I’m looking for the best dividend stocks to buy for this uncertain economic period. And National Grid (LSE:NG) of the FTSE 100 is one I’m giving serious attention to today.

Utilities companies like this are popular lifeboats for investors in tough times. The essential services that water, energy, and telecoms suppliers provide give them exceptional earnings stability across the economic cycle.

That said, these businesses also face rising risks in a several critical areas. Rising interest rates are pushing their debt servicing costs higher. The increasing frequency of weather-related events is also pushing operating expenses skywards.

So should I add National Grid shares to my portfolio today?

Progressive policy

As I say, businesses like this enjoy exceptional profits visibility like few other UK shares. This in turn gives them the financial strength and the confidence to consistently raise dividends.

As the chart below shows, National Grid has a proud record of lifting shareholder payouts in recent decades. Unlike many other FTSE 100 shares, the business even continued raising dividends during the Covid-19 crisis.

That said, you’ll notice there have been rare blips when dividends have fallen at the energy transmission business. This reflects the huge sums it has to spend to keep the country’s pylons, power lines, and substations in good working order. It can sometimes put a strain on the balance sheet and, by extension, pull dividends lower.

Big dividend yields

But City analysts don’t foresee any approaching problems for National Grid’s progressive dividend policy. In fact payments are tipped to keep rising for the next three financial years at least (all the way through to March 2026).

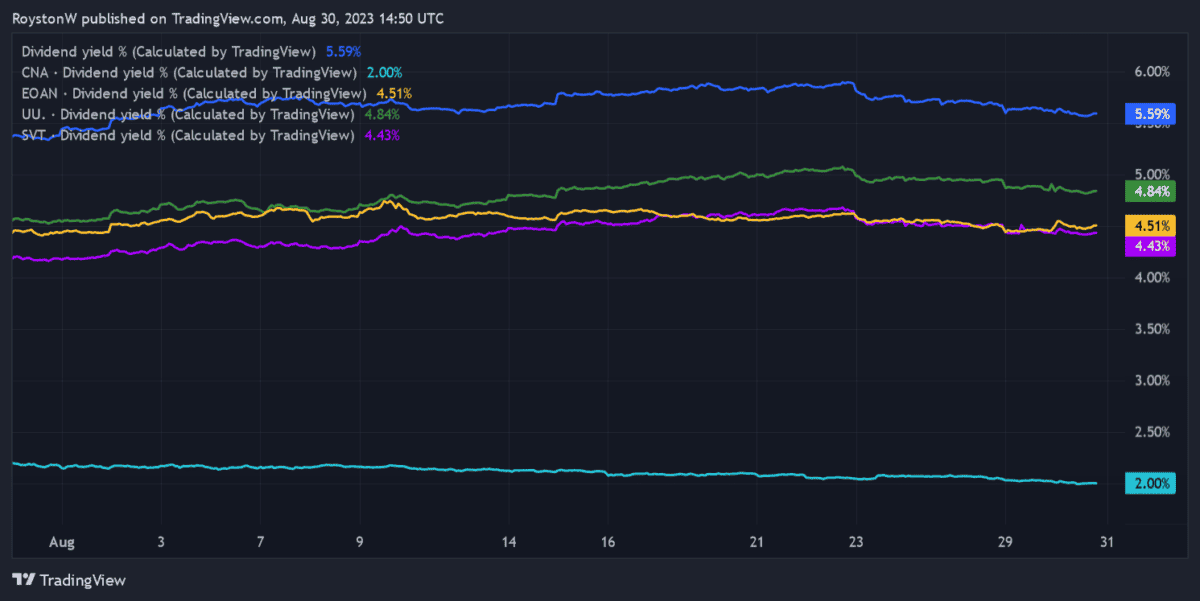

So for this financial year the dividend yield sits just below 5.6%, as the chart below shows. It’s a reading that sails past the 3.7% average for FTSE 100 shares.

But this is not all. As the graphic also shows, the company’s yield also beats those of other UK utilities United Utilities, Severn Trent, and Centrica. It also comes in ahead of German energy giant E.ON‘s 4.51% forward-looking yield.

Should I buy National Grid shares?

There’s no guarantee that National Grid will pay these predicted dividends, of course. City forecasts can often fall flat, and the company’s large net debt (£41bn worth as of March) — allied with the rising cost of servicing it — merit serious attention from investors.

However, I believe the FTSE firm’s defensive operations and solid cash flows put it in great shape to meet analyst expectations. As a long-term investor there are other things I like about National Grid shares, including:

- The company’s UK monopoly, which protects it from competitive threats

- Its heavy investment in renewable energy

- The likely absence of severe regulatory threats in the near future

Like any stock, National Grid has its risks. But I think the potential rewards on offer make it a top stock to buy for a second income.