Serco Group (LSE: SRP) is a UK stock I’ve been monitoring for a while now. Shares of the FTSE 250 outsourcing company are up 10.5% in November, meaning there’s good momentum.

But is now the time for me to invest? Let’s find out.

Analysts rate the stock

For those unfamiliar with the firm, Serco delivers public services across defence, transport, justice, immigration and healthcare. It operates across Europe, the Americas, Asia Pacific and the Middle East.

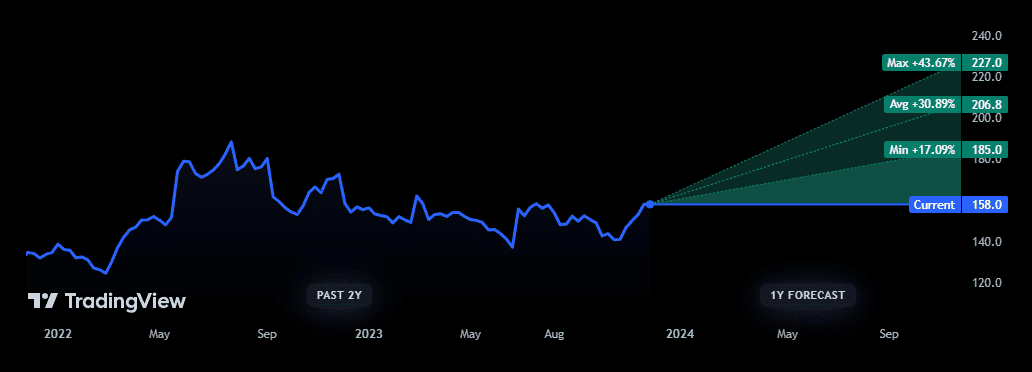

Brokers are bullish on the stock. Of the six City analysts covering it, five rate it as a ‘strong buy’. And there’s an average price target of 206p, which is 30% higher than the current share price of 158p.

A strong H1

In August, the firm released a robust set of interim results. Revenue grew 13% year on year to £2.5bn, while operating profit increased by 52% to £187.7m. This was despite weakness in Asia Pacific and the firm losing Covid-related work.

Serco is seeing a boom in demand for its various immigration services, especially in the UK and Europe. These range from border control and detention centres to accommodation and welfare support.

In September 2022, it acquired a business called ORS that enabled it to enter the European immigration services market. Management said this had “traded ahead of expectations with robust underlying demand due to global migration patterns“.

At the end of June, the order book remained high at £14.1bn. And looking to the full year, it expects revenue of at least £4.8bn, 6% more than last year.

Global migration trend

In 2023, the number of people displaced by war and persecution reached a record 108.4m, according to the UN.

Many millions more are moving to seek a higher standard of living or join relatives who’ve already done so. Hence migration to richer countries, which generally have labour shortages, is at an all-time high.

The World Economic Forum says annual net immigration into Europe is projected to increase steadily from current levels until 2036. And according to figures quoted by Zurich Insurance Group, there could be 1.2bn climate refugees worldwide by 2050 if global warming is left unaddressed.

Most governments simply don’t have the resources to deal with this. So they’ll likely need to continue outsourcing services to specialists like Serco. And this should underpin strong long-term growth in its international markets.

Will I buy the stock?

One thing I like here is that the company offers diversity in geography and sectors.

For example, it has a significant contract with the Australian Department of Home Affairs, which was recently extended until December 2024. And it has just won a £200m electronic monitoring contract with the UK Ministry of Justice.

That said, some of the areas in which Serco operates, notably detention centres, can be controversial. And due to this, I’d say there’s more of a risk of negative headlines knocking the share price. It has happened before and is something to bear in mind.

In fact, this may be why the shares are trading cheaply at a forward price-to-earnings (P/E) multiple of 10.6.

But given the growth potential here, I reckon the stock looks undervalued. Additionally, there’s a modest but growing dividend yielding 1.9%.

All things considered, I’m tempted to invest and may do so.