These income stocks offer dividend yields far above the average for UK shares. Here’s why I think they’re great buys for value investors today.

Glencore

Worries are intensifying over near-term commodities demand as the global economy stagnates. This is reflected in the poor share price performance of mining companies like Glencore (LSE:GLEN).

Multiple poor economic updates from China especially are shaking investor nerves. The Asian powerhouse hoovers up half the world’s copper and around 15% of all oil.

Yet this weakness has boosted the already-impressive valuations of many mining businesses. Glencore, for example, now trades on a forward price-to-earnings (P/E) ratio of 7 times. It also carries a mighty 10.8% dividend yield.

I believe the FTSE 100 business is a steal at current prices. As the world embarks on a fresh commodities supercycle I expect its share price to soar from current levels.

Steady population growth and rising wealth in emerging regions are tipped to supercharge demand for industrial metals. The rush to cut carbon emissions, meanwhile, and the growth of sectors like renewable energy and electric vehicles should also ramp up consumption of products like copper and iron ore.

As one of the world’s biggest mining companies and a major player in the trading arena Glencore is well placed to exploit this theme.

The PRS REIT

Property company The PRS REIT (LSE:PRSR) is another white-hot income stock on my radar. I’m expecting it to deliver market-beating returns as rents in the UK head through the roof.

Figures from the residential rental market are much more resilient than that from the sales sector. This is in part thanks to a steady exodus of buy-to-let landlords that’s worsening an already-huge shortage of available homes.

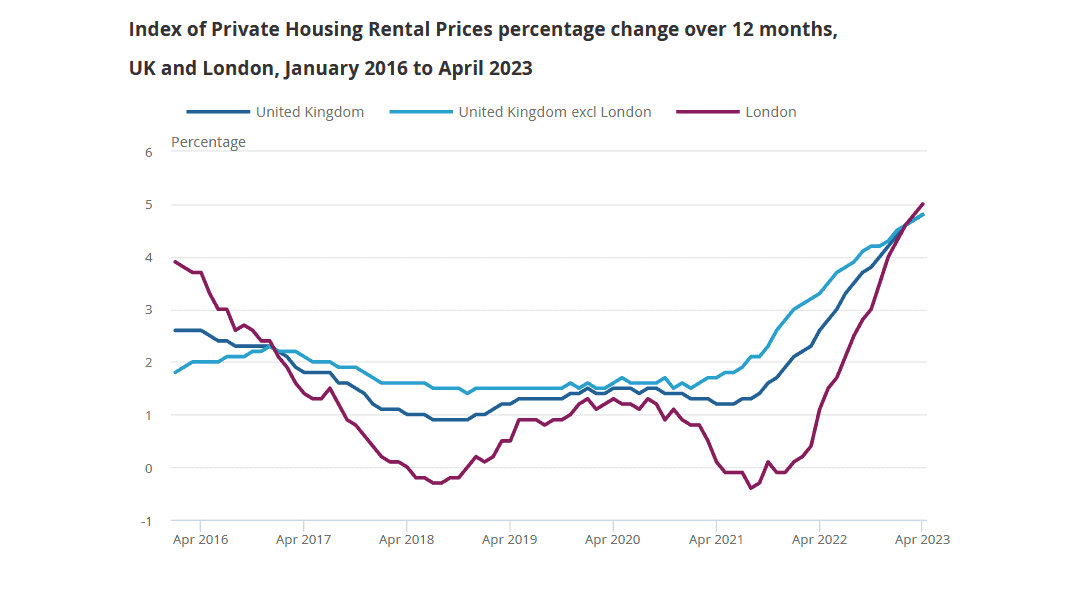

The average private rent actually rose 4.8% in the year to April, latest Office for National Statistics numbers show. This was up from 4.7% in March and the highest increase on record.

Tough conditions on the buying side mean that rents are tipped to keep rising too. Property services business CBRE Group expects private rents to rise 4% and 5% in 2023 and 2024, respectively. It’s a forecast that bodes well for PRS, a real estate investment trust (or REIT) with a portfolio of 5,000 properties.

I think rents here could actually grow faster than the broader market. This is due to its focus on the family homes market where supply shortages are especially acute. Like-for-like rents at the firm rose 5.7% in the three months to March. This was up from 4.8% in the same 2022 period.

Despite the threat of rising construction costs City analysts expect profits to rise 28% and 14% in the next two financial years. Consequently the REIT trades on a forward price-to-earnings growth (PEG) ratio of 0.8.

Any reading below 1 indicates that a share is undervalued. This, in addition to its 4.8% prospective dividend yield, makes it a great income stock for value-conscious investors.