When I was first starting to get my finances together, I used to try to get a decent passive income from savings accounts. It felt less risky to me than shares, and I didn’t really have the time or inclination to look at what other options I had.

Looking back, I wish I’d put my money into shares instead. By investing in quality dividend-paying stocks, I could have got a head start on building a lifelong passive income even if I only had a small amount to invest. Let me explain.

First, my stance on savings accounts like a Cash ISA is they’re a pretty bad place to make my money work for me. There’s a common pitfall. Essentially, the interest in these accounts is usually lower than inflation. So even though my cash looks like it’s growing, I’m actually losing money in real terms.

For example, interest rates are now higher than they have been for years, which means some savings accounts pay around 5% interest. That looks decent, at first glance. The thing is, inflation right now is 8.7%. There’s a 3.7% difference, which is eating away at my hard-earned money.

Losing money

If I had £1,000 in my account and it grew to £1,050, that sounds like I’m making money. But actually, what used to cost £1,000 now costs an average of £1,087 thanks to inflation. And with prices seemingly always getting higher, it’s like I’m guaranteed to be worse off.

These accounts do have their place. I have some money in one because it’s easy to access, so I can get some interest while being able to take my money out whenever I want. And that money is safe too.

However, I aim for wealth creation – without any work involved – and I think a far better method is to invest in income shares.

Income shares — or dividend shares — are stocks I can own that will pay me dividends. I invest in a company, and I make money if it does well. And even though there is a risk of crashes or recessions, the markets have been on an overall uptrend for centuries.

£207,989 nest egg

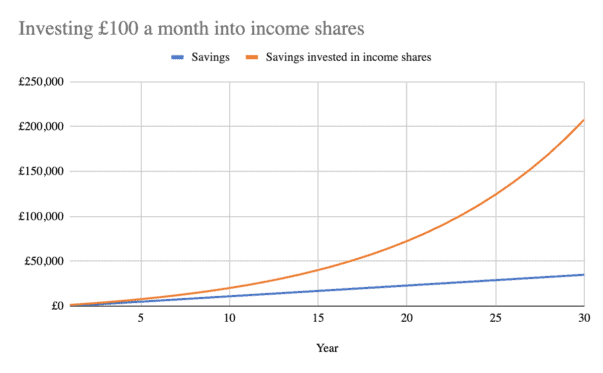

What kind of return could I expect? Well, I aim for a 10% return from my income shares. This is broadly in line with what the markets have returned historically. It’s usually above inflation, and can also turn a consistent saving of something like £100 a month into a surprisingly large nest egg. Of course, I have to remember that such a return isn’t guaranteed.

However, by drip-feeding £100 a month into income shares for 30 years (at 10%), I’d build up a substantial £207,989 net worth. I could withdraw money at 4% for an £8,320 passive income. I’d enjoy a lot of freedom and peace of mind with an income stream like that.

This kind of financial security is why I invest in income shares. And I think it’s worth pointing out that only £36,000 of the nest egg was from what I put in. The rest would come from my investments Not bad for just over £3 a day without doing any extra work.