The recent increase in interest rates has been a bit of a game-changer for income investors. All of a sudden, it’s possible to generate relatively healthy levels of interest from savings accounts.

Should I dump my dividend stocks and stick my money in the bank now that interest rates are higher? Let’s discuss.

Cash savings are lower-risk

There’s no doubt that savings accounts have some advantages over dividend stocks.

For starters, cash savings are lower risk. With stocks, capital is at risk. With savings accounts however, it’s not (assuming the institution is regulated by the Financial Conduct Authority and savings are covered by the Financial Services Compensation Scheme).

Secondly, they typically offer much faster access to money. To sell a stock and obtain the proceeds of the sale, it can take days. With a savings account however, funds can often be accessed in minutes.

Dividend stocks are better for building long-term wealth

Yet as a long-term wealth-creation tool, savings accounts have nothing on dividend stocks.

One of the biggest advantages of dividend shares is that they offer two potential sources of return. There are the dividends. And then there are the potential capital gains. Over the long term, this combination can provide much higher returns than cash savings can deliver.

Unilever shares are a good example here. Over the last 10 years, they have offered a dividend yield of around 3-4% per year. However, over this time horizon, they have also provided a capital gain of around 45%. So the overall returns have been far higher than the returns from cash.

Another advantage of dividend stocks is that many regularly increase their payouts. So investors often receive a rising level of income over time.

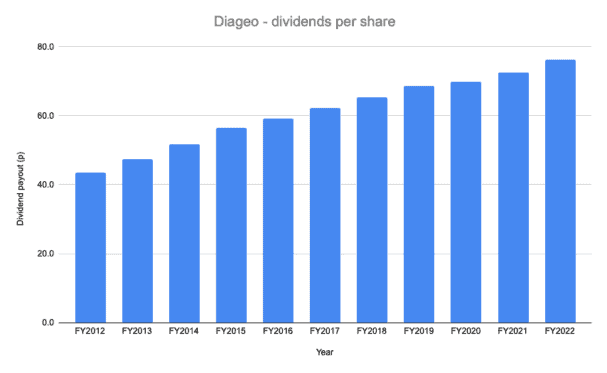

Johnnie Walker owner Diageo is a good example of a company with a strong dividend growth track record. It has registered more than 20 consecutive annual dividend increases now. This means that anyone who has held the stock for the long term has received a growing income stream.

Shares can help investors beat inflation

Given this combination of capital gains and rising income, returns from dividend stocks are often higher than inflation. As a result, they help investors build wealth in real (after inflation) terms.

By contrast, interest on savings accounts is often less than inflation. This is the case today. Even picking up 4% interest right now, investors are still essentially going backwards in real terms because inflation is running at over 8%.

I’m holding on to my stocks

So while I’m enjoying the extra income my cash savings are generating right now, I won’t be dumping my dividend stocks any time soon.

When it comes to building long-term wealth, stocks are far superior to savings accounts, to my mind.