At the time of writing, NIO (NYSE:NIO) shares are changing hands for just short of $8. Over the past three years, it’s been a wildly volatile stock, extending above $60 and finding support around $7.

NIO is an unprofitable Chinese EV manufacturer. But like many companies in this industry, it’s on the road to profitability. At least that’s what investors hope.

Profitability is key here. Nobody wants to invest in a company that will never turn a profit. There’s just no point.

Originally, when I started covering NIO a couple of years back, the firm said it would achieve profitability in 2024/25.

That’s not likely to be the case anymore, with Covid-induced disruption and broad under-delivery issues.

Today, I’m asking whether NIO could one day trade for $40. That’s more than five times greater than the current share price.

Price targets

NIO’s stock is currently trading at the lower end of its price range for the past year and is also trading below its average price over the last 200 days.

Among the 32 analysts who provide one-year price predictions for NIO, the median forecast is $12.62.

Predictions vary, with the highest estimate at $21.72 and the lowest at $4.50. The median forecast suggests a potential increase of 61.01% from the current position.

Of course, this doesn’t mean $40 is not achievable in the medium term.

The road to profitability

In October 2023, NIO delivered 16,074 vehicles, marking a remarkable 59.8% year-over-year increase.

These deliveries comprised 11,086 premium smart electric SUVs and 4,988 premium smart electric sedans.

Moreover, for the year to date, NIO has delivered a total count of 126,067 vehicles, reflecting 36.3% year-over-year growth.

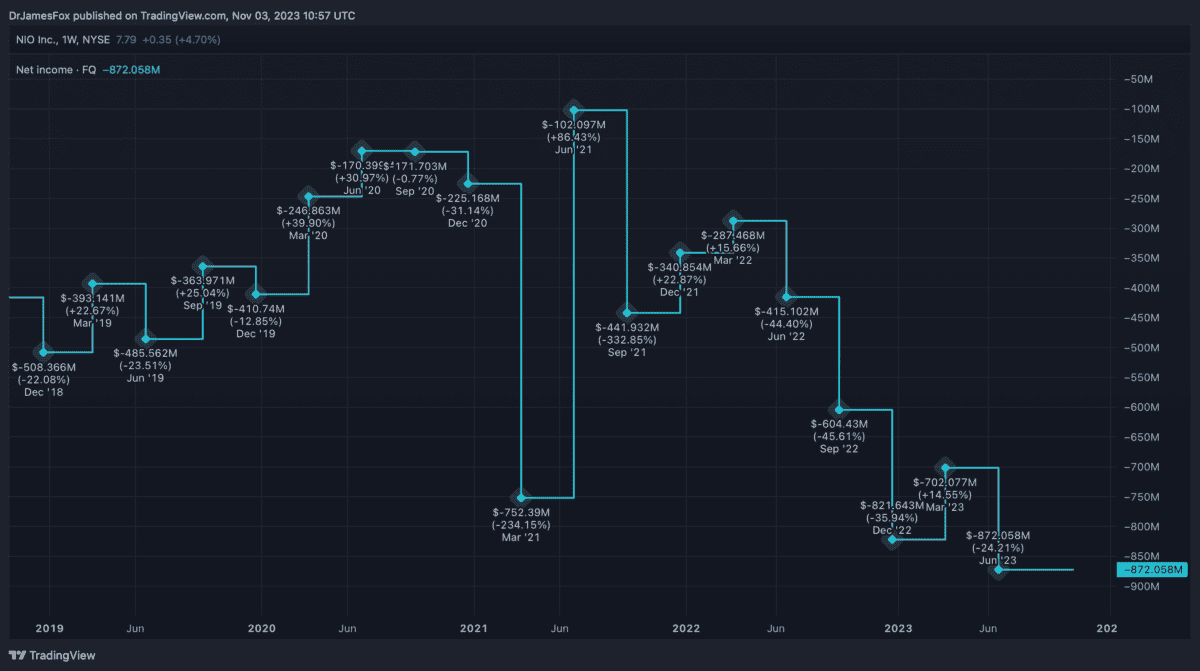

This is great, but the company is still losing money as the chart below highlights. As we can see, there’s no clear movement towards profitability.

