GSK (LSE:GSK) shares were largely unmoved after the company published its Q3 results on Wednesday (1 November). It was a strong quarter, but analysts had anticipated a good showing. As such, the gains were already priced in.

So, if I’d invested £1,000 in GSK shares a year ago, today I’d have £1,020 plus dividends. The stock has risen by only 2% over the period, although its worth highlighting there’s been plenty of volatility in the meantime.

Thankfully, the dividend yield currently sits around 4.1%, meaning I would have received around £40 in dividend payments.

Let’s take a closer look at GSK and explore where the stock might go next.

Q3 earnings

GSK reported a robust Q3, with a 10% increase in total sales, reaching £8.15bn. Excluding falling Covid-related sales, the year-on-year growth rate came in at 16%.

The vaccines sector performed particularly well, with a 33% increase in sales including Covid, and a 34% increase excluding it.

Part of this growth can be attributed to key products such as Shingrix, which contributed £800m in sales — up 15% — and Arexvy, which generated £700m in revenue.

Speciality medicines saw a 1% dip in sales including Covid and 17% growth without them, further highlighting long-term growth potential for the sector. HIV treatments made a significant contribution, with a reported 15% rise in sales.

Meanwhile, general medicines saw a 2% decrease in sales, which was attributed to competition in the generic market.

Litigation

GSK has settled a cluster of lawsuits in California related to the heartburn medication Zantac. However, the pharma giant isn’t out of the woods.

US-based plaintiffs claim the drug, which was widely used until 2020, contained a cancer-causing agent.

GSK says there’s no evidence for this, but having settled some cases, will likely face a long period of uncertainty until all the cases have been dealt with.

It’s widely expected that these lawsuits will cost the company billions, despite thousands of cases being dismissed by a judge so far. There are still some 75,000 cases outstanding in Delaware.

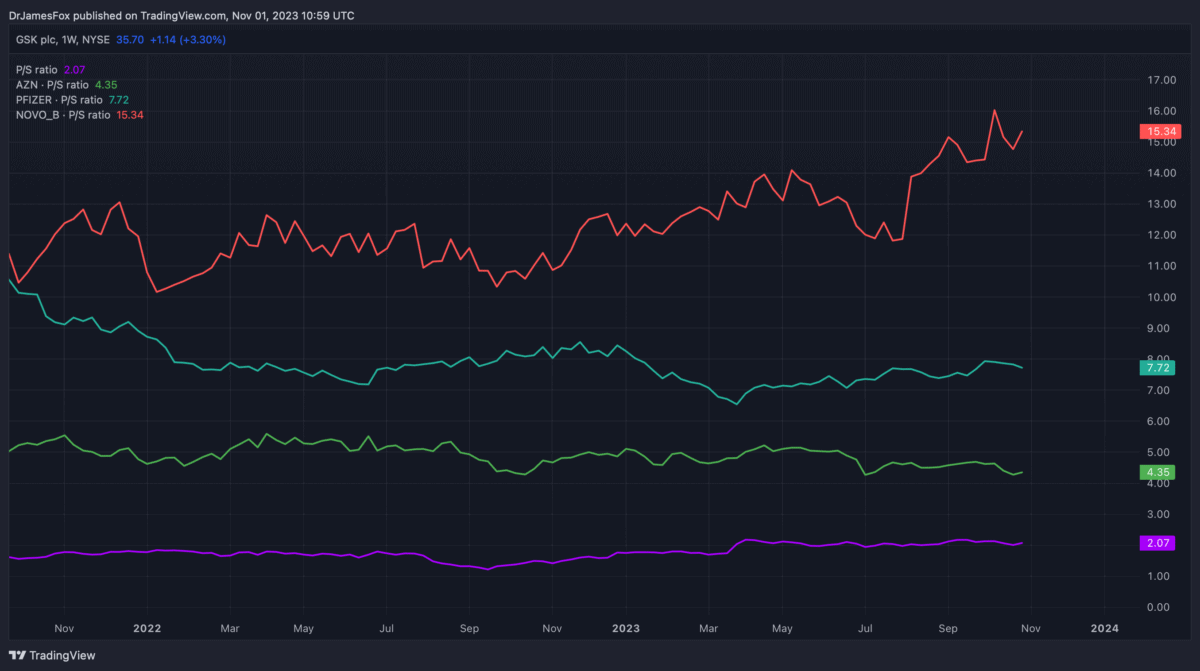

To some extent, this explains why GSK trades at a discount versus its peers. The below chart compares a selection of pharma giants by the price-to-sales ratio.

Playing the long game

Looking closely at the company, it’s clear to see that it’s in a strong position, registering double-digit EPS growth, and advancing in almost every area of its operations.

If I were to increase my holdings in GSK, I’d be playing the long game. I’ve got to accept that the very worst-case scenario regarding Zantac litigation isn’t entirely priced in.

As such, I could see more downward pressure before the share price recovers in the long run.

So, why am I so confident about a recovery for the long term?

Well, the pharma investment hypothesis is underpinned by strong prospects.

Ageing populations worldwide are driving growing healthcare needs, and pharmaceutical firms play a central role in meeting the demand.

With ongoing medical innovations and their ability to address global health challenges, pharmaceutical companies are positioned for sustained growth.

This sector’s resilience, diverse product portfolios, and the high regulatory barriers to entry make it an appealing choice for long-term investors seeking a reliable and potentially rewarding investment.

If I had the capital, I’d increase my stake.