Market sentiment towards Barclays (LSE:BARC) shares is particularly negative, even compared to its peers and the rest of the index. This, in itself, is a challenge, because as investors we need these momentum shifts to make our value investing strategies come good.

However, it’s widely recognised that Barclays is particularly cheap. So just how cheap are the shares, and is this an opportunity for investors?

P/E

The most simple of valuation metrics is the price-to-earnings (P/E) ratio. And this is where Barclays’ discount versus its peers first becomes apparent. Currently, it trades at just 4.27x earnings. That’s a fraction of the index average, around 13x, and substantially below the financial sector average, around 10.5x.

UK banks are among the cheapest. That broadly reflects the negative sentiment surrounding the UK economy and cyclical, UK-focused stocks like Barclays.

It’s also worth noting that any good news seems to be largely ignored by the market, with investors focusing on issues such as falling net interest margins over the next two years, rather than a more positive outlook on impairment charges.

Barclays is the cheapest FTSE 100 bank using the P/E ratio. Its valuation comes in at just a fraction of Bank of America (8.98x), Goldman Sachs (14.8x), and even HSBC (6.75x). Interestingly, Barclays broadly trades in line with Georgian bank TBC Bank (4.7x).

P/B

Price-to-book (P/B) ratio is a simple financial metric used to understand how the market values a company compared to the value of its assets. In a nutshell, the P/B ratio gives investors an idea of whether a stock is trading at a higher or lower value than what its assets suggest.

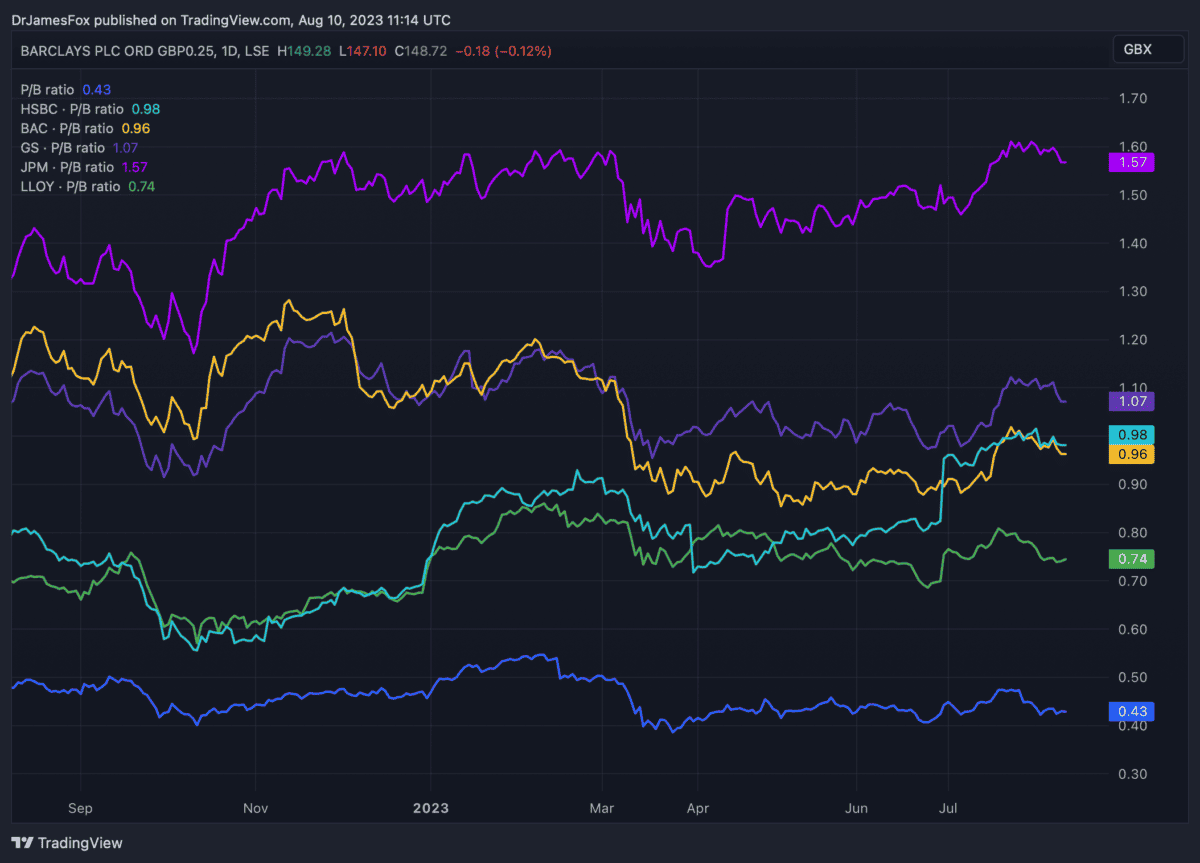

Once again, Barclays looks undervalued here versus its peers. Its P/B ratio is just 0.43, indicating a huge 57% discount versus book value. This is a truly exceptional valuation.

