is an industry associated with high dividend yields. Lambert & Butler manufacturer Imperial Brands (LSE: IMB) is a case in point — the dividend yield is already a juicy 8.0%. On top of that, this month management announced a 4% increase in the annual payout.

Could things keep getting better?

Dividend could grow further

When it comes to the size of the dividend per share, I do think there could be more growth in store.

This year’s increase was a big step up from the more modest raise seen last year. The company has also been spending a lot of money buying back its own shares. £1.1bn is earmarked for that in its current financial year.

The company has a progressive dividend policy. That means that the plan is for the dividend to grow annually, but that is never guaranteed.

Management clearly has an eye on making shareholder returns attractive, perhaps in the hope that will attract more investors and help support the share price. I expect another chunky dividend increase in 2024.

High-yield potential

Still, given that the yield is 8% at the moment, a single-digit percentage increase will not push it to 10% in 2024.

I still think we might see a 10% yield at some point next year, though.

Why?

The answer lies in the two factors that make up a yield. One is the size of the dividend, but the other is the share price. If the Imperial Brands share price falls around a fifth, that would mean the current dividend would equate to a yield of 10%.

Such a fall could happen.

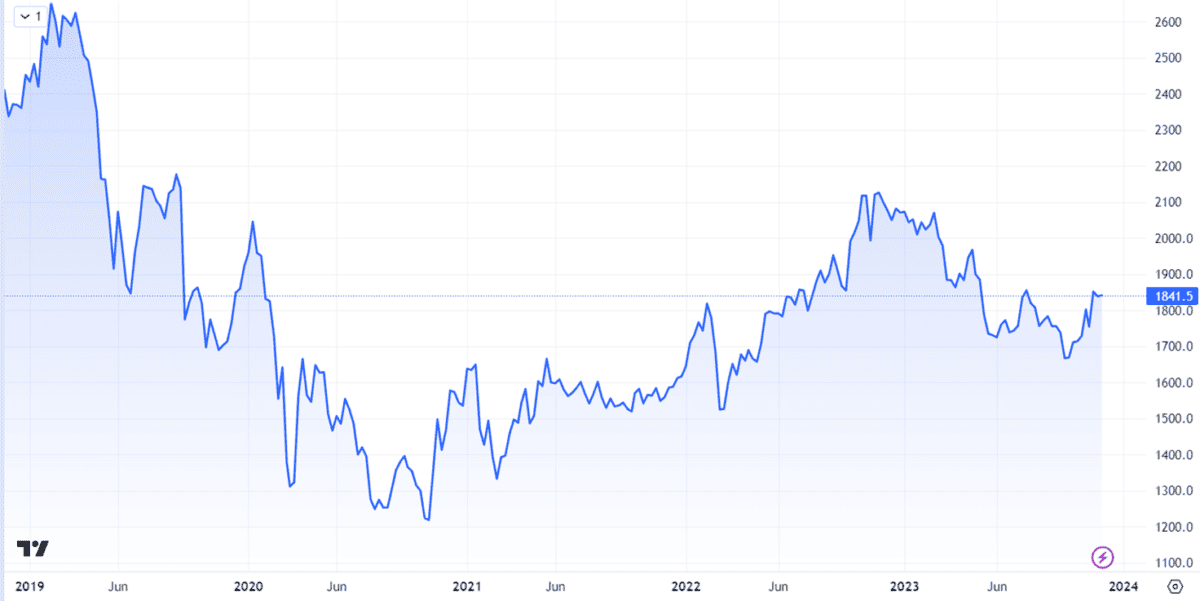

The shares are down 13% over the past year – and 24% on a five-year timeframe.

Tobacco as an industry that faces the risk of declining demand hurting both revenues and profits. Indeed, Imperial reported slightly lower revenues last year than in the prior year, although earnings per share jumped.

10% yield on the way?

Set against that, though, Imperial’s improving earnings could help boost shareholder sentiment – and the share price.

The company’s large buyback should also reduce the number of shares in circulation, helping to boost earnings per share. That could also help the lagging share price.

Still, the company has disappointed shareholders before.

It had a dividend yield well into double digits until it sharply reduced its payout in 2020. Meanwhile, competitors like British American Tobacco are more aggressively pursuing non-cigarette product lines.

Having sold its premium cigar business and moderated its non-cigarette ambitions in recent years, Imperial is more dependent than ever on cigarettes. But that market looks set to shrink considerably in the coming decade.

That strategic challenge could mean investor enthusiasm for Imperial remains weak despite the juicy dividend. That – or a general market pullback – may push down the share price next year and make a 10% yield a reality.

Still, I prefer British American’s wider focus. It has a higher yield to boot. In the long term, if cigarette demand continues to fall, I see a risk of another cut to Imperial Brands’ dividend. So for now I have no plans to invest.