Investing in penny stocks can be highly risky for investors. Smaller companies like these can suffer from extreme price volatility due to their low cost. They can also be more susceptible to collapse due to company- or industry-specific problems of weakness in the wider economy.

But when things go right, investing in young businesses can enjoy significantly better returns than by buying mature companies on say the FTSE 100 or FTSE 250. Profits growth can be far, far superior which, in turn, can result in terrific share price gains.

Here are two top penny stocks I think could deliver exceptional long-term wealth.

Atlantic Lithium

Investing in early-stage mining companies can be packed with peril. Setbacks at the exploration and asset development stages can take a sledgehammer to profit forecasts. These businesses also have weaker balance sheets than the major miners, which makes them more vulnerable to failure.

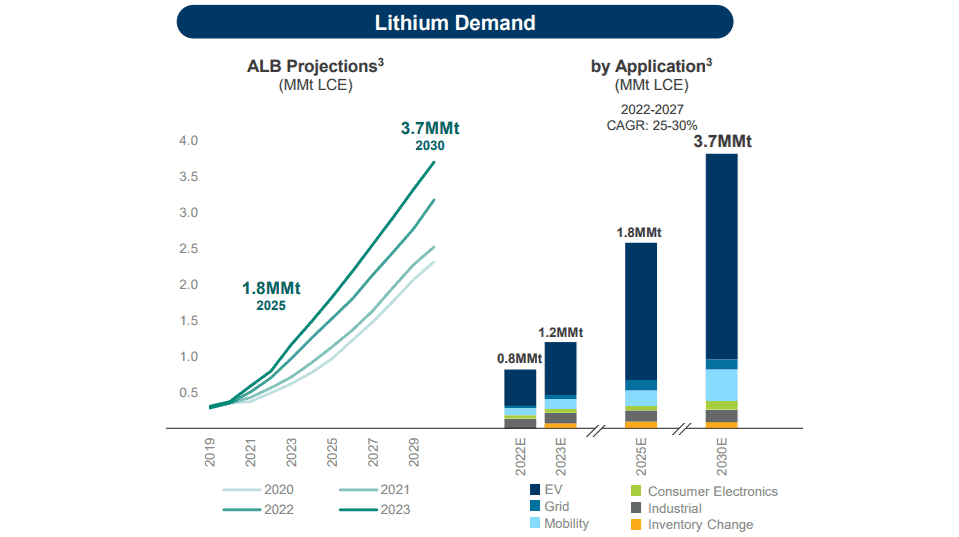

Yet I believe Atlantic Lithium (LSE:ALL) — which owns the Ewoyaa lithium project in Ghana — remains an attractive investment right now. As the graph from chemicals giant Albemarle below shows, demand for the silvery-white metal is tipped to rocket as electric vehicle (EV) sales take off.

The miner is making good progress in getting Ewoyaa up and running in early 2025. It received a mining lease from Ghana’s government in October, while talks over at engineering, procurement, construction and management (EPCM) contract for the main processing plant and non-processing infrastructure are said to be at an advanced stage.

The Ewoyaa project is huge, and when operational will be one of the 10 largest spodumene [ lithium aluminum silicate mineral] concentrate producers on the planet. Thanks to agreements with Piedmont Lithium and Ghana’s Minerals Income Investment Fund, the funding situation for the asset looks pretty robust.

On top of this, Atlantic Lithium also has a series of exciting exploration projects in the Côte d’Ivoire and Ghana. Last week, it received a new licence to explore for lithium in two projects within 70km of Ewoyaa. I think the company could have a very bright future.

European Metals Holdings

I believe European Metals (LSE:EMH) could be another great way to ride the lithium boom. The company owns the Cinovec project in Czechia, a resource that has been labelled ‘a strategic asset’ by the European Union.

It’s no mystery why. Cinovec is the largest lithium resource on the continent, and will produce 29,386 tonnes of lithium hydroxide during its 25-year life.

News of a successful pilot programme in early November illustrates the quality (and thus the huge commercial potential) of the Central European project. It showed “exceptionally clean battery grade lithium carbonate” that demonstrated 99.7% purity.

An added bonus is Cinovec’s location on the doorstep of Europe’s major carmakers and chemicals manufacturers. It’s much simpler and cheaper for the likes of Mercedes-Benz and BMW to source their lithium from here than elsewhere.

I think European Metals’ recent share price slump represents a top dip buying opportunity. A risk is that it could fail to deliver the profits growth its shareholders hope for if EV sales fall short of forecast. But, on balance, things are looking pretty good for the mining company.