Nvidia (NASDAQ:NVDA) stock is up 248% since the turn of the year. It’s understandably the best performing share on the S&P 500.

Normally this would concern me. The idea of investing in a company that has surged so far, becoming one of the most valuable in the world, is a little worrying. After all, it’s got a long way to fall.

However, the bull run has been driven by earnings report after earnings report and the company’s GPUs (graphics processing units) are central to the AI-revolution. That said, it fell post-close after its latest results report.

But could the stock realistically double in value again?

The Q3 figures

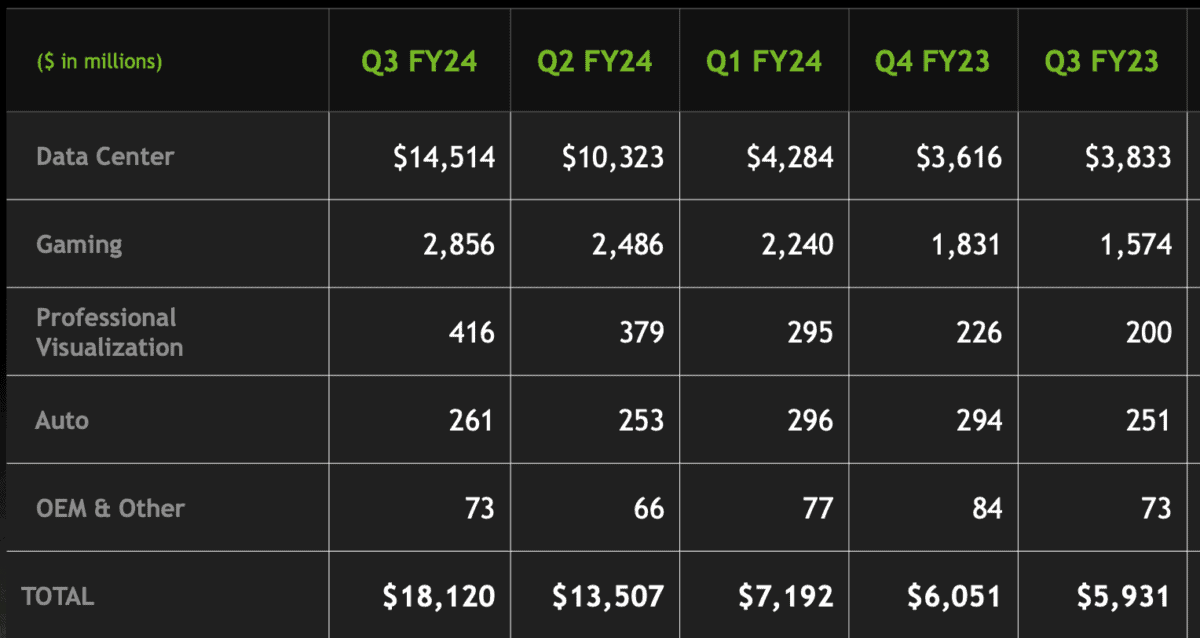

On Tuesday (21 November), the chipmaker disclosed its third-quarter results that exceeded Wall Street’s expectations. Key financial metrics included:

- Adjusted earnings of $4.02 per share, versus consensus $3.37 per share.

- Revenue amounted to $18.12bn, above the anticipated $16.18bn.

Nvidia reported an impressive 206% year-on-year growth in revenue for the quarter to October 29.

Net income surged to $9.24bn, equivalent to $3.71 per share, a significant increase from $680m, or 27¢ per share recorded in the corresponding quarter of 2022. That’s a 12 times increase.

Nvidia’s core business unit is its data centre operation. The department registered a substantial uptick, reaching $14.51bn, reflecting a remarkable 279% increase and surpassing the consensus of $12.97bn.

The company said that half of this data centre revenue came from cloud infrastructure providers. Looking forward, Nvidia forecast $20bn in revenue for the fourth quarter, implying 231% growth.

Doubling again

The stock has more than doubled this year, but could it double again to become the second most valuable listed company on the planet”

I’m sceptical. It’s certainly possible if the current rate of growth is sustained.

However, the chipmaker is already looking very expensive, trading at 121 times trailing 12 month earnings and 52 times forward earnings.

It’s also trading at 22 times sales, which is very expensive. A price-to-sales ratio above 10 is normally considered expensive.

Nonetheless, it would be remiss of me not to look at the price/earnings-to-growth (PEG) ratio. This provides me with a valuation that takes into account forecast growth — normally over the coming five years.

Nvidia’s PEG ratio is 1.38, which is promising. A PEG ratio of one normally suggests that a stock is trading near fair value, while a ratio below one suggests a company could be undervalued. However, it’s pretty rare to find a company with a ratio below one these days.

We should also consider the geopolitical factors that could slow this growth. Nvidia’s GPUs are central to the AI-revolution and the US has taken steps to reduce their export to China.

Nvidia said recent measures, introduced by the US government in October, had no material impact on the quarter. However, the Santa Clara firm said this would have a negative impact going forward.

Another potential weakness is its reliance on Taiwan and Taiwan Semiconductor Manufacturing Company for production. Structural supply constraints are perhaps unavoidable going forward as the firm also has contracts with other companies. Supply shortage would really harm growth.

Of course, Nvidia shares could double again, but I’m cautious. The stock has tremendous momentum and great growth metrics. However, there are some risks, and I’m still uncertain whether I’ll buy.