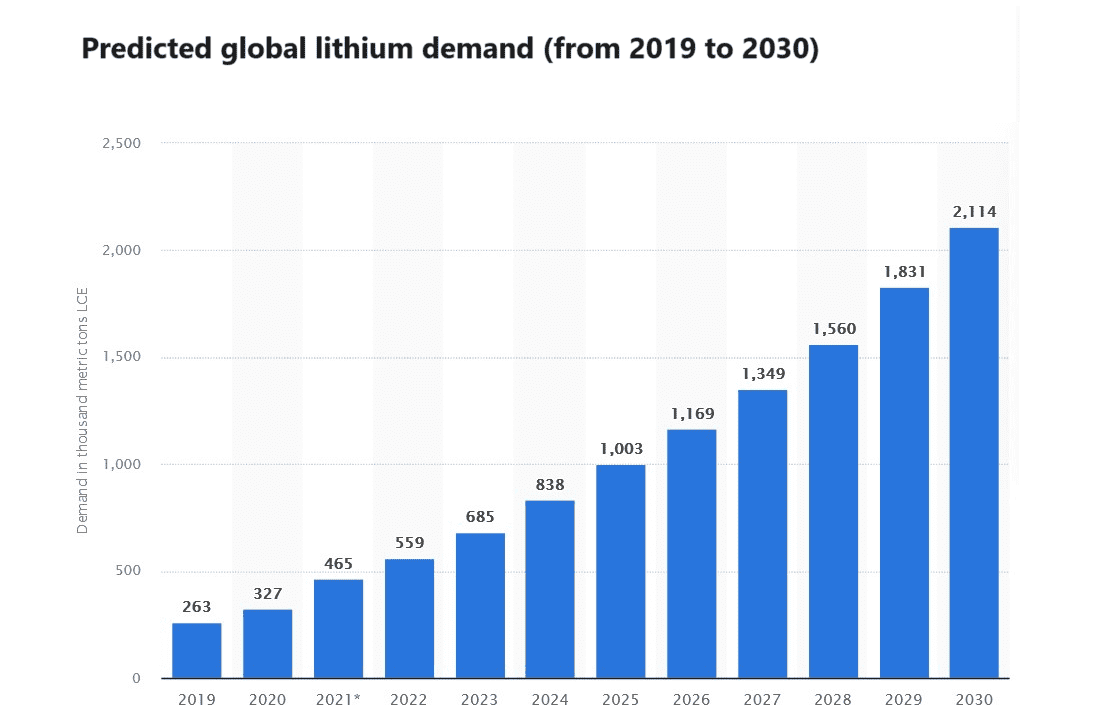

Investing in lithium-producing penny stocks could prove a highly lucrative bet for the next decade. Demand for the silvery metal is tipped to rocket as electric vehicle (EV) sales shoot higher, with Statista analysts predicting that consumption will more than triple by 2030. This is shown in the graph below.

Yet, despite this bright outlook, there is a dearth of new supply set to come online. Just over 50 projects are currently in the global development pipeline, a figure that S&P Global Market Intelligence thinks will create a material deficit of 605,000 tonnes of lithium carbonate equivalent by the end of the decade.

Two top lithium stocks

Of course there’s no guarantee that early-stage lithium miners will be able to command high prices for their product. Lower-than-forecast EV sales, for instance, could cause certain projects to be less profitable than hoped.

Digging for metals is also a difficult process. Mine development delays could leave earnings forecasts in tatters. Production problems later on could also dampen output and result in huge, unexpected costs.

Having said that, the potential reward of owning certain lithium shares could make these risks more than worth it. Here are two penny stocks I’m thinking of buying when I next have spare cash to invest.

1. Atlantic Lithium

Ghana-focused Atlantic Lithium owns what is set to be the country’s first producing lithium mine. It is hoping to produce metal there over a 12-year period beginning in the first half of 2025.

I like Atlantic because of the funding steps it has taken to get the Ewoyaa mine built. It has a deal with Piedmont Lithium that will see the Australian company fund the first $70m of an estimated $185m capital expenditure bill.

