It’s hardly a secret that Tesla (NASDAQ: TSLA) shares have performed very strongly over the long term. But we’d have needed skin as thick as crocodiles to have remained shareholders throughout all the ups and downs at the electric vehicle (EV) company.

Here, I’m going to look at how much I’d have now if I’d made a £10k investment in Tesla shares just over six years ago.

Production hell

In July 2017, Tesla’s hugely anticipated Model 3 rolled off the production line. This was the firm’s first lower-cost and (it hoped) mass-market EV.

We know today that the vehicle has been a big success. It was the world’s top selling plug-in EV between 2018 and 2020. It was only dethroned by the Tesla Model Y in 2021, which shows how truly dominant the firm has been in the EV space for the last few years.

But in 2017 and 2018, this eventual success wasn’t obvious. There were huge problems in the Model 3‘s software and manufacturing assembly lines, severely limiting production output. Indeed, at the time, CEO Elon Musk called it “production hell”.

My hypothetical returns

Some even speculated that the company could go bust. And this uncertainty was reflected in the subsequent share price. If I’d bought Tesla shares on 28 July 2017, I’d have been nursing a 44% loss by May 2019.

However, if I’d held on until today, my £10k would have grown to a staggering £117,700 (excluding currency rate changes). That’s a monstrous 1,077% gain!

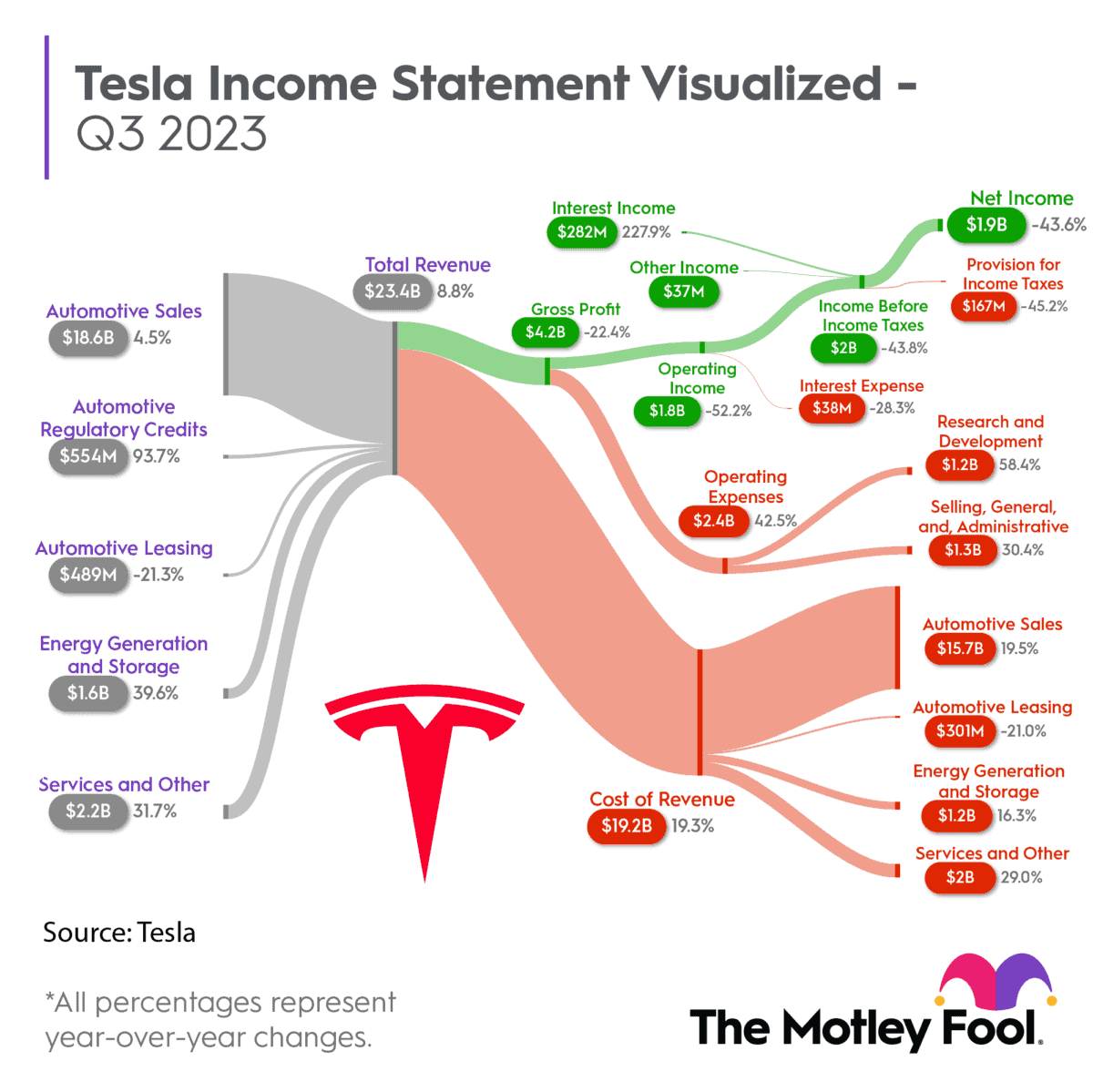

The reason for this massive outperformance is that Tesla has turned from a cash-burning company into a high-margin cash machine. Last year, its revenue grew to nearly $81.5bn, a 51% increase from the previous year. More importantly, it posted net income of $14.1bn versus a near $2bn loss in 2017.

Since its “production hell” days, the company’s execution has been incredible. And even after recent vehicle price cuts, its gross profit margin is 18%, which is still very healthy.

Age-old concerns

Historically, the main criticism levelled against the stock has been its sky-high valuation. Today, it’s trading on a price-to-earnings P/E ratio of 74, which is lower than previous years. But that premium valuation does still mean risk. For example, investor optimism could quickly evaporate if the company’s rapid growth starts to slow.

Another thing often highlighted about Tesla stock is its high valuation compared to legacy automakers like Ford. To me, that’s silly as it ignores some fundamental competitive advantages that Tesla possesses. These include its Supercharger network, as well as its world-leading battery and drive-chain technology.

The firm is also vertically integrated, controlling its production process, from battery cells to vehicle manufacturing. It has a growing energy generation and storage business too.

Plus, there’s a culture of radical innovation, evidenced by the Dojo supercomputer being built to help run the artificial intelligence powering its self-driving software. I don’t see many traditional car companies doing stuff like that.

In 2017, EVs accounted for just 1% of new car sales globally. By 2022, this had grown to 13%. By 2045, it could be 100%.

Now, I did own Tesla shares in 2017 but — stupidly, it turned out — sold them in 2019. However, I bought back in at $192 in December. And I won’t be selling quite so easily next time!