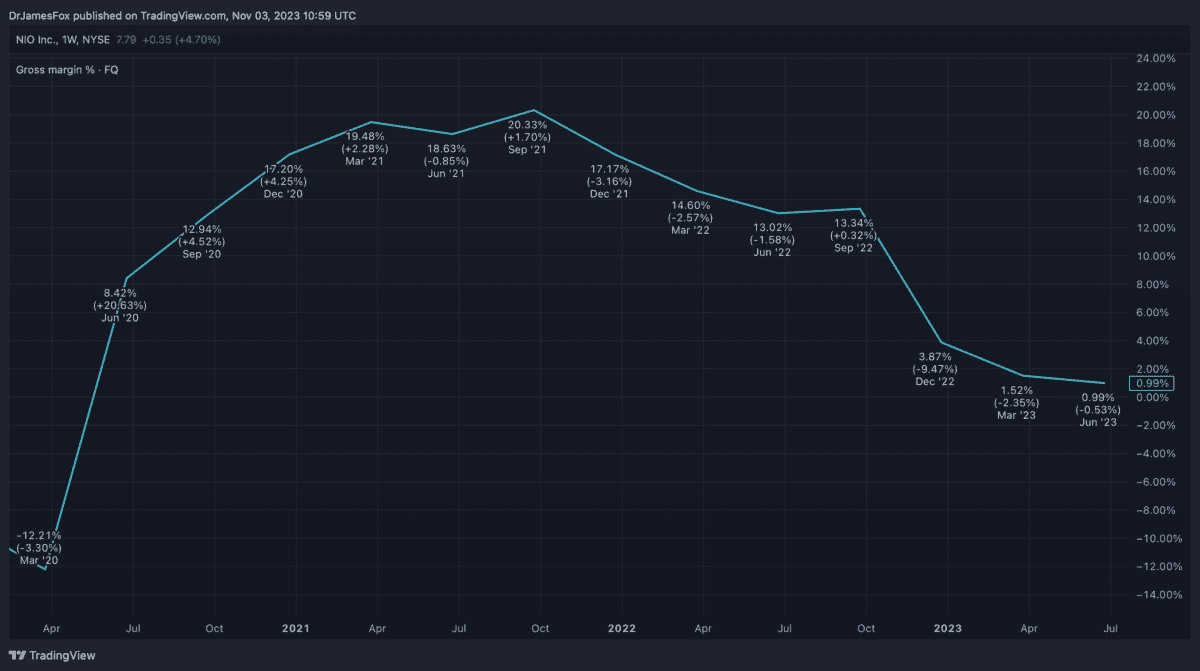

One reason for this is falling gross margins, which has been attributed to price wars and NIO attempting to shift older stock at cheaper prices.

Because of this, profitability really doesn’t appear to round the corner. But if profitability is achieved, I can see the stock surging.

The innovator

I know plenty of ‘NIO bulls’ — investors who are optimistic about NIO stock. One of the core reasons for this is the company’s relentless innovation, particularly its its battery-swapping technology. Charging is one of the biggest issues holding the EV industry back. Long journeys have to be broken up with lengthy service station stops.

However, NIO’s battery-swapping tech allows drivers to swap their empty batteries for full ones in a matter of minutes. These swapping stations also generate revenue for the company.

Valuation

Will NIO hit $40 in the next five years?

It really is hard to tell. But it’s worth highlighting that EV companies — those that are profit-making or particularly promising — trade with expensive valuations. Tesla currently trades at 81 times forward earnings.

As such, NIO wouldn’t need to be earning on a par with Tesla to reach $40 a share. Far from it. Net income of $600m would satisfy the equation.

The question is how can that can be reached. In theory, that could achieved with 200,000 vehicle sales and a net profit of $3,000 per car. I think that’s achievable in five years.