On top of this, in recent days, Ghana’s Minerals Income Investment Fund (MIIF) said it would invest $32.9m to get the asset off the ground. The agreement is non-binding, but it helps to de-risk the project still further.

The MIIF deal puts a value of $372m on Ewoyaa, according to brokers at Liberum. This underlines the huge potential of the project. Atlantic has described West Africa as a “new lithium frontier”, which, if correct, could make the producer a brilliant buy. It also owns exploration assets in Côte d’Ivoire.

2. European Metals

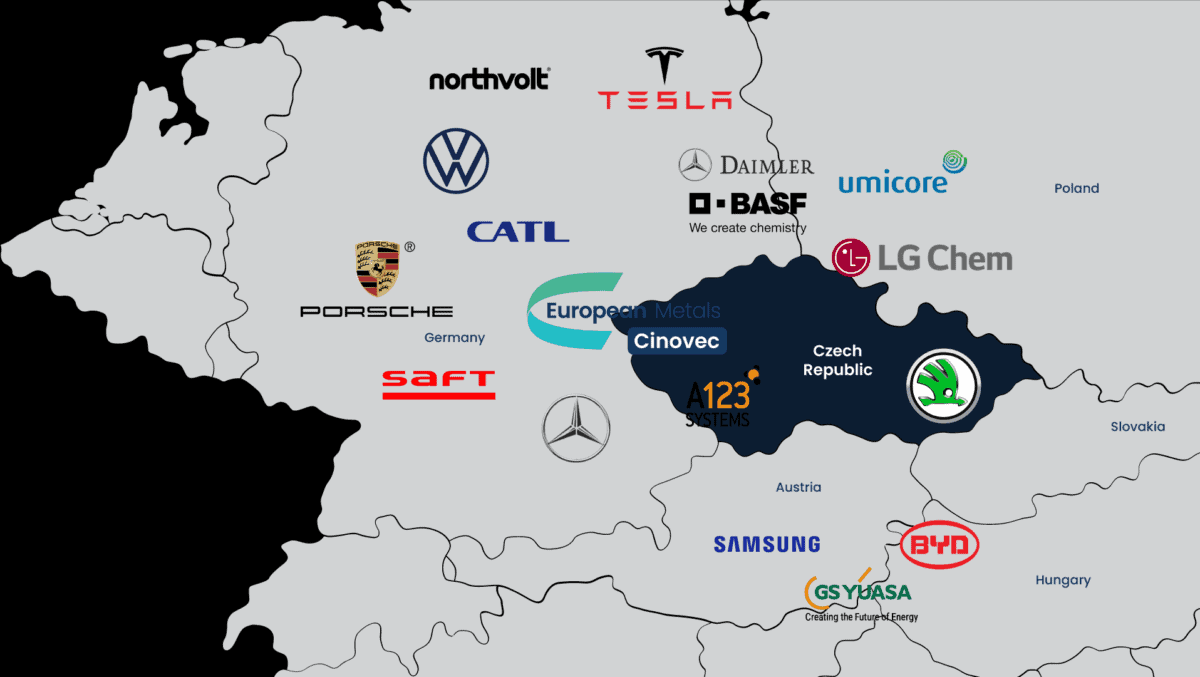

As owner of the Cinovec asset in the Czech Republic, European Metals is developing the largest hard-rock lithium deposit on the continent. Nestled on the Czech-German border, the project — which has a 25-year life — is located on the doorstep of some of Europe’s biggest automakers and chemical producers, as the map below shows.

When the mine’s up and running, European Metals expects to produce 29,386 tonnes of lithium each year. After recent testing, the company believes there is capacity to add a second stage that would double production.

I also like Cinovec because it is one of the world’s ‘greenest’ lithium mines. When it comes to water usage, environmental acidification, and carbon dioxide emissions, the site is at the front of the pack. These qualities could see it become highly popular as ESG investing takes off.