International Distributions Services (LSE:IDS) shares now trade for less than half of their pandemic-era highs. And that wasn’t helped by a disappointing set of results on Thursday 16 November that sent the share price falling further. However, sometimes it pays to buy when share prices fall. Could this be another company to add to my Stocks and Shares ISA?

Returning to profit

The owner of Royal Mail anticipates paying a small dividend from its General Logistics Systems (GLS) unit this fiscal year.

The company says its adjusted operating performance is hovering around the breakeven point.

IDS reported a group adjusted operating loss of £169m for the six months ending 24 September, compared to £57m the previous year.

Royal Mail, facing challenges like strikes, a cyber security incident, an Ofcom fine, and loss of its monopoly on parcels from Post Office branches, contributed to the overall weakness.

Parcel revenues — a higher-margin side of the business — fell 6.2% seemingly amid competition for Post Office parcels.

The company’s group revenue saw a marginal 0.4% increase in the first half, with a 5.9% growth at GLS offset by Royal Mail’s weaknesses.

IDS had initially aimed to turn a profit this fiscal year, but the aforementioned obstacles have led to adjusted operating performance expectations near breakeven.

Of course, the return to profitability will be a key milestone for the company that has endured a tough two years. The share price is currently hovering near where it was in the early stages of the pandemic, when the stock experienced a severe correction.

Worth the price?

IDS certainly doesn’t look expensive trading at just 0.2 times sales, however, it’s not profitable at this moment in time. As such, we have to look further into the medium term to gain a better idea of the company’s valuation.

In the below table, I’m using consensus estimates for the company’s earnings per share (EPS) for the coming three years, including this fiscal year ending in March. These EPS forecasts also allow me to create forward price-to-earnings (P/E) ratios bases on this data and the current share price.

| 2024 | 2025 | 2026 | |

| EPS (p) | -6.7 | 22.7 | 34.1 |

| P/E | n.a. | 10.4 | 6.9 |

Moving towards the end of our time period, we can see a P/E of 6.9 for 2026. That sounds pretty cheap, and it is. The FTSE 100 average is currently around 14.

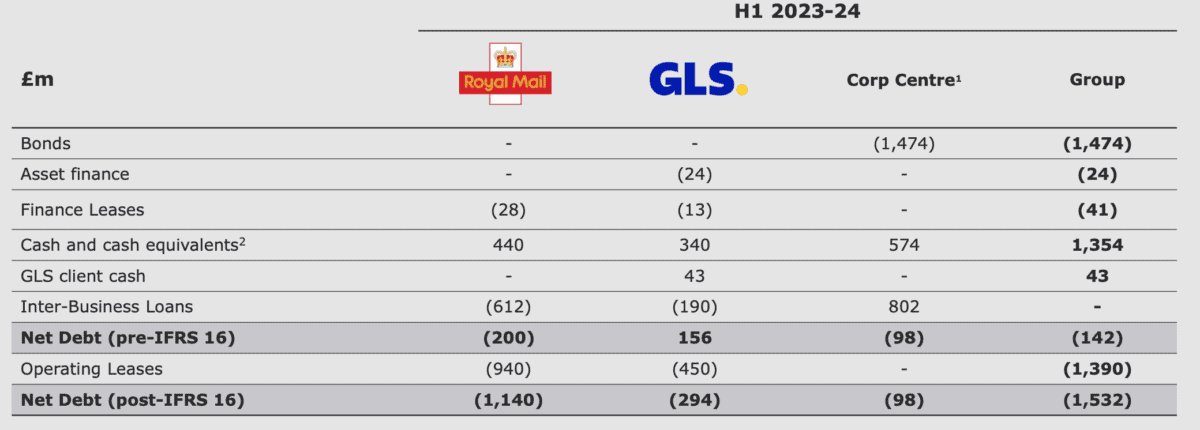

It’s also worth highlighting that IDS carries £1.5bn in net debt. That’s a lot for a company which remains unprofitable and has a market cap of just £2.3bn. The below table highlights how most of this debt is held in the problematic Royal Mail part of the business.

As such, I, like several analysts, would like to see more evidence that IDS’s performance is turning around. High debt levels and struggling operations amid union disputes is a real concern for investors.

Right now, I won’t be adding the Royal Mail owner to my Stocks and Shares ISA, but I’ll keep an close eye on the company. Hopefully, things will improve for this iconic mail delivery service.