Who wouldn’t want an extra grand a year in passive income? After all, UK inflation is still running high despite coming down from the headline figures reported in March.

In fact, the 8.7% inflation rate for April is the first dip below 10% since August last year. While that’s welcome news, food costs are still over 19% higher than a year ago.

The unpleasant upshot of the cost-of-living crisis is that many of us need to make our money stretch further. So, I’ve been scouring the UK stock market for dividend stocks that can increase my own income.

Here’s one of the best I’ve found, with an enormous dividend yield of 9.6%.

The Asian century

Henderson Far East Income (LSE: HFEL) is an investment trust that invests in stocks from the Asia Pacific region. It aims to produce long-term growth in both income and capital.

There are a few reasons why I’m attracted to this part of the world as an investor:

- With 4.3bn people, Asia accounts for over half of the world’s population and is growing rapidly

- It includes many of the world’s fastest growing economies such as China, India, the Philippines, and Vietnam

- More than 1bn Asians are set to join the global middle class by 2030, according to World Data Lab

- Asian company payouts are low by Western standards, offering real expansion opportunities

The portfolio currently contains 46 stocks. Here are the top five holdings:

| % of Fund | |

| Samsung Electronics | 3.3% |

| Ping An Insurance | 3.3% |

| Macquarie Korea Infrastructure Fund | 3.2% |

| Taiwan Semiconductor Manufacturing | 3.1% |

| China National Building Material | 3.1% |

Of course, the path towards an ‘Asian Century’ is not preordained, and there are many things (war, political instability, currency crises, etc.) that could delay or prevent the region from reaching its full potential. Such factors could affect shareholder returns in this stock.

Superb record of growing income

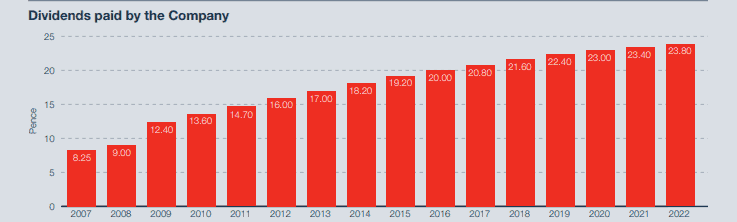

The following chart shows that the trust has increased its annual payout every year since 2007.

That said, the fund’s objective is to produce growth in both income and capital. It has achieved positive total returns on a three-, five-, and 10-year basis, but not for capital return alone.

In its recent H1 report, it said: “Our investment strategy should be leading to an improvement in capital returns as we look ahead and we remain alert to the importance of improvement in this area for shareholders“.

Therefore, I’m hopeful that there could be future share price gains as well as income.

A grand a year

The shares are trading for 248p, as I write. With each one netting a payout of 23.8p last year, that means the dividend yield stands at 9.6%.

For £1,200 a year in passive income then, I’d need 5,040 shares. They would set me back £12,500.

That’s much more than I’ve invested in the shares, which form only a part of my diversified income portfolio. That’s because no company payout is set in stone, so I don’t want all my eggs in one basket.

But the immediate prospects for Asia appear solid to me. China has emerged from Covid restrictions and its economy is gaining confidence. This should have a positive impact on companies across the region and underpin the trust’s dividend.