Last week, I hit a milestone in my SIPP (Self-Invested Personal Pension). For the first time since I opened the account a few years ago, it was worth more than £50,000.

I’m pretty happy that my SIPP’s balance is above the £50k mark. However, I’m aiming to build up much more than that in my account in the years ahead.

If I play my cards right, I reckon it could hit the £500k mark before I turn 60.

Building long-term wealth

Right now, I’m 44.

And I contribute around £1,000 per month (£12k per year) to my SIPP.

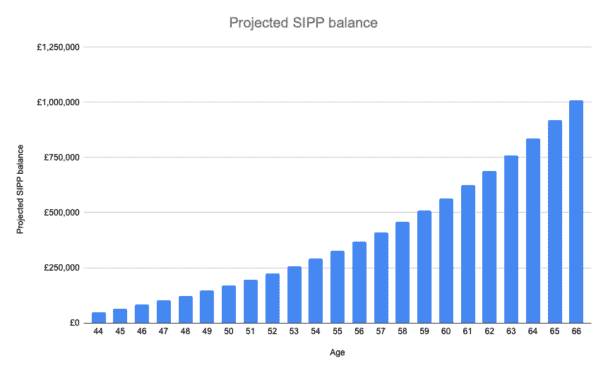

Crunching the numbers, I calculate that if I was to continue paying this much into my account going forward, and I was able to generate a return of 8.5% per year over the long term, I’d hit the £500k mark by 59 (and even £1m by 66).

Note that a lot of the growth here is due to the magic of compounding (earning returns on previous returns), especially in the later years.

For example, between the age of 63 and 66, the projected balance jumps by about £250,000. That shows the power of compounding.

It’s worth pointing out that I haven’t factored in any tax relief here because I contribute to my SIPP directly from my limited company (which reduces my Corporation Tax liabilities).

However, if I was to factor this in, I’d hit the £500k and £1m milestones earlier.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

How I’m investing my SIPP

Now, I reckon an 8.5% return per year is very achievable.

However, to achieve this kind of return, I’ll need to invest properly and for me, that means in the stock market.

So, what I’m doing with my SIPP savings is investing in three main areas to build a rock-solid portfolio.

First, I’ve got some money in tracker funds. These give me broad exposure to global stock markets at a low cost.

Then, I’ve got some money in actively-managed investment funds. Examples here include Fundsmith Equity, Blue Whale Growth, Sanlam Global Artificial Intelligence, and Schroder Global Healthcare. These should hopefully boost my long-term returns (they all have excellent long-term track records).

Finally, I’m investing money in individual stocks. Here, I’m investing in companies that I think are likely to be the leaders of tomorrow.

Microsoft is one example. It’s a leader in both cloud computing and artificial intelligence (AI), so I reckon it’s poised to get much bigger over the next decade.

Nvidia is another stock I’ve bought for my SIPP. It’s the dominant player in the AI semiconductor space so I think it’s set for strong growth in the years ahead.

I’ll point out that I expect this stock market-based investment strategy to have its ups and downs.

There are likely to be some years when I make big returns, some years when returns are a little underwhelming, and some years when I generate negative returns.

I feel that this diversified strategy will deliver good results over the long term, however.

And if I keep contributing to my SIPP regularly, I’m hope that my SIPP will hit seven figures eventually.