Wouldn’t it be incredible to have a tax-free source of passive income? The idea of generating income without the burden of taxes is a dream many of us share.

Passive income, often regarded as the ultimate goal in achieving financial independence, can be generated by investments that do the heavy lifting on our behalf.

So, what if I had £5,000 in savings? Could I really turn that into £60,000 of passive income within 30 years? Well, it’s certainly possible.

Nurturing a portfolio

£5,000 is a great starting point. But in order to make my portfolio grow faster, I’ll need to embrace the concept of regular saving or regular contributions.

This isn’t rocket science. It’s pretty obvious. If I were to contribute £250 a month from my earnings to the portfolio, it would provide me with additional capital for my investments.

Over time, my commitment to regular saving has several benefits, including pound-cost-averaging and harnessing the power of compounding — the snowball effect where my money makes more money.

By consistently adding to my investments, I can create a cycle of growth, where each contribution builds on the previous one.

Compounding

As noted above compounding is central to long-term wealth generation. This is the process of reinvesting my returns year after year.

It might not sound like a world-beating strategy. But it really is. Essentially, when I reinvest my returns year after year, it means I’ll start earning interest on my interest. In turn, this leads to exponential growth.

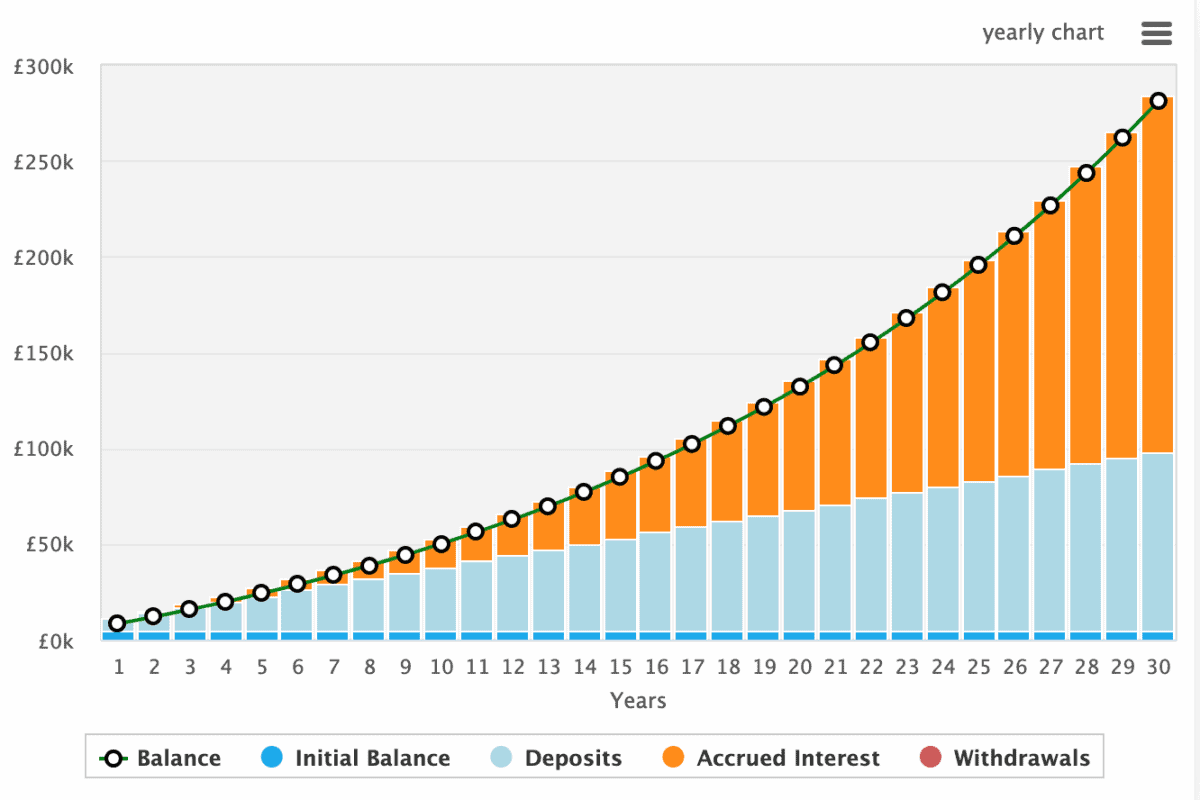

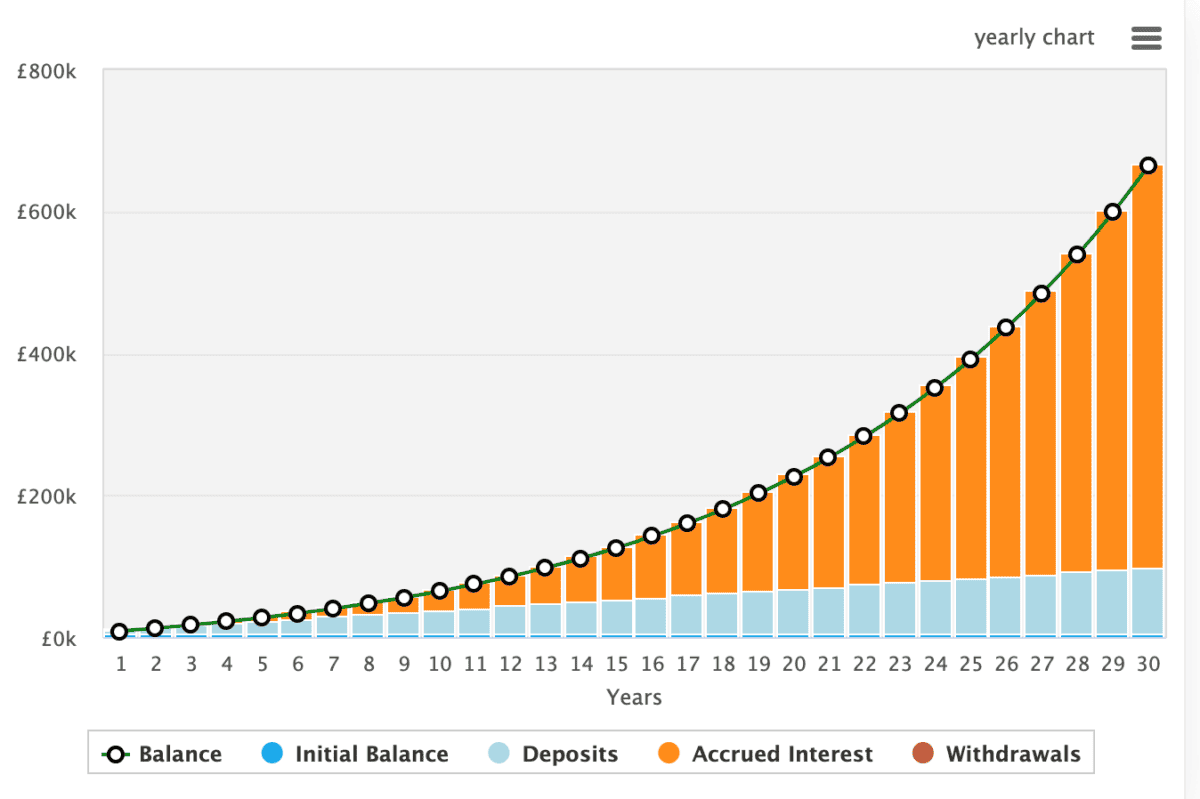

In the below charts we can see how an original £5,000 investment would grow when contributing £250 a month.

The first chart shows how the investment would grow with a more modest 6% annualised return, while the second chart highlights how my investments would grow at 10%.

Low double-digit growth is what many seasoned investors will be looking for. And while that might sound unachievable, I can do it too by using online resources like The Motley Fool to help me make the right investment choices.

Because, unfortunately, if I invest poorly, I could lose money.

Passive income

In the final chart, after 30 years, my investment would be worth around £670,000. That’s a huge amount of money. In fact, it would be growing by a phenomenal £62,000 a year.

So, in theory, I could take that £62,000 and treat it as passive income. It’s worth noting that this may involve selling some holdings as my portfolio is unlikely to generate all that money in the form of dividends.

But finally, and perhaps the most important thing worth noting, is that I’ll want to do all of this within a Stocks and Shares ISA. That’s because the wrapper will shield all my earnings from tax. It could be hugely beneficial.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.