In early 2020, boohoo (LSE: BOO) shares crashed from 327p to 180p in a matter of weeks as the pandemic unfolded. Then they quickly rocketed all the way up to 413p when investors realised online shopping might actually do quite well during a lockdown.

However, by November last year, the shares had fallen to just 47p.

Here, I’m going to look at how much I’d have now if I’d invested £5,000 in boohoo shares one year ago.

Nursing a paper loss

As I write, the boohoo share price is 34p. This represents a one-year decline of 27%, meaning my £5k investment would now be worth about £3,650.

The fast-fashion firm has never paid a dividend, and has recently turned loss-making. So I wouldn’t have received any cash dividends to soothe the pain of my paper loss.

But spare a thought for longer-term investors. The shares are down 88% in three years!

What on earth has gone wrong?

The perfect storm

Obviously, boohoo grew rapidly during the pandemic when the high street was shut. It was always going to be tough to maintain such growth once conditions normalised.

However, the company has since faced a hurricane of headwinds. These have included supply chain problems and scandals, higher item returns, cost inflation in raw materials, freight and energy, a customer cost-of-living crisis, and extreme competition from the likes of Shein.

In H1, covering the six months to the end of August, sales plunged 17% year on year to £729m. It posted a pre-tax loss of £9.1m and now expects full-year revenue to drop by 12-17%.

The lower end of its previous guidance was for a fall of just 5%!

Back-to-growth plan

More positively, the firm has saved £94m through the reduction of inventory. Plus, it has identified gross annualised savings of more than £125m across this financial year and next. But marketing won’t be cut as it continues to invest in its brands.

Furthermore, inflation is falling while it’s benefiting from warehouse automation, which has increased unit pick rate efficiencies. It also now has its first US warehouse to drive faster deliveries to its customers there.

The firm hopes all this can lay the foundations for its medium-term “back to growth” plan.

Looking forward, it intends to stay on top of trends (I’d assume it would be doing this anyway) and operate “a leaner, lighter, faster business model.”

A speculative punt

If boohoo manages to turn things around, I reckon there could be a monumental rebound in the share price. However, that’s a big ‘if’.

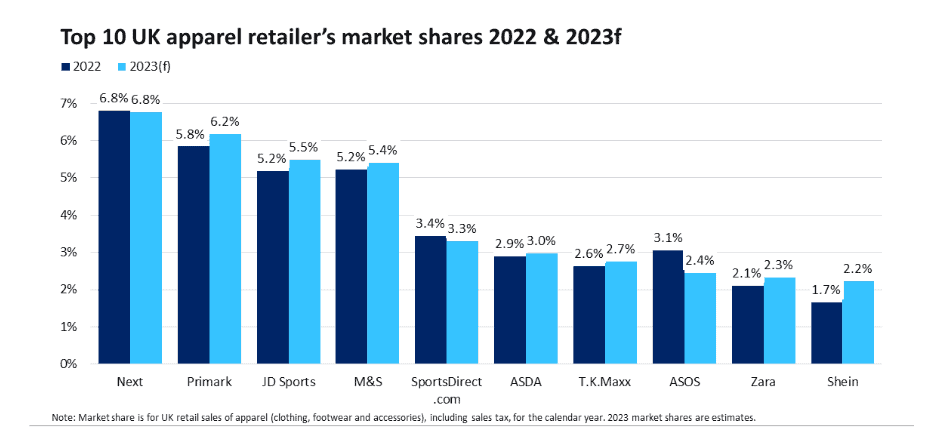

Shein is already the largest fast-fashion retailer in the world and is taking further market share with Gen Z shoppers in the UK. It ships ultra-cheap goods from Chinese manufacturers to UK consumers. That’s hard to compete against.

Last month, Shein acquired the Missguided brand from Frasers Group. And according to GlobalData estimates, it has now entered the top 10 UK clothing retailers.

Is competition why boohoo’s active customers declined 12% to 17m during H1? Perhaps not, but it’s a worrying trend.

Given all this, I think investing in boohoo shares today would be like taking a speculative punt. There are far safer stocks to buy, in my opinion.