I’m looking for brilliant bargains to buy this month. And these top-notch UK value stocks have attracted my attention, thanks to their low earnings multiples.

Here’s why I’d buy them today and hold them for the long haul.

BAE Systems

The defence market is tipped for further strong expansion over the next decade. It’s a phenomenon that makes BAE Systems (LSE:BA.) a great long-term buy, in my opinion.

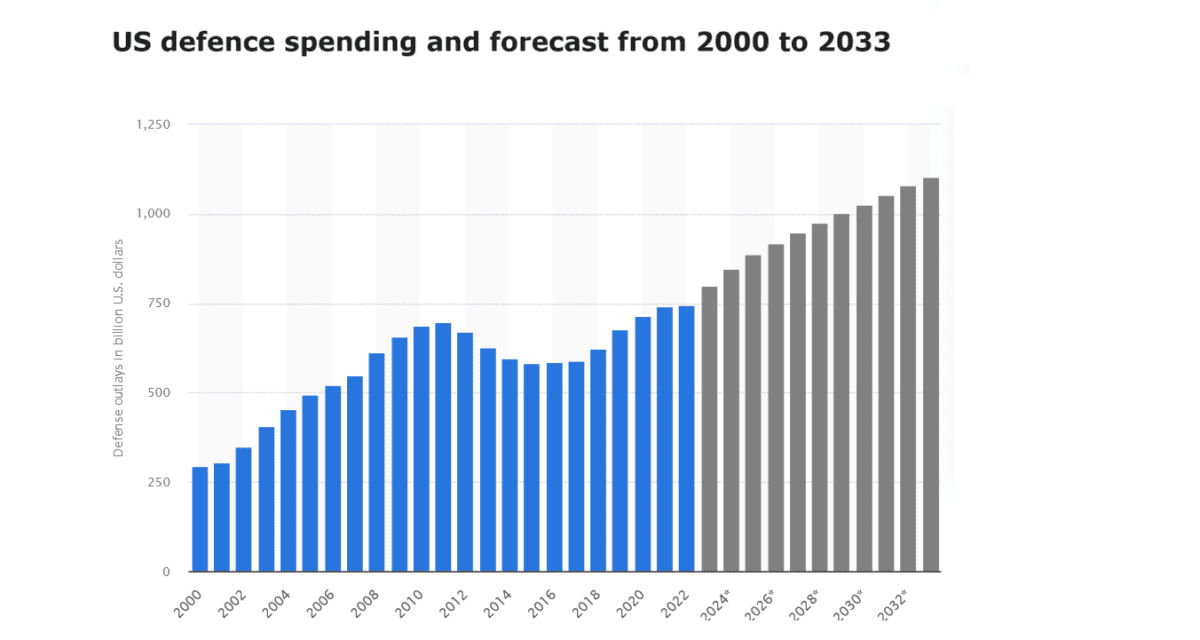

Spending in the West is booming as tensions with China and Russia steadily grow. Weapons sales to the US, for instance, has soared and is tipped to keep flying, as the following forecasts from Statista show.

As a critical supplier to the US and UK governments, BAE Systems can expect orders to steadily pick up as the decade progresses. Just today it announced it had been awarded a near-£4bn contract to build submarines under the AUKUS security pact between the UK, US, and Australia.

The FTSE 100 company looks like it could be a great way for investors to capitalise on this industry boom, too.

As the chart below shows, the company trades at a decent discount to its industry rivals. US defence contractors Northrup Grumman and Lockheed Martin trade on forward price-to-earnings (P/E) ratios north of 20 times. France’s Thales also trades on a multiple above that of BAE Systems, whose ratio stands at around 15.9 times.

Created with TradingView

Okay, the firm’s ratio is higher than the FTSE 100’s multiple of 12 times. But I believe this is a fair reflection of the defence industry’s bright outlook and BAE Systems’ ongoing ability to capitalise on this. It booked a whopping £21.1bn worth of orders between January and June, up 16% year on year.

Earnings here could suffer if programme development issues emerge. But on balance, I think this is a top value stock to buy.

Tritax Eurobox

Demand for logistics and warehouse space is also poised for strong growth over the next decade. It’s why I already own shares in Tritax Big Box REIT and am looking to open a position in Tritax Eurobox (LSE:EBOX) this month.

Why this particular property stock? Well unlike most London-listed businesses in this sector, Tritax Eurobox owns and operates assets across mainland Europe. This helps to spread risk.

Some of the markets the firm operates in are tipped to grow especially strongly, too. Germany is forecast to record the strongest continental expansion over the next three years, according to a recent report from Savills, while Spain’s logistics sector is also earmarked for impressive growth.

Created with TradingView

I also like the excellent value for money that Tritax Eurobox shares offer. As the chart above shows, they trade on a lower forward P/E ratio than those of UK-focused peers Tritax Big Bix, Warehouse REIT, and Urban Logistics REIT.

Investors can also grab a giant 8.4% dividend yield today. I’d buy the company even though tough economic conditions in the near term could hamper profits growth.