For the last few decades, buy-to-let (BTL) property has been an easy way to build wealth. With property prices across Britain continually rising, anyone could make money.

Recently however, the outlook for BTL has become a little murky. As a result, I feel investing in the stock market through a pension is a better way to grow wealth.

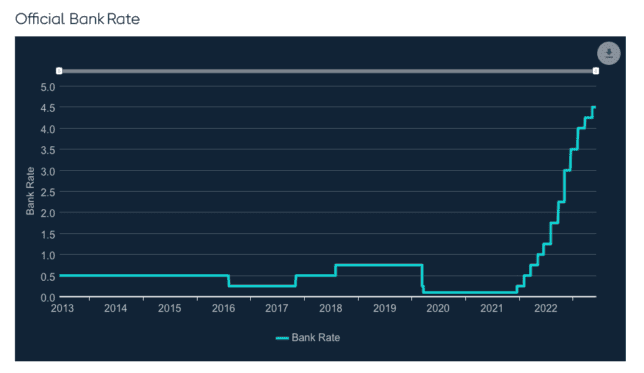

Interest rate challenges

The recent increase in interest rates has been a bit of a game-changer for BTL investing, and not in a good way. All of a sudden, investors are looking at significantly higher borrowing costs. According to Hamptons International, a basic-rate taxpayer now needs to purchase a rental property with a yield of 7%+ to make an after-tax profit.

High taxes

It’s not just higher interest rates that are an issue though. Another major factor to consider is taxes. Anyone buying a rental property today faces things like Stamp Duty surcharges, tax on rental income and on property sales.

Pensions have tax benefits

Money can still be made from BTL, of course, but it’s easy to see why a lot of experts recommend investing within a pension instead.

Today, there are many benefits to this approach to investing. For starters, there’s tax relief on contributions. This means if a basic-rate taxpayer contributes £1,000 into their account, the government adds in another £250 on top.

Secondly, all gains and income generated within the account are tax-free. So there’s no need to worry about paying Income Tax or Capital Gains Tax while building wealth.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Access to incredible investments

The best thing about investing within a pension, to my mind though, is that they generally provide access to a vast range of amazing investments.

For example, through a Self-Invested Personal Pension (SIPP) we can invest in funds like the popular Fundsmith Equity. This is a global equity fund that invests in high-quality businesses worldwide. It has returned over 15% a year since its inception in late 2010, although past performance isn’t an indicator of future returns.

They can also invest in investment trusts, which are like funds but trade on the stock market and often have lower fees. One example here is the Allianz Technology Trust. It aims to achieve long-term growth by investing in technology companies. Over the last five years, it’s delivered a share price return of around 80%, although the stock has been volatile at times.

Of course, individual shares can also be purchased. For example, this could mean investing in iPhone maker Apple.

Apple shares have been an incredible investment lately, turning $10k into about $40k over the last five years.

And after the company recently released a ‘mixed reality’ headset – which could easily be the future in five to 10 years’ time – I’m backing the business to keep rising (over the long run) even though its shares are expensive.

Aiming for £1m

Given this winning combination of tax benefits and top investments, it’s not hard to build wealth within a pension today.

And with the pension ‘Lifetime Allowance’ recently abolished, there’s nothing to stop an investor aiming for an account worth £1m or more.