The below chart highlights this phenomenal discount versus its peers. UK-focused lender Lloyds is closest at 0.74x. Meanwhile, we can see that other banks, notably those that are US-listed, trade near or above their book value.

Performance

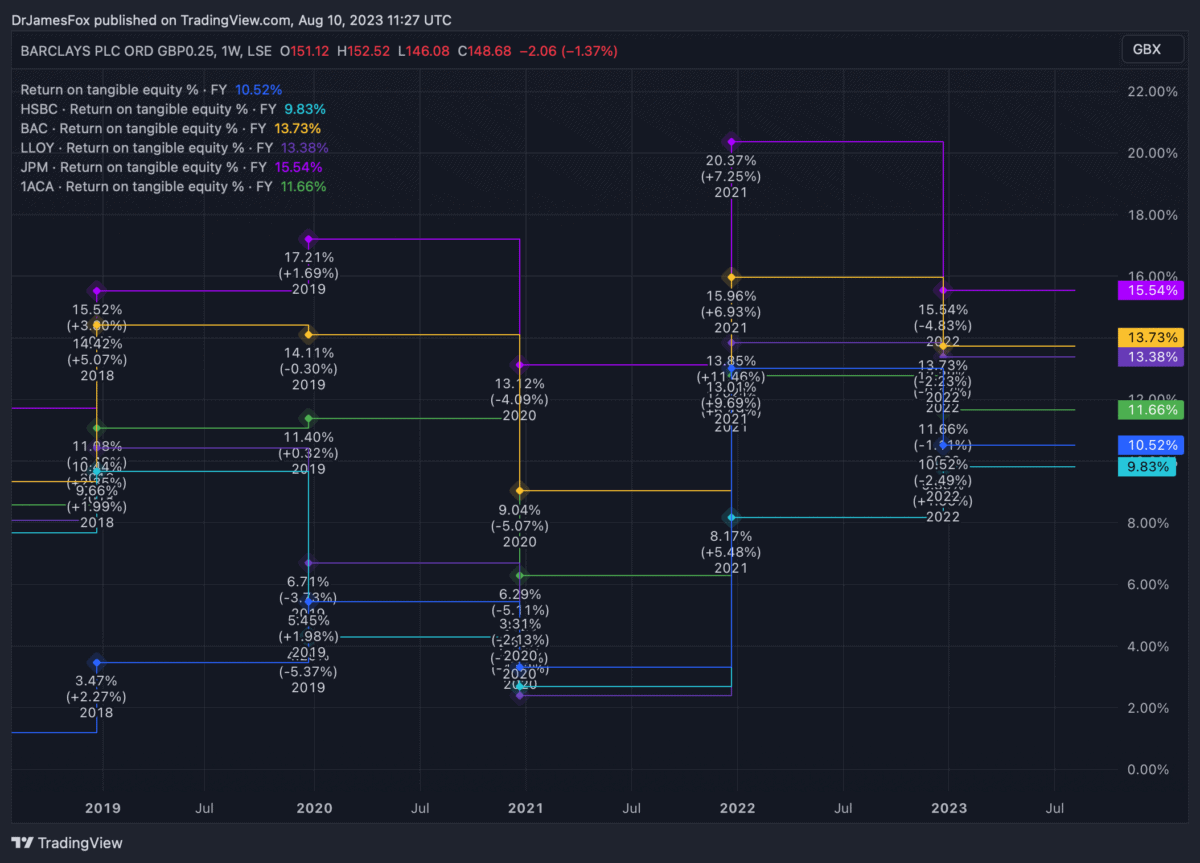

Barclays is less efficient at generating returns than some of its peers. This is demonstrated by the company’s lower-than-average Return on Tangible Equity (RoTE). This is a financial metric that measures a company’s profitability in relation to its tangible equity, essentially how efficiently a company is generating profits using its tangible assets.

The below chart highlights how Barclays compares with its peers. It’s worth highlighting that HSBC has recently upgraded its RoTE guidance to the mid-teens.

Conclusion

Although Barclays demonstrates comparatively lower efficiency in delivering returns compared to its peers, it stands out as the most affordably-priced major universal bank I’ve encountered.

However, it’s important to note that an undervalued stock doesn’t inherently guarantee a positive investment outcome. A positive investment trajectory for Barclays hinges on a necessary change in investor sentiment towards the bank, along with a broader upturn in the fortunes of the UK economy.