In recent years, NIO (NYSE:NIO) has been championed by some as a competitive threat to Tesla (NASDAQ:TSLA). The electric vehicle (EV) manufacturer already has a strong presence in China’s premium market segment and ambitious international expansion plans suggest NIO stock could have a bright future.

However, while both firms enjoyed explosive share price growth during the pandemic, the US giant’s held on to its gains more successfully than NIO. Over five years, the Tesla share price has advanced 906%, compared to just 6% for its Chinese rival.

So, is NIO stock cheaper today? Here’s what the charts say.

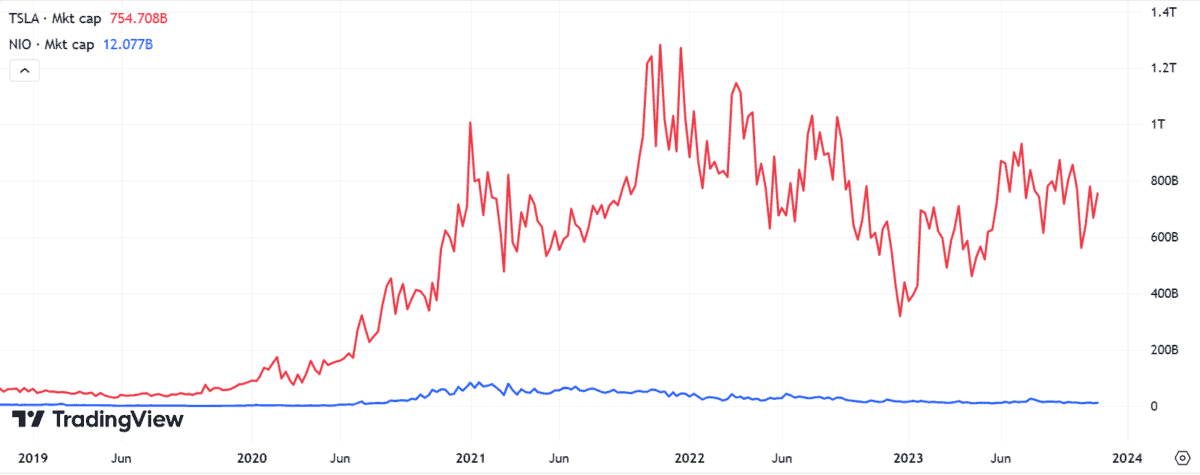

Market cap

First, let’s look at the carmakers’ respective market capitalisations. This metric’s a good indication of a company’s size.

As the chart above shows, Tesla’s grown over 11.5 times larger in five years. A $65bn market cap back in November 2018 has ballooned to over $754bn today.

By contrast, NIO doubled in size from a $6bn to a $12bn company.

Therefore, Tesla’s a far bigger industry player than NIO. This doesn’t mean it’s a better company per se, but potential investors should note that it benefits from economies of scale that NIO doesn’t.

Indeed, recent price cuts across its range of vehicles serve as good examples of the US giant exercising its muscle in the increasingly competitive EV market. After initially resisting, NIO subsequently followed suit by slashing $4.2k from the price of all models a few months ago.

