The Rolls-Royce (LSE:RR) share price is up 195% over 12 months, but it’s up even more from from its nadir at 64p in October. All in all, if I’d invested when the stock bottomed out, I’d be up 243% now. That’d be my £1,000 investment would be worth £3,340.

What’s behind the recovery?

The explosion in the Rolls-Royce share price can be traced to several factors, including:

- Improved financial performance: Rolls-Royce has reported improved financial performance and back-to-back earnings beats in recent quarters. This has been driven by a number of factors, including increased demand for within civil aviation and lower costs across the business.

- Positive outlook for civil aviation: The outlook for the aerospace industry has improved significantly during the year, with demand for new aircraft expected to grow in the coming years. This is good news for Rolls-Royce, which is a major supplier of aircraft engines.

- Reduced debt levels: Rolls-Royce has reduced its debt levels in recent months. This has made the company’s balance sheet more robust and reduced its financial risk — net debt stands at £3.3bn.

- Investor sentiment: Investor confidence in Rolls-Royce has improved in recent months. In fact, it’s one of the few FTSE 100 stocks to see such momentum. This is due to a number of factors. These include the company’s improved financial performance, positive outlook for the aerospace industry, and reduced debt levels.

The £6 forecast

Forecasts vary, but UBS, which consistently held a positive view on Rolls-Royce, has been accurate to date with the stock exceeding expectations twice this year.

In UBS’s new best-case scenario, Rolls-Royce’s stock could reach 600p. Meanwhile in the worst-case scenario, the bank anticipates it falling to 100p. And that risk remains in place.

But the Swiss bank feels Rolls-Royce will beat its 2023 outlook. Its analysts believe Rolls-Royce could generate £2bn in free cash flow (FCF) by 2024 and £2.8bn in underlying FCF by 2026.

While they acknowledge economic risks, especially due to the company’s exposure to misfiring China, UBS highlights its examination of aircraft usage trends in H1, suggesting a further increase in flying hours in H2.

Long-term tailwinds

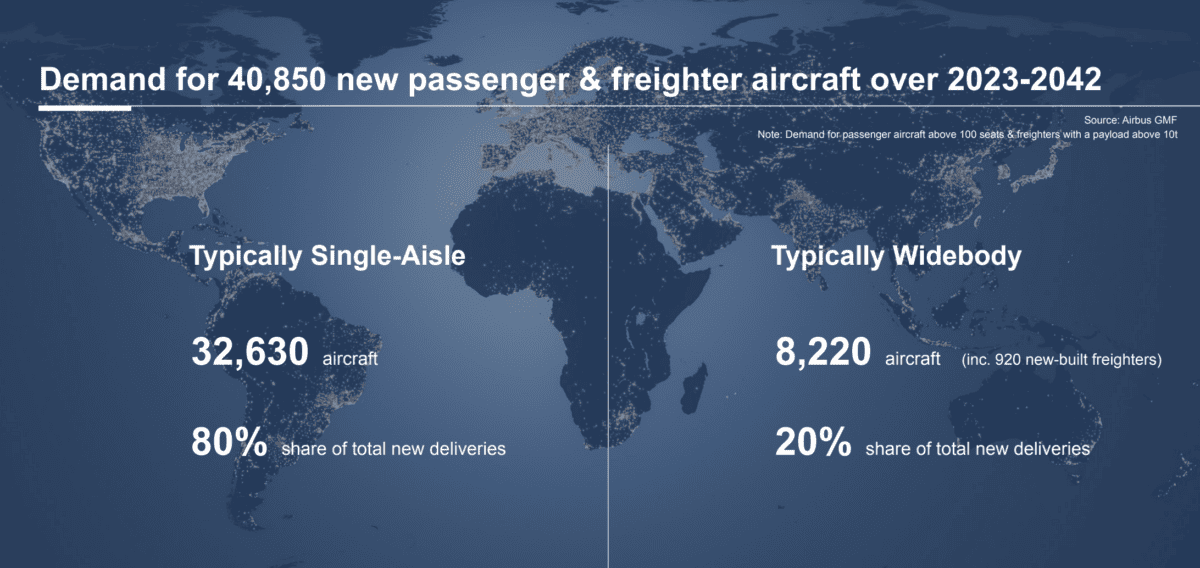

Rolls-Royce is well positioned to take advantage of global trends in aviation. According to Airbus projections, there will be a need for 40,850 more aircraft by 2042, with the majority (80%) of these aircraft falling into the single-aisle category.

While this is a phenomenal number, driven by millions of people joining the global middle class every year, Rolls-Royce may need to shift its offering towards the single-aisle market. Rolls’s engines are typically used on wide-body planes.

Meanwhile, ongoing global competition between the West and Russia, China and their partners is likely to continue driving the defence sector forward. The firm’s expertise will likely prove invaluable in maintaining Western advantage over near peers adversaries.

While unconventional, I’d also draw investors to historian Niall Ferguson’s works and his recent interview with Bloomberg. Ferguson has long highlighted the positive impact of the Cold War on the pace of change, especially within defence. In what many describe as a new Cold War, companies like Rolls-Royce will undoubtedly be leaned on to drive Western development in everything from directed energy weapons to nuclear power.

While better value may exist on the index, Rolls-Royce is an interesting and attractive long-term pick.