Special stocks with the potential to generate truly explosive returns are rare. This is especially the case with many UK shares where growth is notoriously low. But with the prospect of growing my money by as much as 65% over the next year, FTSE 250 stalwart WH Smith (LSE:SMWH) could be worth exploring.

Travelling upwards

The first factor that makes WH Smith special is its successful diversified business model. The company has stores in a variety of areas that include high streets, travel locations, and online channels. This provides resilience and multiple avenues for growth.

The firm recently reported a 28% jump in annual revenues. This was led by a 42% surge in its high-growth global travel division. That’s because the retailer’s travel stores have benefited tremendously from the ongoing recovery in airport passenger volumes. This shows that despite its wavering high street presence, WH Smith has the potential to stage a comeback akin to the likes of Marks and Spencer.

Looking ahead, WH Smith plans to open over 80 new stores globally in the coming year. The board has made its intentions clear that it wants to capitalise on the robust travel rebound. This is a smart strategy as passenger traffic continues to recover to its pre-pandemic levels. Provided this momentum can be sustained, WH Smith could potentially achieve 20%-30% annual earnings growth in the years to come.

This level of rapid expansion and increased profitability could serve as a powerful catalyst to send its share price soaring. After all, analysts are pricing in an annual growth rate of approximately 28%.

Expensive shopping spree?

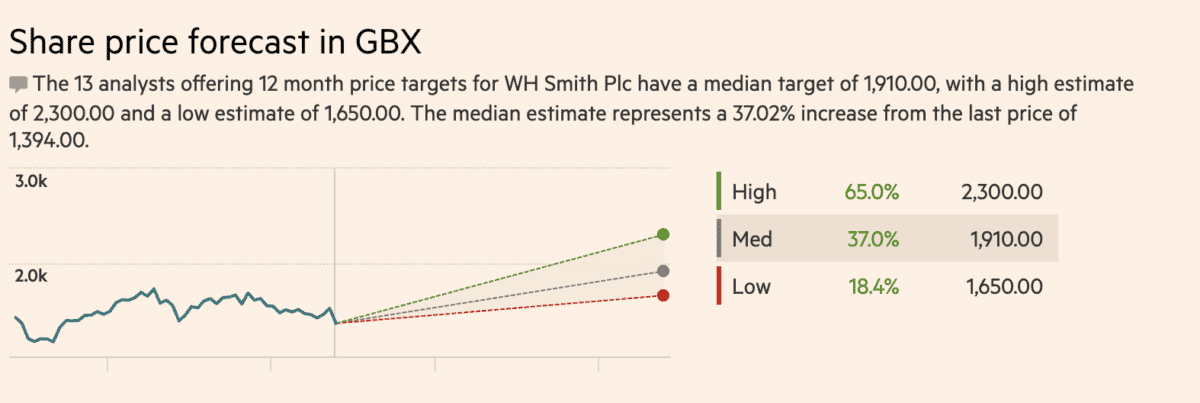

The consensus price target currently indicates that the shares could rise by as much as 65% over the next year. The average price target of £19.10 implies the market has yet to fully account for WH Smith’s growth.

So, if profits wind up exceeding expectations as global travel recovers, this stock’s valuation multiples could be justified as it currently trades at a relatively hefty price-to-earnings (P/E) ratio of 27.1. Nonetheless, it could be on course to do just this. The group’s premium positioning gives it a solid strategic advantage to drive sustained outperformance.

Headwinds to consider

That said, risks still exist that could stop the rise of this potentially explosive share. First is the intensifying competition in the travel retail space, which cannot be ruled out. But perhaps most notably, deteriorating consumer spending could affect its top and bottom lines if the UK economy takes a turn for the worse. This could end up becoming a double whammy as it could affect travel volumes through the airport and train/bus stations, resulting in lower volumes as well.

While challenges remain, the firm seems well prepared to weather storms relative to retail peers. Therefore, for investors seeking a special under-the-radar stock with visible catalysts to potentially generate explosive returns, I think WH Smith checks many of the right boxes.

Forecasted growth of 65% over the next year isn’t monumental. But when compared to the average return of the FTSE 100, which yields less than 10% (excluding dividends), this figure is rather considerable. If I invested £20,000 today, a 65% gain would generate a return of £13,000 in a year! On that basis, I’m eyeing WH Smith shares for my next purchase.