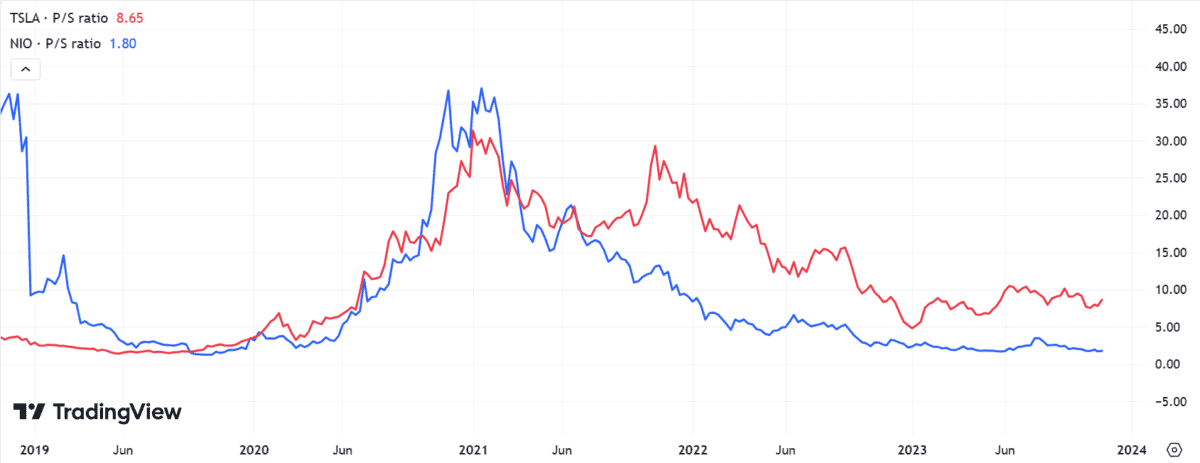

Valuation

Next, there’s the subject of valuation. It’s arguably more suitable to use the price-to-sales (P/S) ratio rather than the price-to-earnings (P/E) ratio as a comparison tool since NIO’s currently a loss-making enterprise.

Both companies have been on a rollercoaster ride, but at today’s prices NIO shares look cheaper than Tesla shares — at least on this metric alone. The former stock’s P/S ratio of 1.8 compares favourably to its larger competitor’s 8.65 ratio.

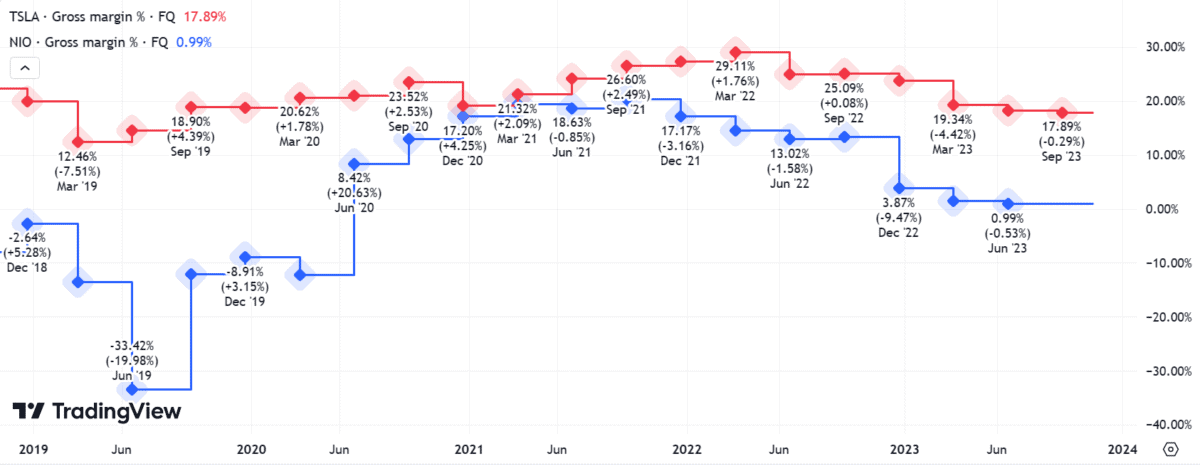

Profitability

However, as mentioned, NIO isn’t profitable. In fact, it currently loses $35,000 on each car it sells. In addition, the company’s gross margins have been lower than Tesla’s for the past five years — often substantially lower.

It’s suspected that significant subsidies from the Chinese government have made this possible. At first glance, benefitting from Beijing’s strategic policies might count in NIO’s favour as the company’s still early in its growth journey.

However, the European Union’s now launching an investigation into the Chinese government’s activities in the EV sector. This could lead to tariff impositions in NIO’s crucial European markets. CEO William Li has also been highly critical of perceived US protectionism in recent months.

Ultimately, such political tensions could be an unwelcome headwind for the company as it tries to expand its international footprint. After all, NIO’s yet to export a single car to the massive American market.

So is it cheaper?

NIO might look cheaper than Tesla on some traditional valuation metrics. That shouldn’t be discounted lightly. However, on questions of profitability and market dominance, Tesla looks the better company to me.

I have concerns about the valuations of both EV shares at today’s prices, so I’m keeping this pair on my watchlist for now. However, if I had to pick one, I’d rather buy Tesla stock today.