On June 27, top asset management firm Baillie Gifford closed its British Smaller Companies Fund after a prolonged period of underperformance. It said investor demand for the sector and the 29-year-old fund itself had been “weak” for a number of years.

Confirming the closure, a spokesperson for the Edinburgh-based fund manager added that it’s increasingly committed to a global focus with regard to smaller companies.

While it’s not uncommon for funds to close, the implication here seems to be that the British smaller companies sector has become a bit of a backwater. The disappointing performance of the FTSE AIM All-Share index, which is down 31% in five years, suggests this might be the case.

I have a few AIM shares in my portfolio and I’m committed to buying more. But in light of this fund closure, am I wasting my time? Let’s explore.

Poor performance

The fund’s investment objective was to outperform (after deduction of costs) the Numis Smaller Companies index by at least 2% per annum over rolling five-year periods.

For the year to 31 January, the return was -30.2% compared to the index return of -7.5%. This was therefore far below its target return of -5.6%.

The British Smaller Companies Fund also failed to beat the index over a five-year period. And shortly before it closed, fund assets stood at £137m, which was half of what they were just two years ago.

Baillie Gifford confirmed that all shareholders will receive cash to the value of their holdings within 30 days of closure.

Delisted shares

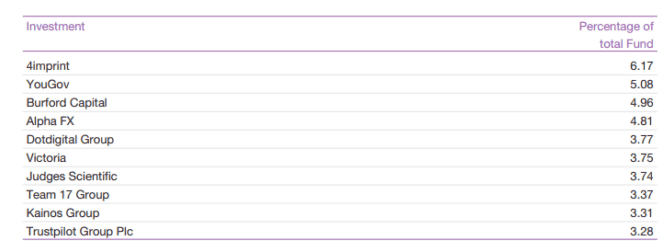

In January, the fund published its last ever annual report. Below are its top 10 holdings from then:

The top of the portfolio appears solid to me. Indeed, despite their pricey valuations, Judges Scientific and 4imprint are growth stocks that I intend to buy soon. And I’ve long admired financial technology firm Alpha Group, which is also well regarded among UK fund managers.

Over five years, these stocks are up 288%, 158% and 283%, respectively.

However, these good picks hide a couple of very unfortunate ones. First, this list doesn’t include data software company WANdisco, whose shares were suspended on 9 March after management discovered “significant, sophisticated and potentially fraudulent irregularities“.

Prior to that, the shares were trading at £13.10. But the fund’s most recent financial statements estimated an updated fair valuation of £2.62 per share. The portfolio had a large 5.7% allocation to the stock.

Additionally, it held a smaller position in Revolution Beauty, which had its shares suspended in September last year. This was after the company failed to publish its results and concerns were raised about its financial accounts.

How I’m responding

Clearly, in the case of potential fraud, it’s hardly the fault of fund managers if the information they’re analysing is falsified. Nevertheless, these unfortunate stock picks must have weighed heavily on both performance and investor sentiment.

The fund held between 40 and 80 mainly small-cap stocks. Fortunately, I don’t need to have that many holdings in just one section of the market. And I don’t have the pressure of fixed five-year performance targets.

So, my own approach won’t be changing. Whether small-cap or large-cap, I’ll continue cherry-picking what I consider to be the best UK shares.