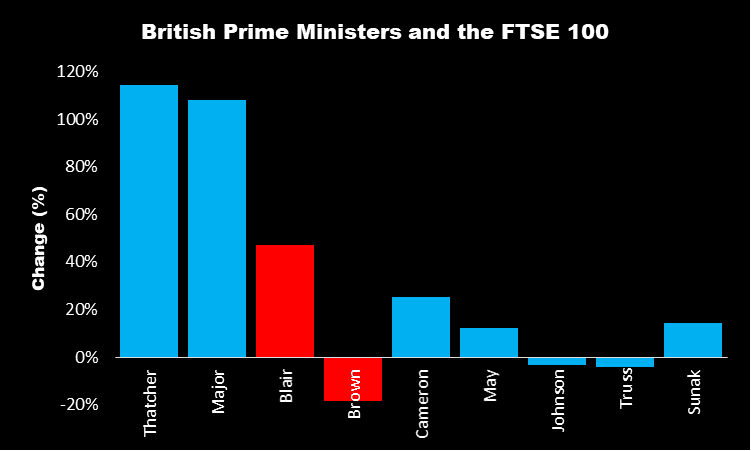

With a general election imminent, I’m wondering how a change of government might impact my portfolio. The chart below shows how the FTSE 100, used as a proxy for the wider UK stock market, has performed under our last nine Prime Ministers.

Encouragingly, only three of our leaders have presided over a fall. To be fair, Boris Johnson had a pandemic to deal with. And Gordon Brown was unfortunate to be in office when the global financial crisis hit. As for Liz Truss, well, what can I say?

‘Events, dear boy, events’

But a British Prime Minister can do little to influence global events. This makes me think luck has been a big factor in determining how the market has performed under their tenures.

However, I think the chart illustrates a more important point. Generally speaking, those serving the longest saw the biggest increases in the FTSE 100. And that’s because successful investing requires taking a long-term view.

During the Footsie’s first 23 years, Margaret Thatcher, John Major and Tony Blair saw the index increase from 1,000 to 6,527. This tells me that longevity of service, rather than any specific policies, is probably the biggest reason behind the differences highlighted.

Lift-off

The index of the 100 largest listed companies was launched in January 1984.

Margaret Thatcher was in charge at the time and she was committed to the privatisation of a raft of state-owned industries. She told the 1985 Conservative Party conference: “Let us together set our sights on a Britain … where owning shares is as common as having a car”.

With one third of adults investing directly in the stock market, there’s a long way to go before that vision is fulfilled. But it’s undoubtedly true that we’re now closer to a share-owning democracy than when she first took office.

Ringing the changes

One of her early privatisations was that of BT (LSE:BT.A). In 1984, I remember my dad proudly telling me that he had bought shares in the company. I had no idea what this meant.

On flotation, the telecoms giant had a stock market valuation of £7.8bn. Today, it’s worth £10.2bn. But to have kept pace with inflation, its market cap should be over £30bn.

If BT were a PM, I think it would be more of a Gordon Brown than a Boris Johnson. It’s a steady — if unspectacular — performer. For the year ended 31 March 2024 (FY24), analysts are expecting earnings per share of 15.9p. Over the next two years, this is forecast to be 16p (FY25) and 16.1p (FY26).

However, despite a rise in earnings, the ‘experts’ are forecasting the dividend to fall slightly from an anticipated 7.7p in FY24, to 7.31p, by 2026. Even so, the stock’s still yielding an attractive 7%. Of course, dividends are never guaranteed.

With both main political parties adopting a near-identical approach to taxes and borrowing, if there’s a change of government, I suspect it’s going to have little impact.

Individual companies may be affected by the introduction of specific policies that affect their industries. For example, BT has been lobbying the Labour Party to encourage easier rollout of broadband to blocks of flats. But overall, it’s probably going to be business as usual for the UK stock market.