Despite a challenging market for grocers, the Tesco (LSE:TSCO) share price has risen 18% over 12 months. It’s one of the strongest performers on the FTSE 100.

Although it hasn’t achieved the supercharged growth that Marks & Spencers has experienced, Britain’s largest supermarket chain has very strong fundamentals and a great platform for further success.

Here’s why I think Tesco will continue to grow.

Market share

The pandemic and the cost-of-living crisis has had a profound impact on where we shop. And the big winners have been Aldi and Lidl.

Their growing market share has come at the expense of the UK’s existing supermarkets.

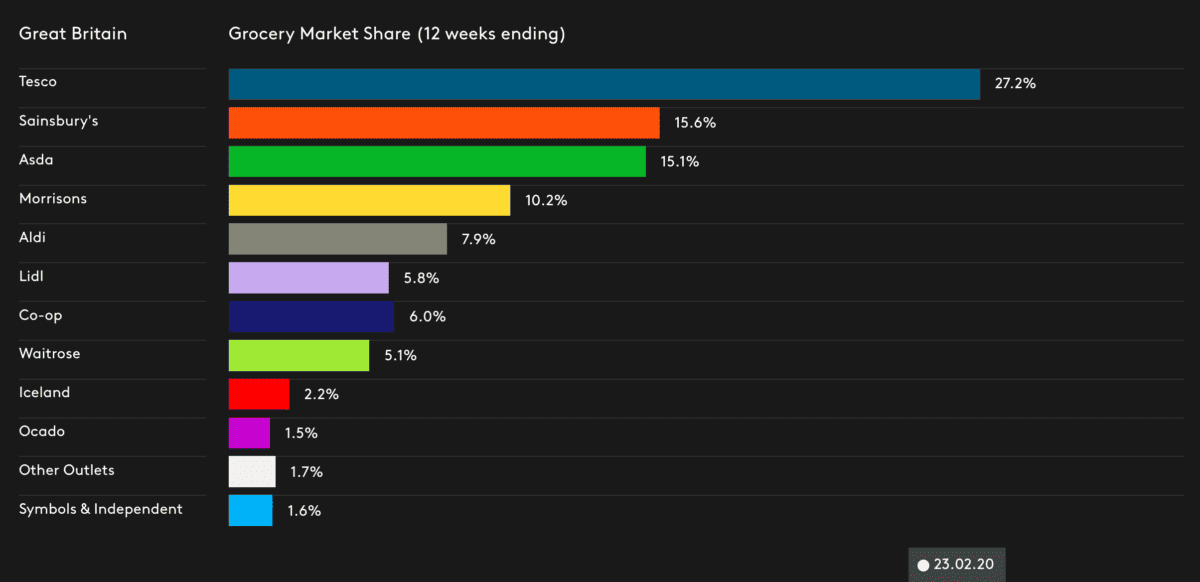

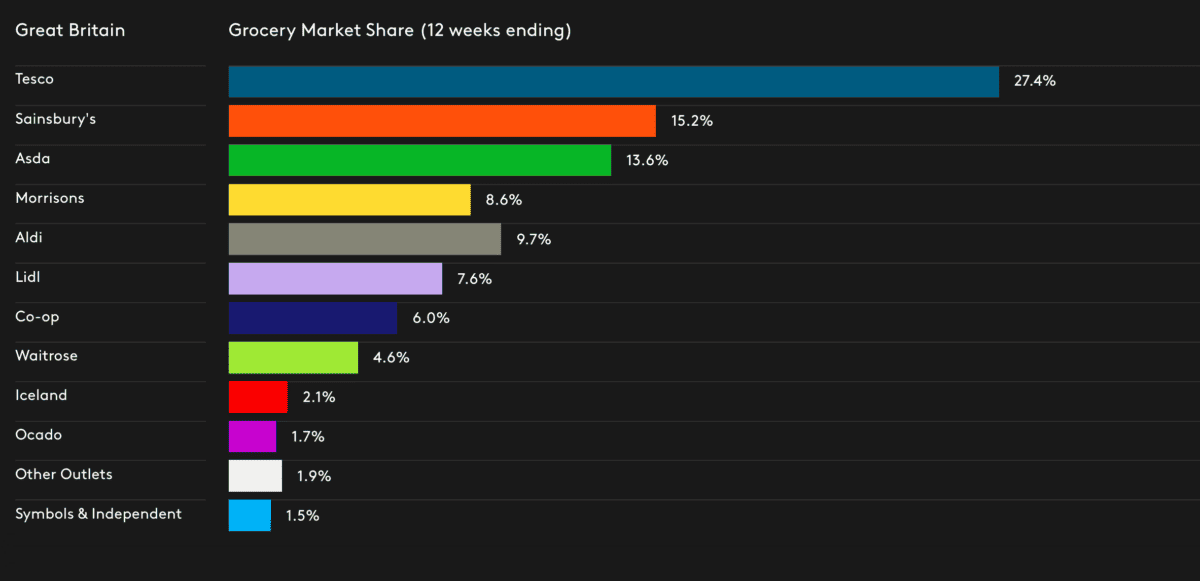

The market share of supermarkets in the UK before the pandemic is shown in figure 1, and figure 2 shows the market share data today.

The charts show that both Aldi and Lidl have increased their market share by almost 2%. That might not sound like a lot, but it’s a considerable shift in less than four years.

It’s primarily come at the expense of Asda and Morrisons, while Tesco has actually made a small gain over the period. This is quite an achievement considering the pressures the industry has been facing.

Scale and position

Part of the reason Tesco has been able to maintain its market share is its scale. As Britain’s largest supermarket, it’s utilised its scale and commanding position to keep prices low, absorbing lower margins when required.

In turn, this can lead to rather boring wine shelves — and other products — as the company favours volume over unique and possibly better products. This has long been its way of operating, but it’s been particularly beneficial in a period of high inflation and rising competition.

I’d also argue that its commanding market share and operating model puts Tesco in a strong position for when the economy improves. It’s a more aspirational brand than Aldi, Lidl, Morrisons, and Sainsbury’s, and could see some more market share gains in 2025 as recession fears lift.

Nonetheless, I’m aware that Tesco may need to compete even more fiercely in 2024 as interest rates bite and spending on groceries falls.

Valuation

Tesco is currently trading at 14.1 times earnings on a TTM (trailing 12 months) basis. That broadly puts it in line with peers — Sainsbury’s at 12 times (2023 earnings) and Marks & Spencers at 13.1 (TTM).

Here’s how these listed supermarkets compare on a forward basis, using projected earnings for the next three years.

| Tesco | 2024 | 2025 | 2026 |

| EPS | 23.2 | 24.3 | 26.2 |

| P/E | 12.1 | 11.6 | 10.7 |

| Marks & Spencer | |||

| EPS | 18.4 | 21.8 | 23.9 |

| P/E | 13.5 | 11.3 | 10.3 |

| Sainsbury’s | |||

| EPS | 16.5 | 20.3 | 21 |

| P/E | 16.4 | 13.3 | 12.9 |

It’s worth highlighting that Sainsbury’s has seen a drop-off in earnings this year, which is why the price-to-earnings (P/E) ratio is higher for 2024.

For me, Tesco and Marks & Spencers look like strong investment options with impressive earnings growth over the medium term.

With a strong market positioning, and attractive valuation metrics, I’d considering adding Tesco to my portfolio when I have the capital available. It’s not a bargain, but it’s certainly well priced.

However, I’m also impressed by the Marks & Spencers business model. It’s a stock I’m taking a closer look at.