Warren Buffett, the legendary investor often dubbed the “Oracle of Omaha”, currently boasts a net worth that has surged to an impressive $123bn.

What sets Buffett apart in the world of finance is not just his staggering wealth but also his unparalleled investment philosophy, which places a heavy emphasis on the power of compound returns.

For decades, Buffett has adhered to a time-tested strategy that harnesses the exponential growth potential of compounding.

As aspiring investors seek to navigate the complex world of financial markets, there’s much to be gained from taking a page out of Buffett’s playbook and recognising the transformative potential of compound returns in building lasting wealth.

“My wealth has come from a combination of living in America, some lucky genes, and compound interest”.

How compounding works

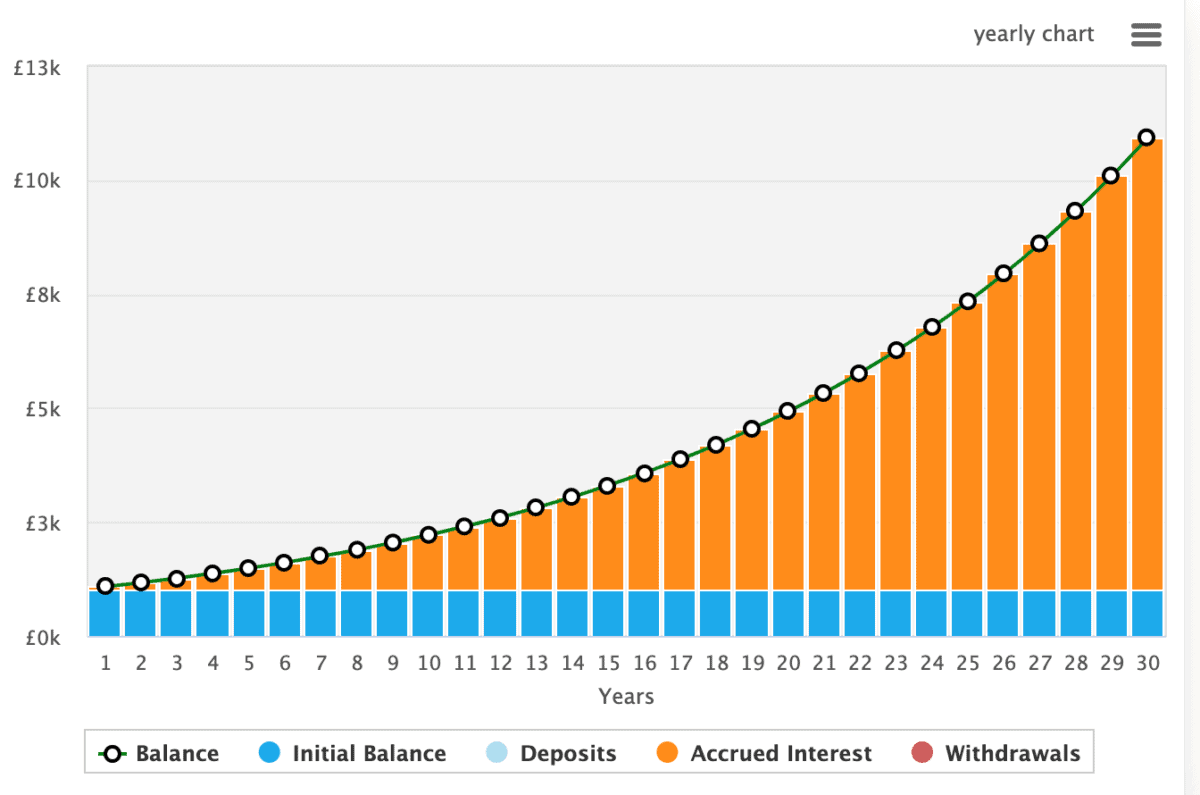

Compound returns is a powerful concept in finance that helps our money grow over time. It’s much like a snowball rolling downhill, getting bigger and bigger. Here’s a simple explanation of how it works with an example using an 8% annualised return:

Imagine I have £1,000 that I decide to invest, and I manage to achieve an 8% annual return on my investment. In the first year, my investment grows by 8%, which means I earn £80 (8% of £1,000). So, at the end of the first year, I’ll have £1,080.

Now, in the second year, my 8% return is not calculated on my initial £1,000, it’s calculated on my new total of £1,080. So, I’ll earn £86.40 (8% of £1,080) in the second year. Now, my total investment is £1,166.40.

