Meta (NASDAQ:META) shares are up 104.5% over the past 12 months. So factoring in the 10% appreciation of the pound, today I’d have around £1,900 if I’d invested £1,000 in Meta shares a year ago. That’s a really strong return.

Volatile

Meta is worth $778bn, meaning its three times larger than the biggest company on the FTSE 100. However, that doesn’t stop it from being volatile. In fact, I’ve been shocked over the last year by the size of the swings we’ve seen in some of these huge US-listed companies.

Last November, Meta shares fell as low as $88. Today, the stock trades for just over $300. Should we have seen it coming? Quite probably. The social media giant is at the forefront of artificial intelligence (AI) and wasn’t expensive by any means.

My buy case

Despite already being up 100% over 12 months, I recently added the stock to my portfolio. I believe this bull run still has further to go.

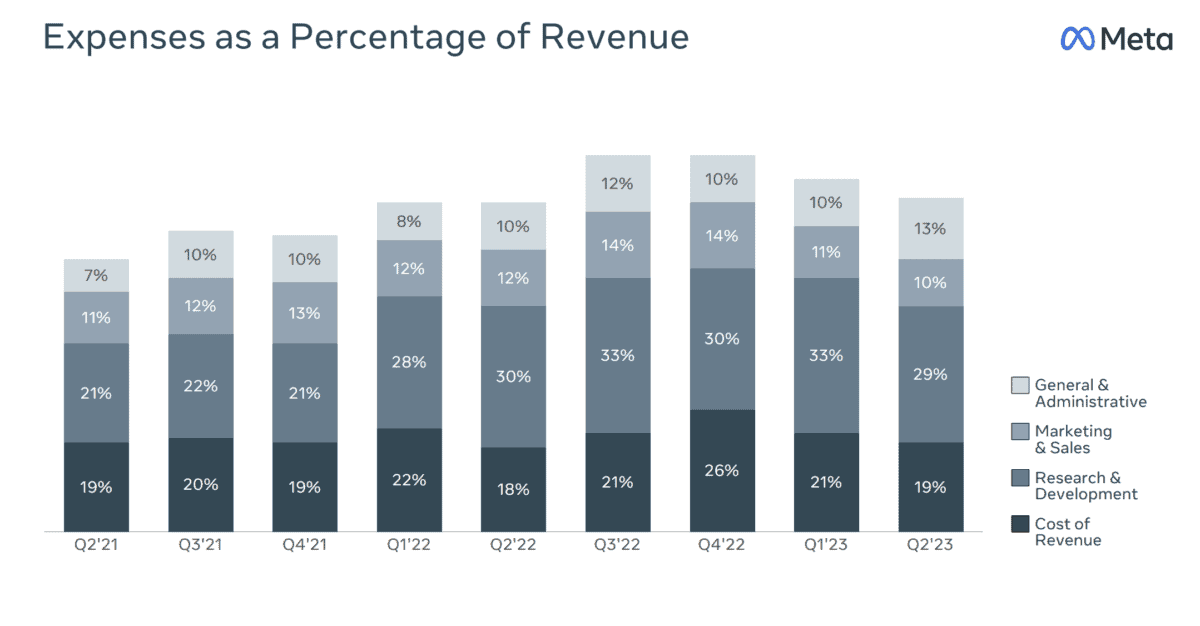

Meta has delivered back-to-back earnings beats this year. Improved performance has been positively influenced by a cost-cutting initiative and a focus on the monetisation of its vast social media empire.

One of the key drivers of Meta’s recent growth has been the success of its new Threads platform. Threads, which became the fastest-growing social media application ever, already has 130m users.

Many analysts believe that if monetised correctly, Threads could generate up to $3bn in revenue over the coming year.:

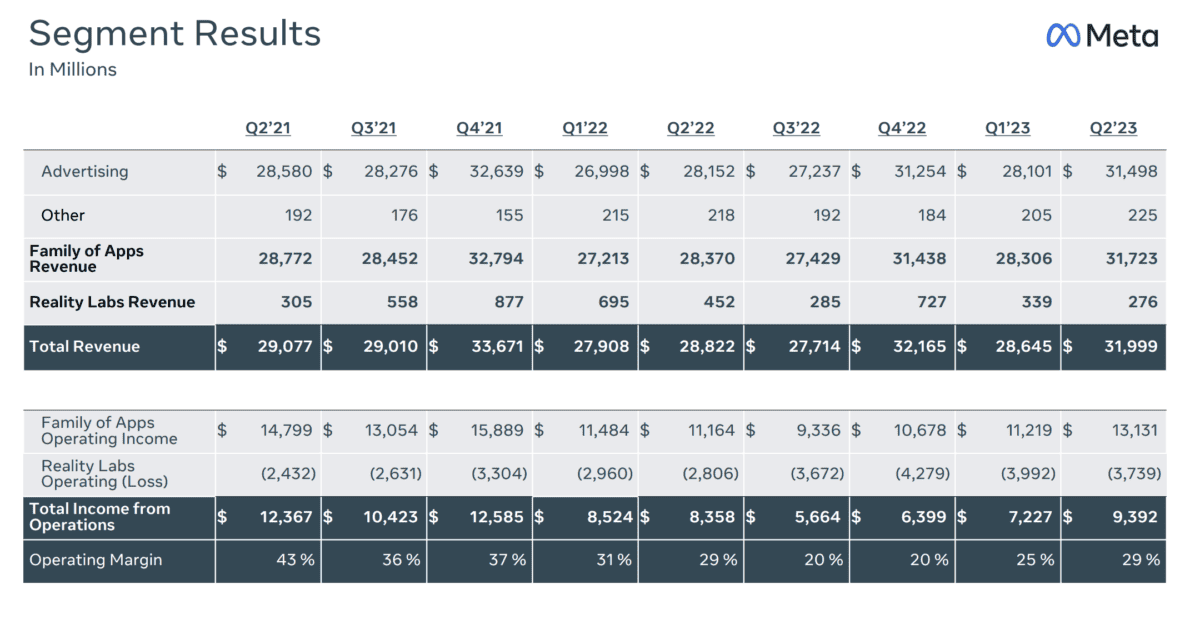

I’m also attracted by Meta’s move into the virtual reality (VR) space. I appreciate that Meta lost $13.7bn on its Reality Labs division, which is the part of the company that makes VR headsets.

However, I think VR is a lot more than just a gaming gimmick. It has endless applications and, among other things, could prove hugely valuable for developments in medical training.

Meta is working on developing VR applications for business, education, and other uses, but it’s unclear when these will become mainstream.

For a company at the forefront of the tech space, Meta isn’t expensive, trading at 5.6 times forward sales and 22.5 times forward earnings. Compared to AI-leader Nvidia, it’s phenomenally cheap.

Overall, I believe Meta is a well-positioned company with a number of factors working in its favour. The company has a strong track record of financial performance, an attractive valuation, and is at the forefront of AI and the VR space.

Bear case

However, given the current global economic slowdown, I’m wary that demand for advertising — a major revenue source — could fall, putting downward pressure on revenue per advertisement.

Businesses tend to trim their advertising budgets during economic downturns, which could impact the performance of advertising-dependent parts of the business — almost all of it.

Nonetheless, while there are some risks associated with the stock, I believe the potential rewards outweigh the risks.