Inflation may be cooling but it’s still uncomfortably high. So it’s been nice to see a couple of dividend stocks in my portfolio announcing 10% dividend increases in recent months.

While they operate in very different industries, both companies look as strong as ever today.

A beefy raise

First up is McDonald’s (NYSE: MCD). In October, the restaurant giant announced its next quarterly payout will be $1.67 per share. That equates to a roughly 10% increase over the previous payout of $1.52 per share.

While the yield is fairly modest at 2.36%, the Dividend Aristocrat has served up 48 years of consecutive annual dividend increases. And the payout has more than doubled over the past decade, accompanied by a near tripling of the share price.

It might seem somewhat surprising to consider that revenue peaked years ago. It was $23.1bn last year, down from $28.1bn in 2013.

So what’s been going on here?

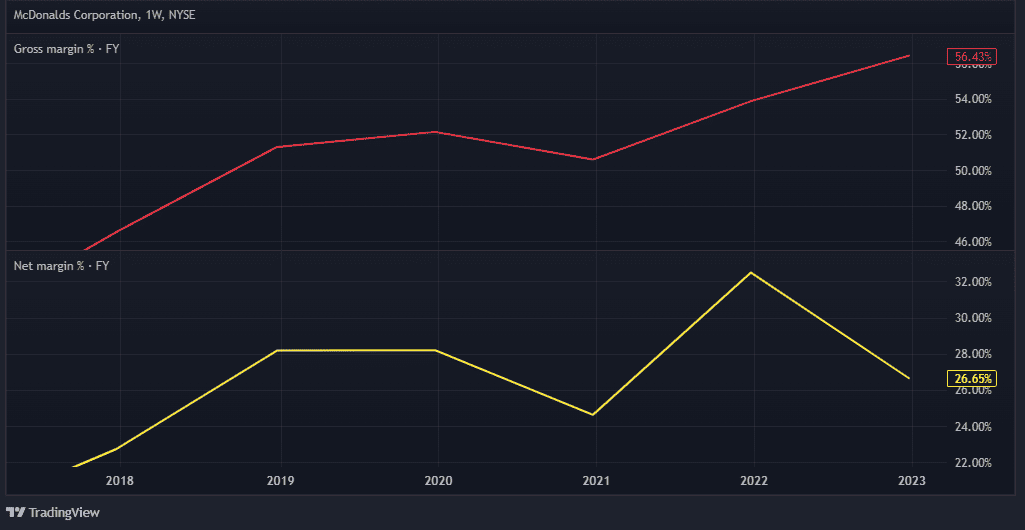

Well, McDonald’s has famously been moving to a franchise model for some time. As a result, it has fewer company restaurants to operate while it collects rent and royalties from its franchisees. And this has seen its profit margins expand meaningfully over the past few years.

Looking ahead, I’m optimistic the company can maintain its excellent dividend record. It recently raised the royalty fees for new US franchisees from 4% to 5%, bringing them in line with the rate it charges elsewhere. This was the first such increase in nearly 30 years.

Meanwhile, China has become its second largest market, with restaurants there doubling to more than 5,500 since 2017.

Consumer consumption concerns

Now, I should touch on the risk of GLP-1 weight-loss drugs like Wegovy. These reduce food intake and could (in theory) also reduce restaurant visits and threaten sales.

But will a significant percentage of the global population stay on these drugs permanently? What happens when they stop taking them? I feel it’s too early to make sweeping assumptions, one way or the other.

However, if need be, McDonald’s could respond with menu changes, including innovations around ingredients and portion sizes.

Personally, I think the risk is overblown and I’ll add to my holding if fear engulfs the stock.

Record order book

The second stock that has given shareholders a 10% pay rise is BAE Systems (LSE: BA.). The 2023 interim dividend of 11.5p per share, to be paid on 30 November, is 10.5% more than last year.

The FTSE 100 defence giant is forecast to pay out 30p per share for 2023, an increase of around 11%.

The 2.6%-yielding stock has surged 117% over the past five years as global defence budgets have risen in response to the war in Ukraine and ongoing geopolitical tensions.

This saw BAE take in orders of £21.1bn during H1, resulting in a record order backlog of £66.2bn. In Q3, management said another £10bn of orders had been booked.

Of course, the firm’s growth is beholden to ongoing military spending by governments. Any drop in that and the share price could suffer.

However, its swollen order book contains complex defence programmes undertaken over many years. This provides great earnings visibility. BAE has also upgraded its three-year free cash flow guidance, suggesting more dividend growth ahead.