Generating passive income through stock investments is straightforward. While it may appear initially challenging, it’s entirely feasible to transform a relatively small figure into a life-changing income.

Regular savings

Even if I’m starting with £10k in savings, I can significantly boost my portfolio growth through disciplined and regular savings. By setting up automatic contributions, I can ensure a portion of my income consistently goes into my investments.

This disciplined approach, combined with the power of compound interest, can gradually transform my £10k into a more substantial and growing source of passive income over time.

Wise moves

If I make poor investment decisions I can lose money, so thorough research is imperative. Following billionaire investor Warren Buffett’s first rule, “don’t lose money,” requires searching for discounted opportunities in every investment.

Buffett uses a “margin of safety” concept. This involves buying stocks below their intrinsic value to minimise downside risk and enhance long-term investment prospects. It’s a fundamental principle of value investing, emphasising prudent decision-making and risk reduction.

To find undervalued stocks, I can start by analysing a company’s financial health, including its balance sheet and income statement. Assessing the company’s competitive position, industry trends, and growth potential is also crucial.

Additionally, I can use valuation metrics like price-to-earnings (P/E) ratios and price-to-book (P/B) ratios to identify stocks trading below their intrinsic value.

Conducting thorough due diligence and staying informed about market developments are also key steps in avoiding losses and pursuing successful investments.

Let it grow

At all costs, I need to avoid taking money out of our portfolio until I’ve reached my goals. This is because compound returns have a powerful snowball effect, where the earnings generated on my investments are reinvested to generate even more earnings.

In turn, this accelerates my wealth accumulation over time. By staying disciplined and letting my investments grow undisturbed, I can harness the full potential of compounding to achieve my financial objectives.

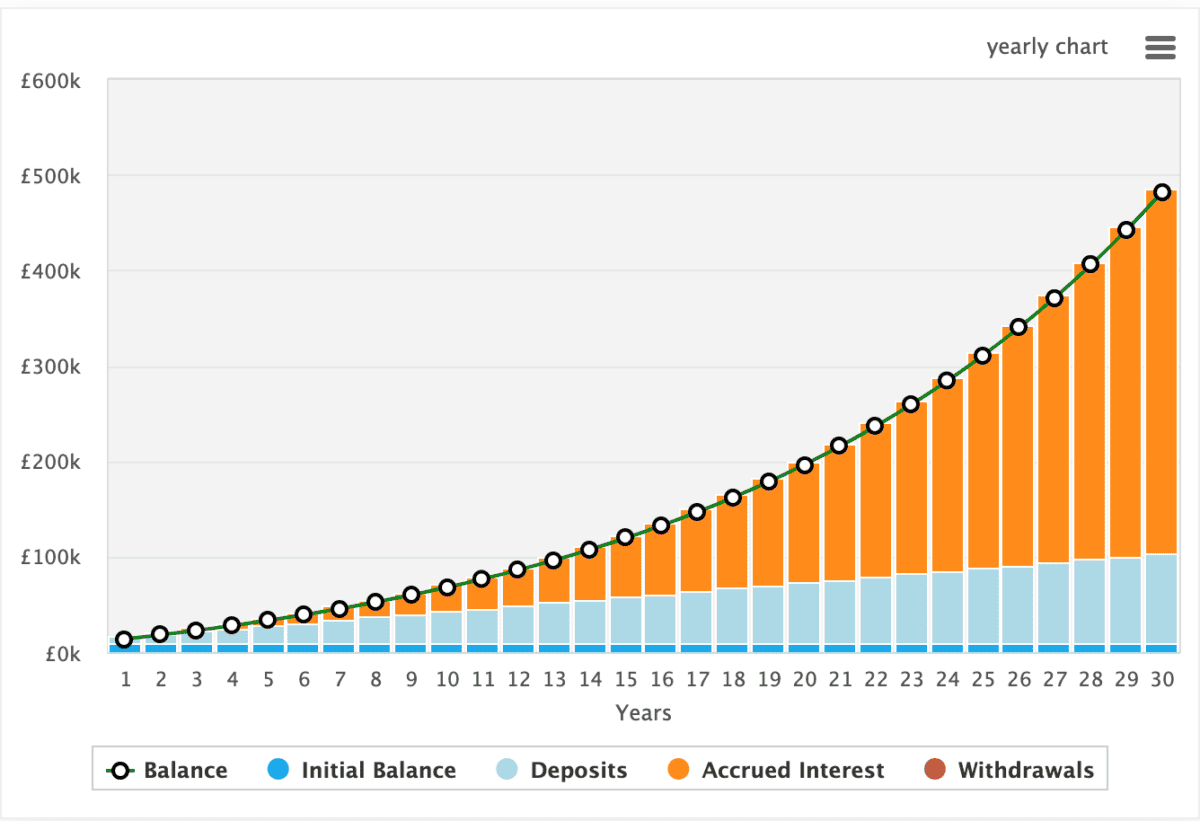

The chart below demonstrates how, using compound returns, my wealth could grow when starting with £10k, saving £250 a month, and achieved an 8% annualised growth rate.

My calculations suggest that after 23 years, my portfolio would be generating £20k a year in passive income. Depending on allocation, some of this would come in the form of dividends, and some in share price growth.

The ISA

Finally, I should consider using a Stocks and Shares ISA as a strategic vehicle for pursuing my long-term passive income objectives. This tax-efficient account can offer advantages such as shielding my investments from capital gains and income tax, providing a valuable tool to help me grow my wealth steadily over time while minimising tax liabilities.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

In turn, if I’m in a position whereby I can take £20k a year from my ISA as passive income, that’s where the ISA becomes really valuable. If I’m already a top-rate tax payer, this could be saving me as much as 45%.