The soaring popularity of so-called artificial intelligence (or AI) stocks has been one of the big investment stories of 2023.

The stunning evolution of OpenAI’s ChatGPT chatbot over the last year has led to an explosion in the number of businesses exploring AI to boost their operations. So I’m searching for the best investment trusts that give investors a chance to potentially make big bucks from this latest technological revolution.

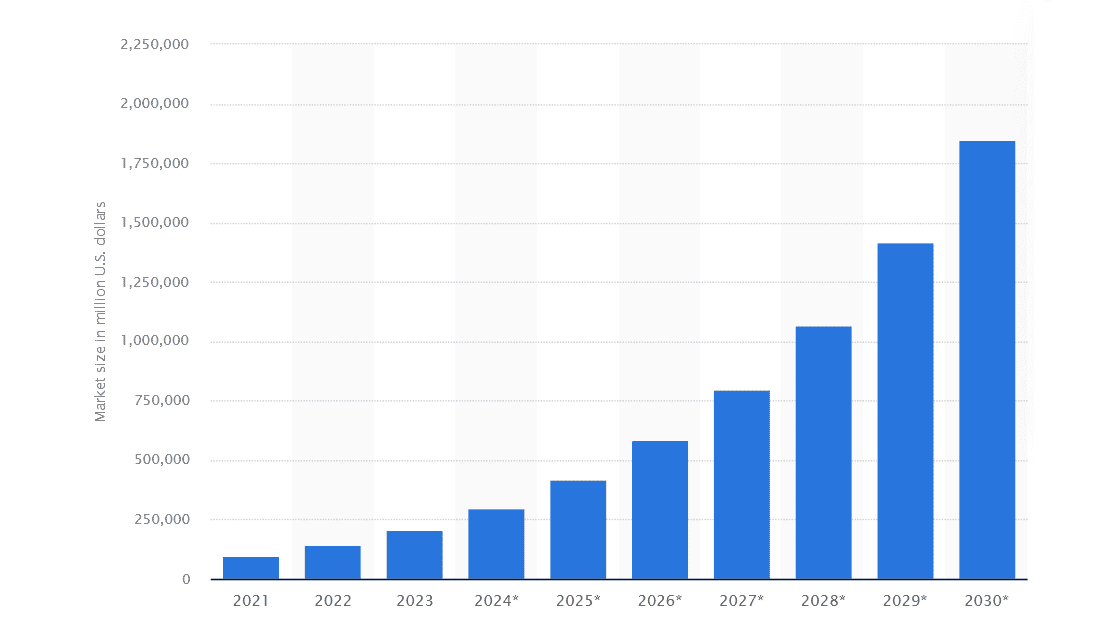

The chart below illustrates why AI has captured the investment community’s imagination. According to Statista, this market is set to grow by a stunning 789% between this year and 2030.

Graphics processing unit (or GPU) maker Nvidia has been one of the biggest beneficiaries of the AI revolution of late. It’s share price has more than trebled in 2023 as a result. But there could be better ways to try and capitalise on this growing market, and I’m targeting some investment trusts. Their diversified approach (that is, investing in a range of different companies and/or assets) helps to spread risk.

Here are two top trusts I’m considering buying for my own portfolio.

Polar Capital Technology Trust

Polar Capital Technology Trust (LSE:PCT) has been delivering solid returns for its investors since 1996. And it contains all of the big beasts that play a critical role in the growth of AI.

The trust — with more than three-quarters of its funds invested in North American companies — includes the likes of Microsoft, Apple, Alphabet and Nvidia. Just over half of its capital is invested in software and semiconductor manufacturers.

On the downside, the technology trust’s focus on the US and Canada leaves it more exposed to financial downturns in the region. It also means it has less chance to capitalise on soaring growth rates in emerging regions. Just 9.5% of its funds are invested in Asia Pacific firms (excluding Japan).

Yet I believe its impressive portfolio still makes it an attractive buy. And at current prices it trades at a handy 13.1% discount to its net asset value (NAV).

Allianz Technology Trust

Allianz Technology Trust‘s (LSE:ATT) share price is also cheaper than the sum of the instrument’s parts. Its share price is 13.2% lower than its NAV.

As you may expect, this financial vehicle invests in many of the same companies as Polar Capital. But it’s even more highly geared towards mega-cap US technology companies.

In total, North American companies comprised a whopping 95.2% of its portfolio as of August 2023. Nvidia was its single biggest holding, comprising 0.4% of the total portfolio, while key holdings here included Meta and Amazon. Around 10% of its capital was also invested in e-commerce companies.

The cyclical nature of the tech sector means the trust’s shares could fall again if nervousness over the global economy spikes. But over the long term I believe it could prove to be a top investment as AI adoption takes off.