Growth stocks are the holy grail of investing — highly desirable but difficult to find.

GlobalData is forecasting that the electric vehicle (EV) market will grow at an annual rate of 15.9% between 2023 and 2035. I’m wondering which companies are best placed to benefit from this.

Tesla

Tesla (NASDAQ:TSLA) stock is currently changing hands for the price it was in June 2023.

Four months of no growth is concerning for a company that built its reputation on delivering exceptional returns to shareholders.

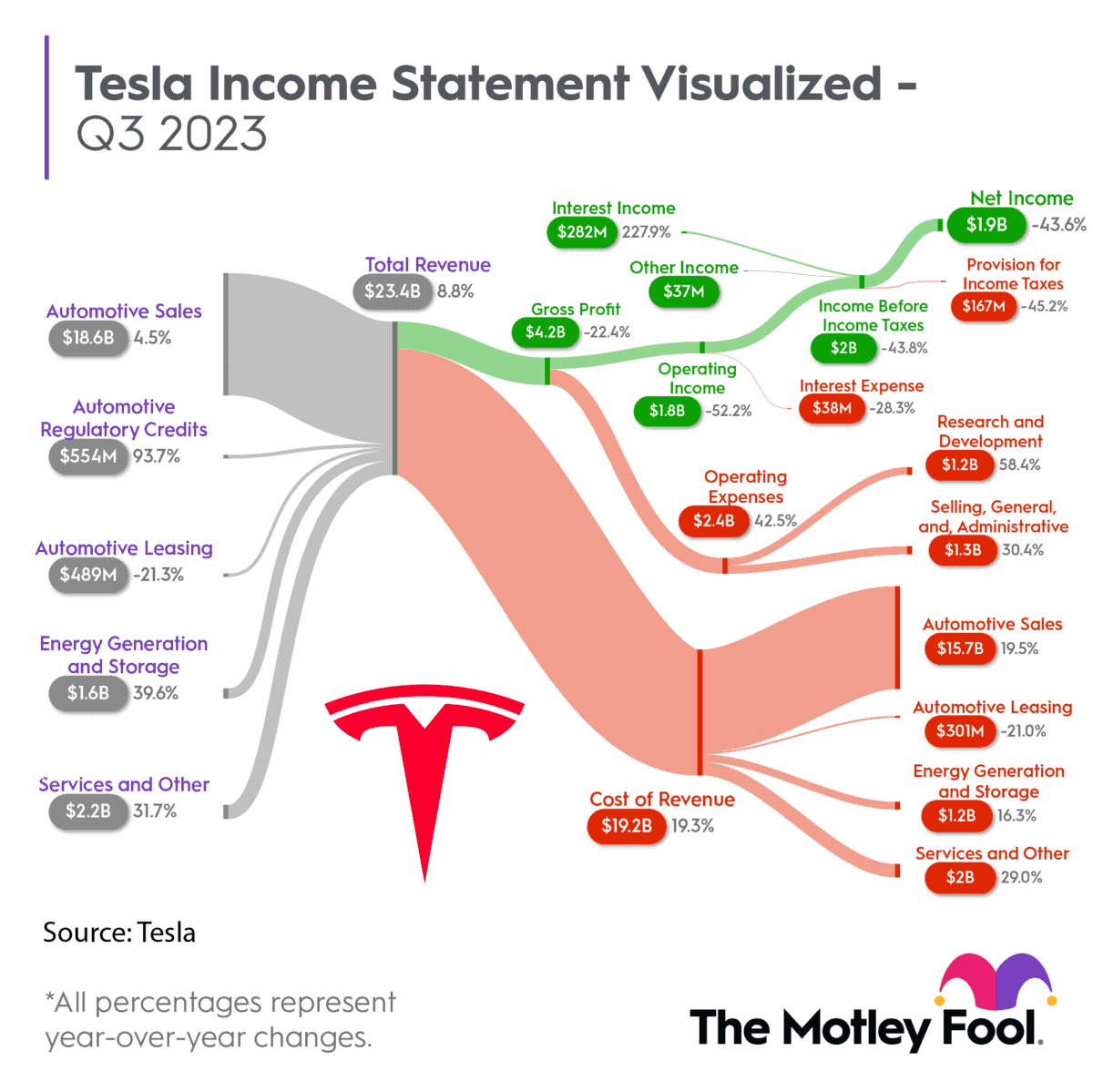

The latest figures from the company are also disappointing.

It delivered 435,059 cars in the third quarter of 2023, which was 4.7% below expectations.

Tesla is also cutting prices across its range. It did this in March 2023 and has decided to do it again. As an example, the list price of its basic Model 3 was reduced by $2,000 earlier this year, and a further reduction of $1,250 has just been announced.

Although this might increase the number of cars sold — and hurt some of its rivals — it’s unclear whether this additional revenue will compensate for the loss of earnings.

But Tesla is still the world’s most valuable EV manufacturer. It has a market cap of $837bn, compared to $36bn for China’s Li Auto, which is in second place.

There are other mainstream manufacturers that make both conventional and electric vehicles. But none of these have valuations higher than Tesla’s.

And that’s always been a problem for me.

According to Macrotrends, Tesla currently has a price-to-earnings ratio of 73, which makes it very expensive, although it has been higher.

Rivian

I’ve always liked the fact that Rivian Automotive (NASDAQ:RIVN) is currently producing more vehicles than Tesla was at the same stage. And its trucks and pickups are better looking than anything its larger rival makes.

But my confidence in the company has been shaken.

On 9 August 2023, its CEO told Bloomberg: “the cash that we have has put ourselves in a position to not need capital until the end of 2025“.

However, 57 days’ later, the company announced plans to raise $1.5bn via convertible notes.

Not surprisingly, investors reacted badly and its stock closed 22% lower on 5 October 2023.

But in the third quarter of 2023, deliveries were 15,564, 11% more than the average of analysts’ forecasts.

The fund raising is intended to de-risk the launch of the R2 sports utility vehicle but it’s turned into a bit of a PR disaster.

Alternatives

With the shine coming off these two manufacturers, I’m wondering what the next high-growth EV stock might be.

Of the 10 most valuable, nine are relatively small, producing no more than 150,000 vehicles a year.

And yet some of their valuations are even more astronomical than Tesla’s.

VinFast Auto of Vietnam produced only 11,315 cars during the first half of 2023. But it’s valued at $18bn!

Verdict

If I had to pick the best EV growth stock, I would still choose Rivian. But I don’t like it enough to buy any stock. I think it’s the best of an expensive bunch.

The recent fall in its stock price could be a buying opportunity. But I’ve lost confidence in the management.

I’m therefore going to wait until the financial position of the company becomes clearer before deciding whether to invest.