Over 12 months, the easyJet (LSE:EZJ) share price is up just 5%. And this is because the stock tanked in October, falling a sizeable 15%. So why is that? Let’s take a look.

A challenging month

In October, the easyJet share price dipped due to a confluence of factors.

One significant contributor to this downward trend was the company’s profit guidance falling short of market expectations. easyJet gave its full-year profit outlook in the Q4 report, indicating a range between £440m-£460m. However, this was notably below the consensus forecast of £469m.

This discrepancy can be attributed to various factors including the impact of strike action during the summer months and heightened competition.

However, we can also speculate that rising global fuel prices following the Hamas attack on 7 October had an impact on the share price — not Q4 performance.

The outbreak of war between Israel and Hamas caused oil prices to spike given fears that the war could escalate.

The Middle East region holds over 60% of the world’s proven crude oil reserves. Additionally, it’s home to the world’s largest oil exporters including Saudi Arabia, Iraq, and Iran, while possessing several key maritime choke points.

In turn, I imagine the conflict would have damaged demand for winter sun destinations in the region. I’d actually been planning to head back to Aqaba on easyJet in December… but maybe we’ll wait — a missile recently hit nearby Taba.

easyJet also serves destinations including Hurghada and Sharm El-Sheikh.

Buy the dip?

‘Buying the dip’ is a strategy where investors purchase assets, typically stocks, during a market decline with the expectation their value will eventually rebound, allowing for potential gains.

So is this 15% decline an opportunity to buy? Well, there’s certainly a strong investment hypothesis.

For one, the budget-conscious business boasts a significantly healthier financial position than many of its peers, offering a considerably greater cushion for potential risks.

On the topic of fuel, easyJet has a robust hedging strategy in place, with nearly 75% of its fuel needs for the first half of FY24 secured at $866, and a solid 46% hedged for the second half at $822.

This allows it to operate on the front foot, according to demand forecasts. In fact, in the Q4 report, easyJet said it has placed a firm order with Boeing for 157 aircraft for delivery between FY29 and FY34.

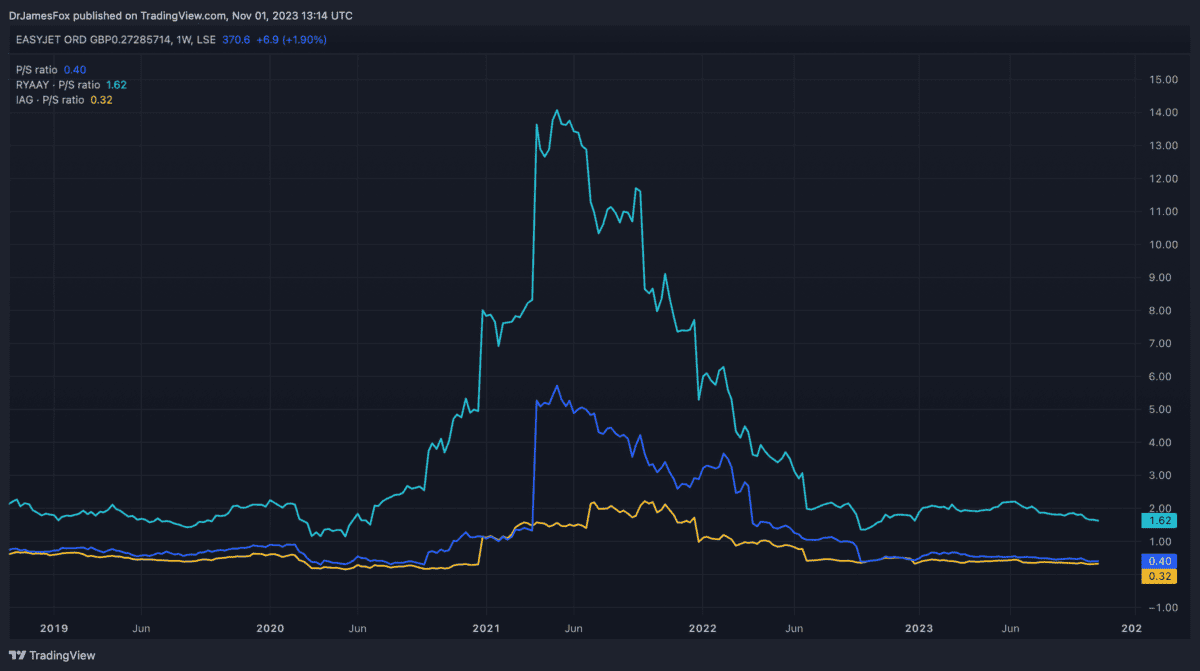

We can also see that easyJet looks cheap compared to its budget peer Ryanair, but broadly trades in line versus European giant IAG. The below chart shows a price-to-sales comparison.

Naturally, no investment is without risk. Given easyJet’s emphasis on the budget segment of the market, there’s a possibility its customer base could be the initial group to feel the pinch if we experience a substantial recession.

Nonetheless, easyJet looks like a strong investment opportunity. The growth of its package holiday segment looks set to expand margins, while its solid financials means dividends should remain sustainable.

If I had spare capital I would investment today. However, my preference remains IAG.