This process continues year after year, with my investment earning a percentage of the new, larger amount. Over time, this compounding effect causes my investment to grow exponentially. Here’s how it might look after a few years:

- Year 1: £1,000 + £80 = £1,080

- Year 2: £1,080 + £86.40 = £1,166.40

- Year 3: £1,166.40 + £93.31 = £1,259.71

- Year 4: £1,259.71 + £100.78 = £1,360.49

- Year 5: £1,360.49 + £108.84 = £1,469.33

As you can see, my investment grows faster and faster with each passing year because I’m earning interest not just on my initial £1000 but also on the interest I’ve already earned. This is the snowball effect of compound returns, and it can lead to significant wealth accumulation over time.

As we can see below, the long I leave it, the faster it grows. After 30 years, the size of my investment will have increased tenfold.

Be more Buffett

Of course, there are many ways we can follow Buffett. Thankfully, he regularly shares his thoughts and philosophy of investing. He also reminds us that we can lose money if we invest poorly and if we follow the crowd.

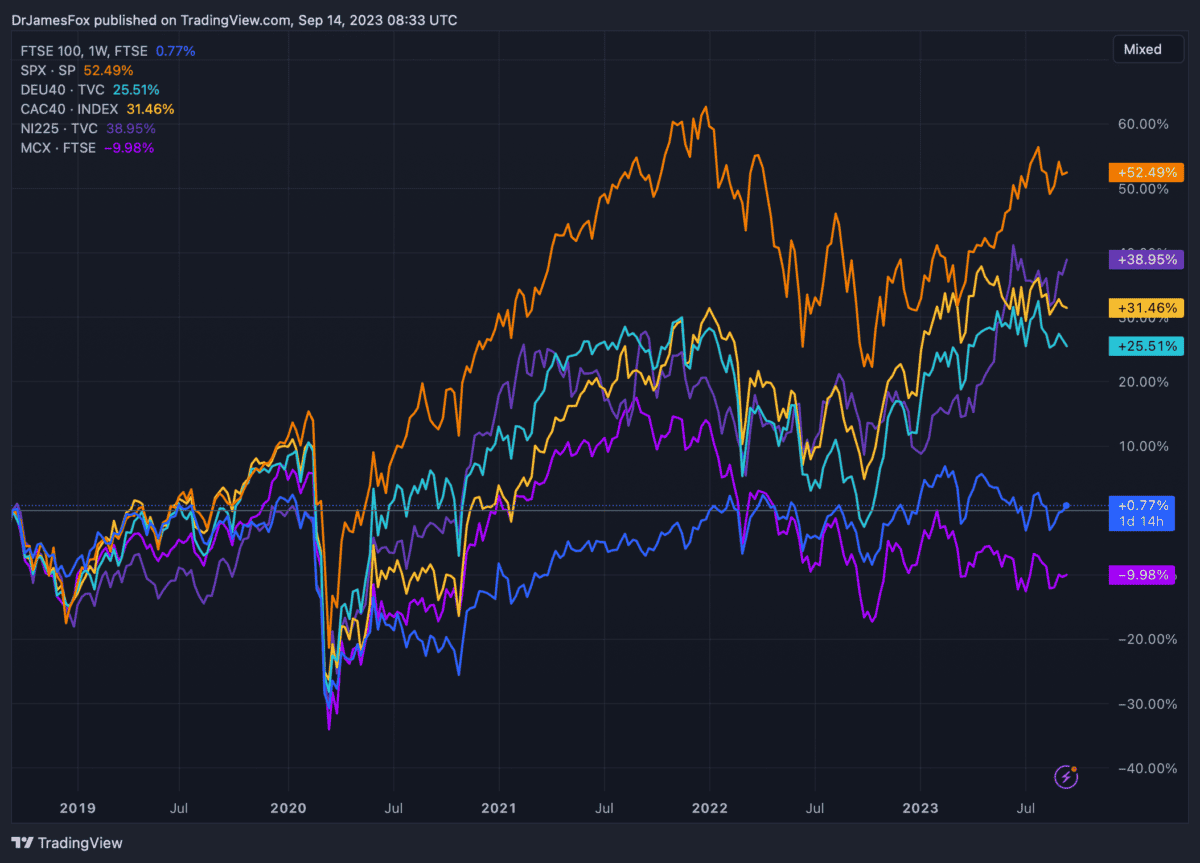

In fact, the current environment in the UK presents us with a unique opportunity a British Buffett would likely relish. And that’s the opportunity to buy top quality stocks at discounted prices.

And when we look at the FTSE 100, discounts are everywhere, from Barclays which trades at 0.42 times book value, to Hagreaves Lansdown, which is trading with a historic low price-to-earnings multiple.

Just look at how the FTSE 100 has compared to its international peers. The index is full of value.