FTSE 100 stock Rightmove (LSE: RMV) fell 16% last month. The fall was the result of fears that rival OnTheMarket – which was snapped up by US online property search company CoStar Group – could be more of a threat to the business in the future.

Here, I’m going to discuss why I think investors should consider buying the stock after its recent drop. Let’s get into it.

The best company in the FTSE 100?

Rightmove is a high-quality business. I’d argue that it’s one of the highest-quality businesses in the entire FTSE 100 index (or even on the London Stock Exchange for that matter).

For starters, it has a very powerful brand. When someone wants to search for a house to buy or rent here in the UK, they usually turn to Rightmove first.

As a result of this brand power, the company has a ridiculously high market share. For the first half of 2023, its market share of the UK property search space was 86%.

This brand power and market share give the company a real competitive advantage. Because it’s such a dominant platform, property agents can’t afford to ignore it.

Superb financials

The company also has top-notch financials.

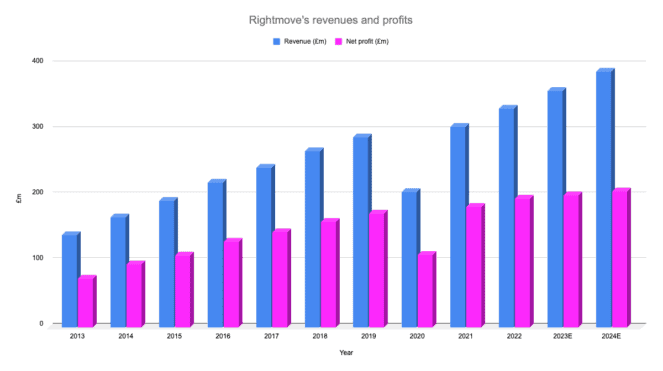

Over the last decade, revenues and profits have increased significantly. It’s worth noting that unlike housebuilders, Rightmove isn’t materially impacted by the property cycle.

Chart: Created by author. Data: LSEG.

Meanwhile, it generates a very high return on capital (a measure of profitability). Over the last five years, return on capital employed (ROCE) has averaged 376%. That makes the company the most profitable in the FTSE 100 index (by a mile).

As for the balance sheet, this is rock solid, with basically no debt.

And in terms of dividends, the company has been a reliable payer (it recently raised its H1 payout by 9%). The yield is around 2% currently.

Available at an attractive valuation

Now, investors normally need to pay up for this kind of quality.

Typically, a company of this ilk will command a price-to-earnings (P/E) ratio in the 20-25 region.

Currently though, Rightmove shares sport a forward-looking P/E ratio of just 18.

That strikes me as a bargain.

And I’m clearly not the only one who sees value at current levels.

Recently, analysts at Berenberg upgraded the stock to ‘buy’ from ‘hold’ on the back of its recent dip.

They see the share price fall as an ‘overreaction’ and believe that Rightmove is likely to remain the number one property portal in the UK.

Their price target is 605p – nearly 30% above the current share price.

I’m backing this winner

What about the OnTheMarket/CoStar deal though? Could this have an impact on growth?

Potentially. However, I can’t see it having a major impact if I’m honest. To my mind, Rightmove’s brand is just too strong.

If OnTheMarket did become a more powerful force, I’d expect property agents to use both it and Rightmove.

Of course, I could be wrong here.

In today’s fast-moving digital world, competitive advantages can be eroded quickly (just look at how Apple Pay has impacted PayPal).

I’m backing Rightmove to continue winning, however, and I’ve bought more shares for my own portfolio recently.

I think other long-term investors should consider doing the same.